Traders Brief - Global tension clouding the sentiment

HLInvest

Publish date: Wed, 24 Oct 2018, 09:46 AM

MARKET REVIEW

Regional markets ended in the bloodbath mood, where most of the key benchmark indices plunged more than 2% amid rising trade war and geopolitical tensions. The Shanghai Composite Index and Hang Seng Index plummeted 2.26% and 3.08%, respectively, while Nikkei 225 down 2.67%.

Similarly, stock on the local front ended in the negative territories and the key index fell below 1,700 psychological level and closed at 1,697.60 pts (-1.44%). Market breadth was bearish with 727 decliners vs. 170 gainers. Market traded volumes stood at 2.01bn, worth RM2.01bn. We noticed most of the Hang Seng and FBM KLCI put warrants were traded actively under this bearish environment.

Wall Street started the session on a bearish tone and the Dow plunged more than 500 points following the release of weaker-than-expected corporate earnings from Caterpillar and 3M. Nevertheless, the key index managed to pare down part of the losses to end at 25,191.43 pts (-0.50%). Meanwhile, S&P500 and Nasdaq fell 0.55% and 0.42%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI declined for the 4th consecutive day, extending the retracement phase after hitting the recent high of 1,743. The MACD Line and Histogram continued to trend lower. Both of the RSI and Stochastic oscillators are hovering below 50; indicating that the momentum is weak at this juncture. The resistance will be located around 1,743-1,750, while the support will be pegged around 1,683, followed by 1,660.

On the local bourse, with both the external (trade war, interest rate upcycle outlook and 10- year Treasury yield) and internal (Budget 2019) factors are still pointing towards a softer global outlook, we believe market sentiment will stay tepid ahead of the Budget 2019. Hence, traders may focus on high dividend yield, defensive sectors and steep oversold counters for trading opportunities.

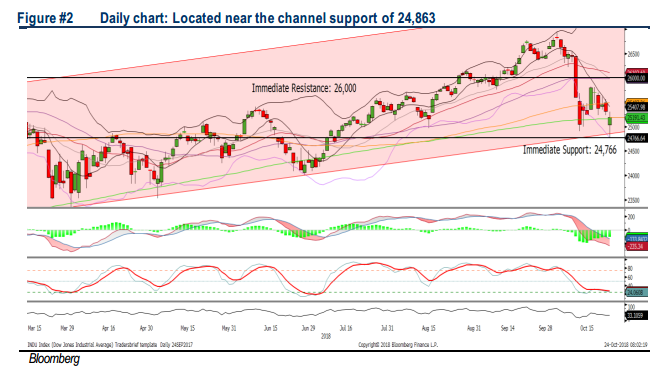

TECHNICAL OUTLOOK: DOW JONES

The Dow was flirting along the SMA200 (25,158) and managed to end above the long term moving average as buying interest emerged amongst the consumer staples sector. However, most of the technical readings are negative for the Dow and we expect the rebound to be short lived at this moment. Hence, we opine that the upside may be limited around 25,600-25,790, while the support will be pegged around 24,863-24,900, followed by 24,500.

We believe the impact of the trade war between the US and China has impacted selected corporates in the US. Furthermore, should there be a prolonged trade war, it may increase costs for companies and raising fears that tighter global trade conditions would cause a slowdown in global economic activities. Hence, we may anticipate heightened volatility moving forward on Wall Street.

Source: Hong Leong Investment Bank Research - 24 Oct 2018