Traders Brief - Negative sentiment to persist amid sliding oil

HLInvest

Publish date: Mon, 26 Nov 2018, 09:13 AM

MARKET REVIEW

Asia’s stock markets ended mostly lower as investors remained wary on the trade tensions between the US and China, coupled with renewed uncertainties on Brexit. Shanghai Composite Index and Hang Seng Index declined 2.49% and 0.35%, respectively, but Nikkei 225 rose 0.65%.

Meanwhile, stocks on the local front rebounded from an intra-day low of 1,689.14 pts to inch marginally higher by 0.02% to 1,695.88 pts. Market breadth remained negative as decliners outpaced gainers by a ratio of 3-to-1. Market traded volumes stood at 1.58bn, worth RM1.10bn. Nevertheless, paper-related stocks such as MUDA (+12.2%) and ORNA (+4.5%) traded actively higher for the session.

Wall Street ended lower as technology giants such as Apple Inc succumbed to further selling pressure after Wall Street Journal reported that the company could reduce prices for iPhone XR in Japan amid softer sales and energy shares were traded lower on the back of sliding crude oil prices. The Dow and S&P500 declined 0.73% and 0.66%, respectively, while Nasdaq fell 0.48%.

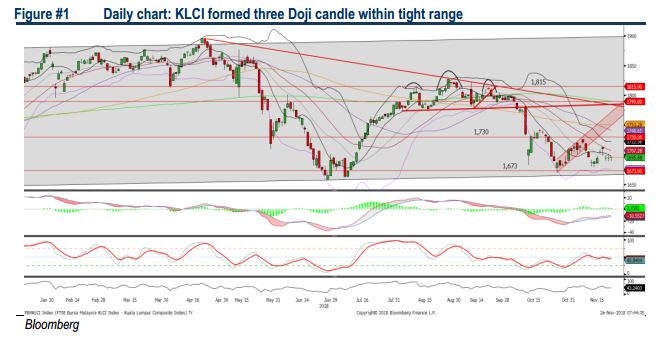

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has been trending within a narrow range of 1,689-1,701 over the past three trading days. The MACD Line is hovering below zero, while both the RSI and Stochastic oscillators are trending below 50. We believe the KLCI’s upside will be capped around 1,701- 1,730. Meanwhile, support will be located near 1,689, followed by 1,673.

On the local front, we may anticipate some selling pressure, tracking the negative sentiment on Wall Street. Moreover, the weakening ringgit and crude oil prices could dampen the trading mood on domestic-driven and oil and gas sectors. However, traders may focus on export oriented companies over the near term amid weaker ringgit outlook.

TECHNICAL OUTLOOK: DOW JONES

The Dow remains on a downward bias mode, falling below the lower band of the uptrend channel. The MACD Indicator is negative as the MACD Line is falling sharply and the MACD Histogram continues to weaken further over the past week. The RSI and Stochastic however are in the oversold region and we could anticipate a short term technical rebound over the near term. The immediate resistance will be envisaged around 24,500-25,113. Support will be pegged around 24,000-24,153.

In the US, volatility will remain over the near term with the unsettled trade issues, which investors will be closely watching the conclusion of the G20 summit this week for further clues on the trade disputes status between the US and China. Also, few other major events that investors will be taking note are the OPEC and FOMC meetings. Nevertheless, EU leaders backed Theresa May’s Brexit withdrawal agreement over the weekend may lift the trading tone mildly.

Source: Hong Leong Investment Bank Research - 26 Nov 2018