Tradersbrief - Mild Bargain Hunting Activities May Emerge

HLInvest

Publish date: Wed, 28 Nov 2018, 04:45 PM

MARKET REVIEW

Key regional benchmark indices ended on a mixed note ahead of the Trump-Xi meeting in the upcoming G20 meeting as President Trump commented that the US will continue to raise the tariffs on Chinese products in Jan 2019. The Shanghai Composite Index and Hang Seng Index slipped 0.04% and 0.17%, respectively, while Nikkei 225 rose 0.64%.

Although Wall Street surged strongly overnight, stocks on the local front traded on a cautious tone after Genting sued Disney and Fox, dampening the sentiment on the local exchange; the FBM KLCI (-1.00%) ended negatively and market breadth was bearish with nearly 7 decliners for every 2 gainers on the broader market. Market volume stood at 2.18bn, worth RM2.61bn.

Wall Street traded on a volatile manner yesterday, ending positively following comments from Trump’s top economic advisor, Larry Kudlow that the US and China will have a “good possibility” to strike an agreement on trade. The Dow traded towards an intraday low of 24,416.03 pts before closing at 24,748.73 pts (0.44%), while S&P500 and Nasdaq rose 0.33% and 0.01%, respectively.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has formed a bearish flag formation yesterday after breaching below the 1,689 level. The MACD indicator continues to weaken further yesterday, while both the RSI and Stochastic oscillators are hovering below 50. Hence, with the weaker technical readings, the KLCI’s upside will be capped around 1,700-1,730. Meanwhile, support will be pegged around 1,673.

On the local front, we could expect mild bargain hunting activities to emerge among bashed down stocks, tracking the positive rebound on Wall Street. However, the rebound are likely to be short lived as we are going through a subdued reporting season, as most of the corporate earnings are weaker-than-expected.

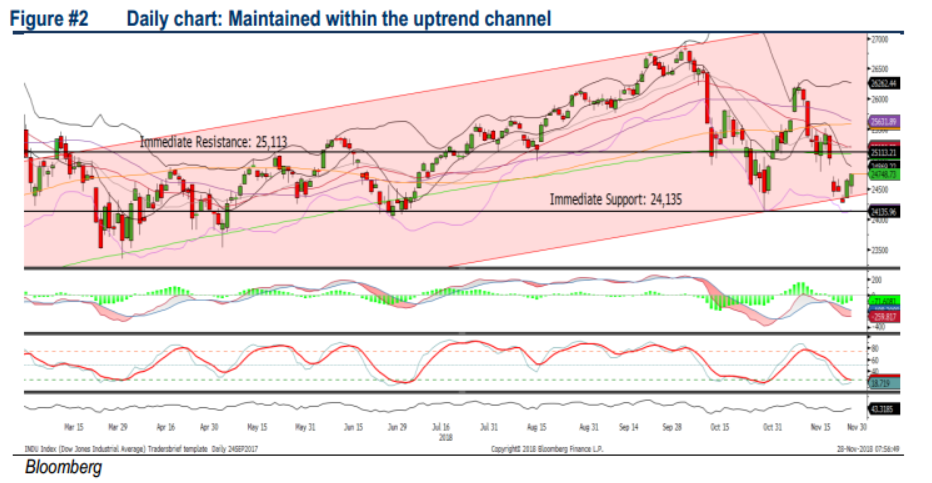

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to trade higher for the second consecutive sessions, rebounding off the lower band of the upward channel. The MACD Histogram has recovered mildly, while both the RSI and Stochastic oscillators are moving out of the oversold region; positive recovery in momentum. Hence, we opine that the Dow could rebound higher with the resistance envisaged around 25,133, while the support will be anchored around 24,135.

In the US, we believe the market volatility will remain over the near term ahead of the Trump-Xi trade discussion in the upcoming G20 summit. Also, few other major events such as OPEC (6 Dec) and FOMC (18-19 Dec) meetings will be monitored closely for further clues on the market direction moving forward.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we had closed our daily Technical Tracker positions on PECCA (13.5% gain) and FPI (17.3% gain).

Source: Hong Leong Investment Bank Research - 28 Nov 2018