Traders brief - Wall Street meltdown could spillover to Malaysia

HLInvest

Publish date: Wed, 21 Nov 2018, 04:14 PM

Taking cues from the Wall Street overnight, Asia’s stock markets trended into the negative territories. Also, Japan automaker Nissan dragged the sentiment on Japan stock exchange; Nikkei 225 declined 1.09%. Meanwhile, Shanghai Composite and Hang Seng Index dived 2.13% and 2.02%, respectively.

Meanwhile, our local stock exchange was broadly positive on Monday as the FBM KLCI reversed from an intra-day low of 1,698.51 pts to end at 1,710.71 pts (+0.25%). Market breadth was also positive with 428 gainers vs. 365 losers, accompanied by market volumes of 1.58bn shares traded for the day, worth RM1.56bn. The local bourse was closed on Tuesday for public holiday.

Wall Street ended sharply lower for another session led by technology giants such as Apple as Goldman Sachs warned weaker demand for Apple products and iPhone XR outside US, coupled with the decline in energy shares on the back of falling oil prices overnight. The Dow and S&P500 plunged 2.21% and 1.82%, respectively, while Nasdaq dived 1.70%.

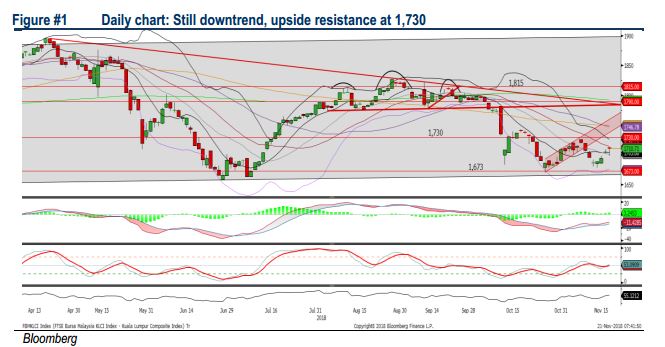

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded off the 1,700 psychological level, forming a hammer candle on the short term SMA20 and the MACD Line continues to trend higher. The RSI and Stochastic oscillators are hovering above 50; suggesting that the positive momentum is intact. Despite the technical readings are positive, we believe the upside could be capped near the 1,726-1,730 as global market sentiment is turning negative. The support will be anchored around 1,700, followed 1,673.

Meanwhile, on our local stock exchange, we anticipate the selling pressure could spillover to stocks on the local front with the unfavourable global trading tone as well as the weaker Brent oil prices, which may contribute to the negative trading tone amongst oil and gas stocks. Hence, the KLCI’s upside will be capped along 1,726-1,730, while traders may look for safe-haven stocks under the consumer and utilities sectors.

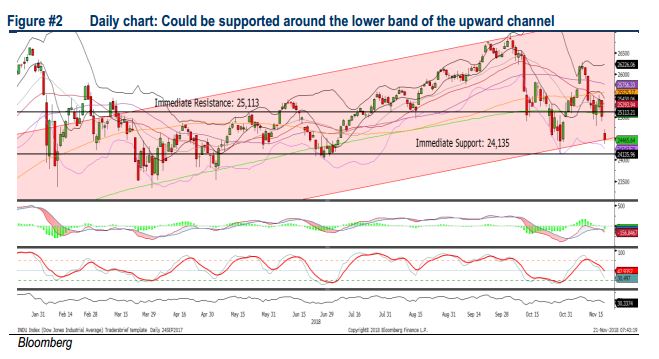

TECHNICAL OUTLOOK: DOW JONES

The Dow retested the resistance along 25,500 and reversed, falling more than 900 points over the past two trading days. The MACD Indicator is hovering below the zero level, while the RSI and Stochastic oscillators have dropped below 50; suggesting that the negative momentum is dominating at this moment. Hence, the Dow’s upside will be capped around 25,113, followed by 25,500. Support will be located around 24,135, followed by 24,000.

With the uncertain trade development as Donald Trump and Xi Jinping will be discussing several agenda during the upcoming G20 summit, coupled with the softer outlook guidance from most of the tech giants, we believe the volatility may remain over the near term with higher downside risk on Wall Street.

Source: Hong Leong Investment Bank Research - 21 Nov 2018