Traders Brief - Cautious amid results season and G20 summit

HLInvest

Publish date: Fri, 23 Nov 2018, 09:55 AM

MARKET REVIEW

Asia’s stock markets traded mixed with the Nikkei 225 and Hang Seng gained 0.65% and 0.18% while Shanghai Composite Index eased 0.23%, respectively. Overall sentiment was cautious ahead of the crucial Trump-Xi meeting end Nov and a tepid close in Dow overnight (Dow surrendered a 205-pt gains to end flat at 24464).

In line with regional markets, KLCI also ended flat with a 0.3-pt gain at 1695.6 after fluctuating within a range of 12.7 pts from intra-day high of 1701.7 and a low of 1689.0. Trading volume decreased to 1.75bn shares worth RM1.44bn as compared to Wednesday’s 2.05bn shares worth RM1.94bn. Market breadth was negative with 310 gainers as compared to 484 losers.

Wall St was closed overnight for the Thanksgiving Day holiday, while the futures market traded and close at 1 pm Eastern time on Friday. On 21 Nov, Dow squandered a 205-pt technical rebound (after a brutal two-day 950 pts selloff) to end 1-pt lower at 24464, dampened by weaker-than-expected Oct durable goods orders and persistent fears about a slowing US economy, policy errors by the Fed, the U.S-China trade tensions. At the time of writing, the Dow mini futures are sliding 78 pts at 24385.

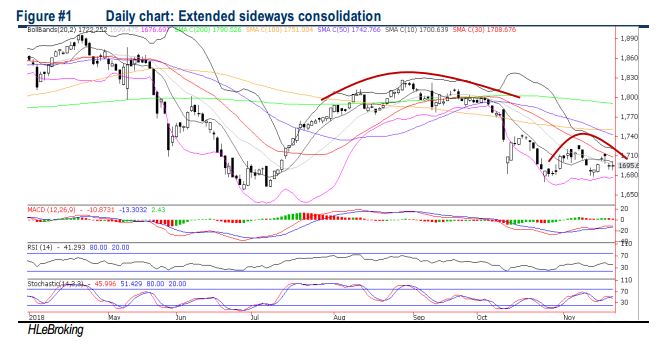

TECHNICAL OUTLOOK: KLCI

The formation of Doji candle for a 2nd day and negative MACD indicate that the KLCI trend to remain cloudy. Also, both the RSI and Stochastic oscillators have crossed below 50; suggesting that the negative momentum is picking at this juncture. Should there be a downward violation below 1,680, next support will be set around 1,673. However, if the key index breaches above 1,700, next resistance will be located around 1,730.

We expect KLCI to engage in range bound consolidation in the near term in wake of external headwinds and internal clouds surrounding the ongoing Bursa Malaysia 3Q18 results season and slowing Malaysian economy, compounded by weak crude oil and FCPO prices. Major supports are at 1657-1670, whilst formidable resistances are near 1709 (30D SMA) to 1726 (1M high).

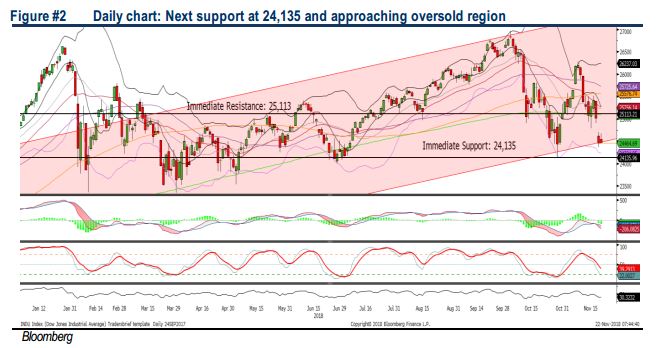

TECHNICAL OUTLOOK: DOW JONES

After falling sharply over the past two trading days, the Dow trended sideways, supporting above the lower band of the upward channel. However, most of the technical indicators are indicating that the negative momentum could remain over the near term. Hence, we believe the Dow may trend sideways with a downward bias move towards 24,135. Nevertheless, the resistance will be located around 25,000-25,113.

Without any significant development on the trade development, we believe the volatility could remain over the near term and investors will be focusing on the upcoming G20 summit to get more clues on the trade discussions, while the outcome on the FOMC and the OPEC meeting will be monitored closely as it will be affecting markets’ trading tone moving forward. Meanwhile, sales figures during the US Black Friday will be closely watched, as it is known as the start to the US holiday shopping season, to gauge the resilience of the US economy. The Dow’s resistance and support will be envisaged around 24,135 and 25,113, respectively.

Source: Hong Leong Investment Bank Research - 23 Nov 2018