Traders Brief - Buying support may sustain

HLInvest

Publish date: Thu, 01 Nov 2018, 04:32 PM

Despite China releasing weaker-than-expected manufacturing data (Chinese official manufacturing PMI came in at 50.2, below analyst forecast of 50.6), Asia’s stock markets ended positively, tracking the rebound on overnight Wall Street. The Shanghai Composite Index and Hang Seng Index gained 1.35% and 1.60%, respectively, while Nikkei 225 2.16%. Meanwhile, stocks on the local front trended positively, in tandem with the regional markets; the KLCI rallied higher to 1,709.27 pts (+1.38%). Market breadth was bullish with more than 7 advancers for every 2 decliners on the broader market. Market volumes stood at 2.37bn, worth RM2.38bn. Also, we noticed the foreign trade flows has turned positive (+268.7m) yesterday after 6 consecutive days of outflow.

Wall Street ended positively (Dow: +0.97%, S&P500: +1.09%) on the final day of October amid further bargain hunting activities as optimism on quarterly results from selected technology giants. However, on the MoM basis, the Dow and S&P500 declined 5.07% and 6.94%, respectively amid worries on higher interest rates as well as rising concerns on the unsettled trade war between US and China.

TECHNICAL OUTLOOK: KLCI

Finally, the FBM KLCI has rebounded off the lower band of the upward channel, surpassing the 1,690 and 1,700 levels. The MACD Line is recovering, but still below zero. Meanwhile, both the RSI and Stochastic oscillators are hooking up. Hence, based on the technical readings, the FBM KLCI could rebound higher towards 1,730. Support will be pegged around 1,690.

Tracking the performance on overnight Wall Street, buying interest may sustain on the local front, lifting the KLCI higher. However, upside could be capped as profit taking activities may emerge ahead of the “belt-tightening mode” Budget 2019. Hence, KLCI’s trading range likely to be capped between 1,690-1,730.

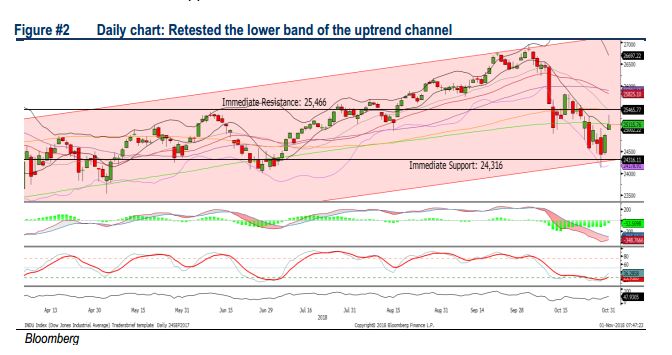

TECHNICAL OUTLOOK: DOW JONES

The Dow rebounded off the lower band of the uptrend channel and ended above the 25,000 psychological level. Although MACD Line is trending higher, it is still below zero. The RSI is trending towards 50, while the Stochastic is hooking up above the oversold region. With the technical readings pointing towards a short term recovery, next resistance will be located around 25,466 and the support will be anchored around 24,316.

We opine that this rebound would be short-lived given the few upcoming major events such as mid-term US presidential election and the meeting between US President Trump and Chinese President Xi this month, which could provide heightened volatility and downside risk towards the stock markets.

Source: Hong Leong Investment Bank Research - 1 Nov 2018