Traders Brief - Buying interest to spillover to Bursa Malaysia

HLInvest

Publish date: Thu, 29 Nov 2018, 05:05 PM

MARKET REVIEW

Asia’s stock markets traded mostly higher as investors focused on Larry Kudlow’s comments on the trade developments, stating a there is a “good possibility” the two countries (US and China) could reach an agreement in this upcoming G20 meeting. The Nikkei 225 gained 1.02%, while Shanghai Composite Index and Hang Seng Index advanced 1.05% and 1.33%, respectively.

Stocks on the local front were fluctuating between the positive and negative territories throughout the session before closing marginally higher at 1,686.55 pts (+0.09%) led by the rebound in Genting Berhad. Market breadth was neutral as there were 401 gainers and 405 losers across the board, while traded volumes stood at 1.67bn, worth RM2.11bn.

US equities rallied higher on a surprise move following Jerome Powell’s speech in the Economic Club of New York, where his tone has shifted to slightly dovish from a hawkish stance earlier on. The Dow and S&P500 2.50% and 2.30%, respectively, while Nasdaq increased 2.95%.

TECHNICAL OUTLOOK: KLCI

Following the sharp decline on Tuesday, the FBM KLCI managed to recover marginally, forming a hammer candle yesterday. The MACD Indicator, however still suggest that the momentum is weak as the Histogram has been trending lower. Meanwhile, both the RSI and Stochastic oscillators are hovering below 50; suggesting that the negative momentum is still intact. Hence, we believe that the FBM KLCI is likely to have limited upside over the near term with the resistance located around 1,700-1,730. Meanwhile, support will be anchored around 1,673-1,680.

Tracking the strong rebound on Wall Street, we anticipate the buying support to further emerge on the local front, supporting the FBM KLCI at least for the near term. Meanwhile, traders could be focusing in export-oriented stocks as the USD/MYR is still on a weakening bias outlook.

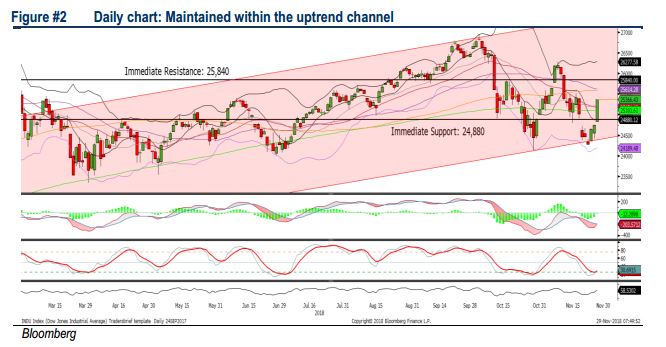

TECHNICAL OUTLOOK: DOW JONES

The Dow further rebounded after retesting the lower band of the upward channel last week, the MACD Histogram has recovered over the past few sessions. The RSI and Stochastic are trending higher after hovering within the oversold region last week. Based on the technical readings on the indicators, we may expect the Dow to continue its rebound formation towards the resistance along 25,840, while the support will be pegged around 24,880.

Sentiment has changed from downward bias to positive bias following the comments from the chief economic adviser, Larry Kudlow, suggesting optimism on trade resolution. Also, dovish comments from Federal Reserve Chairman, Jerome Powell lifted the sentiment. Nevertheless, should there be any negative surprises from the G20 summit, OPEC and FOMC meetings; profit taking activities may return.

Source: Hong Leong Investment Bank Research - 29 Nov 2018