Traders Brief - Anticipating the selling tone on local front

HLInvest

Publish date: Thu, 25 Oct 2018, 09:10 AM

MARKET REVIEW

Following the selldown on Wall Street on Tuesday, Asia’s stock markets trended mixed amid mild bargain hunting activities; the Nikkei 225 and Shanghai Composite Index rose 0.37% and 0.33%, respectively, but Hang Seng Index slipped 0.38%.

On the local bourse, sentiment was weak, taking cues from overnight Wall Street.The FBM KLCI fluctuated between the positive and negative territories throughout the session before closing lower at 1,690.04 pts (-0.45%). Market breadth was still negative with 620 losers vs. 245 gainers. Market traded volumes stood at 2.35bn, worth RM1.95bn.

Stocks noticed a massive sell offs on Wall Street as the Dow tumbled more than 600 points to end at 24,583.42 pts (-2.41%) led mainly by technology shares, shrugging off a solid start to the third quarter reporting season. The S&P500 and Nasdaq dived 3.09% and 4.43%, respectively.

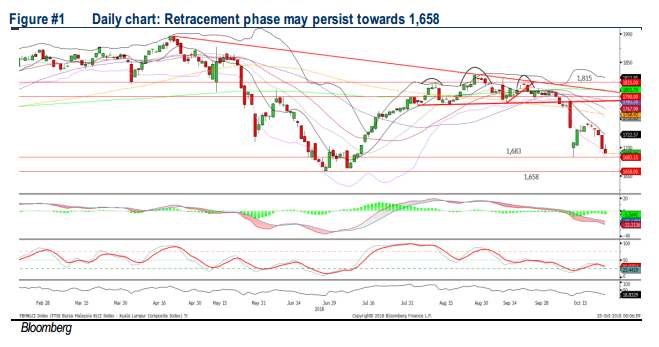

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended negatively for 5 trading days and below 1,700 for the second straight day. The MACD indicator and both the oscillators are still negative; indicating that the upside move could be limited over the near term. Resistance will be located around 1,700, followed by 1,743. Support will be pegged along 1,683, followed by 1,660.

On the local front, investors remained on the sidelines and will be cautious amid the negative global market performances. With little positive fresh catalysts to lift the stock market and we opine that the KLCI will stay weak below the 1,700 moving forward, at least until Budget 2019.

TECHNICAL OUTLOOK: DOW JONES

At this juncture, the Dow has violated below the SMA200 level and closed below the 25,000 psychological level. Technical readings on the indicators (MACD, RSI and Stochastic) are weak and the retracement phase may extend over the near term. Next support will be set along 24,000. Meanwhile, the Dow’s upside will be capped along 25,000, followed by 25,600.

Despite the stronger-than-expected 3Q results, investors continue to reduce exposure on technology shares amid extended concerns over future global outlook due to the unsettled trade war as well as the rising interest rate outlook. We believe these factors will continue to cloud market sentiment over the near term. Should the Dow violates below the 24,500 level, it will trigger further selling pressure towards 24,000.

Source: Hong Leong Investment Bank Research - 25 Oct 2018