Traders Brief - Cautious tone ahead of Budget 2019

HLInvest

Publish date: Tue, 23 Oct 2018, 04:30 PM

MARKET REVIEW

After China’s regulators commented to craft a series of rules and measures in order to support the struggling market last week, President Xi vowed “unwavering” support for non-state firms over the weekend. These positive news flow have set a bullish tone towards the regional markets; Shanghai Composite Index and Hang Seng Index rocketed 4.09% and 2.32%, respectively.

However, stocks on the local bourse bucked the regional trend and the key index declined 0.56% as investors stayed cautious ahead of Budget 2019. There were nearly 5 decliners for every 3 gainers on the broader market. Meanwhile, market traded volumes stood at 1.95bn, worth RM1.68bn.

Wall Street ended weaker led by financial stocks amid rising worries that the higher mortgage rates will cap loan growth moving forward. Bank of America and Citigroup fell more than 3% and the Dow and S&P500 slipped 0.50% and 0.43%, respectively.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI is still trending within the retracement phase following the strong rebound two weeks ago near the 1,683 level. The MACD indicator continues to hover below the zero level. Meanwhile, both the RSI and Stochastic oscillators softer below the 50 level. With the weaker readings on the indicators, the key index’s upside will be capped along 1,745-1,750, while the support will be located around 1,700, followed by 1,683.

On the local bourse, stocks may stay soft prior to the “belt-tightening mode” Budget 2019, as Finance Minister mentioned less “goodies” to be given out, while market participants are anticipating new tax policies to be implemented. Hence, the FBM KLCI is likely to trade sideways over the near term.

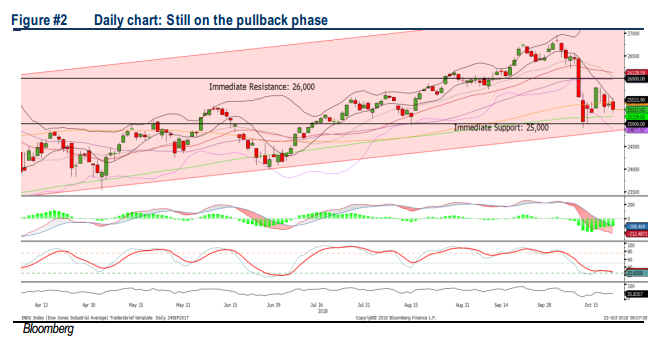

TECHNICAL OUTLOOK: DOW JONES

The Dow continues with its pullback phase after the rebound two weeks ago along the SMA200, the MACD indicator is trending lower, while the RSI and Stochastic oscillators are weakening below 50. We opine that the upside will be limited around 25,600-25,818, while the support will be envisaged around 24,900-25,222.

We expect the upcoming midterm elections, the unsettled US-China trade disputes as well as the rising interest rate outlook could dampened the stock markets moving forward. However, the stronger-than-expected corporate earnings will be able to cushion the downside risk over the near term.

Source: Hong Leong Investment Bank Research - 23 Oct 2018