Tradersbrief - Positive Trading Tone to be Expected After G20

HLInvest

Publish date: Mon, 03 Dec 2018, 09:18 AM

MARKET REVIEW

Asia’s stock markets traded slightly higher in the anticipation of positive trade deals to be struck during the G20 summit in Buenos Aires. The Nikkei 225 and Hang Seng Index rose 0.40% and 0.21%, respectively, while Shanghai Composite Index gained 0.82%.

Despite the positive mood regionally, stocks on the local front trended mostly in the negative territories led by sell down in telco and banking heavyweights, which contributed to weaker closing on FBM KLCI (-0.97%). Market breadth was bearish as decliners led advancers by a ratio of more than 2-to-1. Meanwhile, market traded volumes and values increased to 3.09bn, worth RM4.55bn vs. 2.16bn, worth RM2.45bn on Thursday on the back of Index rebalancing activities.

Wall Street ended on a positive note prior to the Trump-Xi discussion during the G20 summit meeting as renewed optimism on US-China striking a deal on trade. Over the weekend, president Trump has agreed that he will leave the tariffs on USD200bn worth of Chinese products at a 10% rate and won’t raise it to 25%. The Dow and S&P500 added 0.79% and 0.82%, respectively.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has formed a bearish engulfing candle last Friday prior to the G20 summit. The MACD Line is still below the zero level, while both the RSI and Stochastic oscillators are below 50. Despite the technical readings are negative, we believe the sentiment may turn positive after Trump-Xi meeting. Hence, we think the FBM KLCI could be due for a technical rebound, targeting 1,700-1,730. Support will be pegged around 1,673-1,680.

On the local front, stocks may turn slightly positive in view of the positive trade developments between the US and China as President Trump will remain the tariffs at 10% for the USD200bn products. Hence, we opine that traders will be able to capture a good trading opportunity today on recent bashed down stocks amid the slightly positive environment.

TECHNICAL OUTLOOK: CLOSED POSITIONS

On Friday, we had closed our 4Q18 technical tracker positions on PHARMA (7.6% gain) and daily technical tracker QES (7.1% loss).

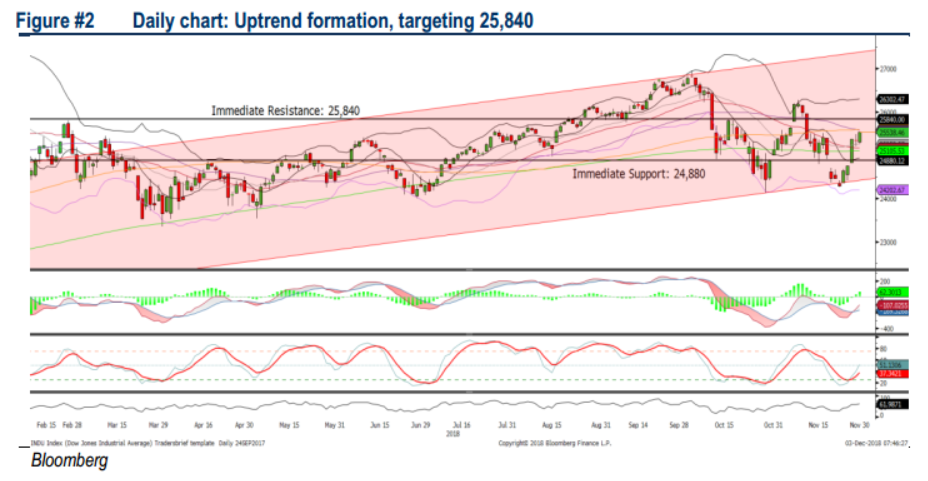

TECHNICAL OUTLOOK: DOW JONES

The Dow rebounded further in the anticipation of positive deals to be struck in the G20 summit and MACD Indicator is on a recovering trend after the MACD Line crossed above Signal Line. Meanwhile, the RSI and Stochastic oscillators are slightly positive. We may anticipate further rebound to retest the resistance along 25,7840, while support will be located around 24,880.

In the US, we believe buying interest is likely to emerge at least for the near term following the positive tone on trade deals over the weekend. However, there is a 90-day window for the US and Chinese to continue on the negotiations regarding the disagreements on technology transfer, intellectual property and agriculture.

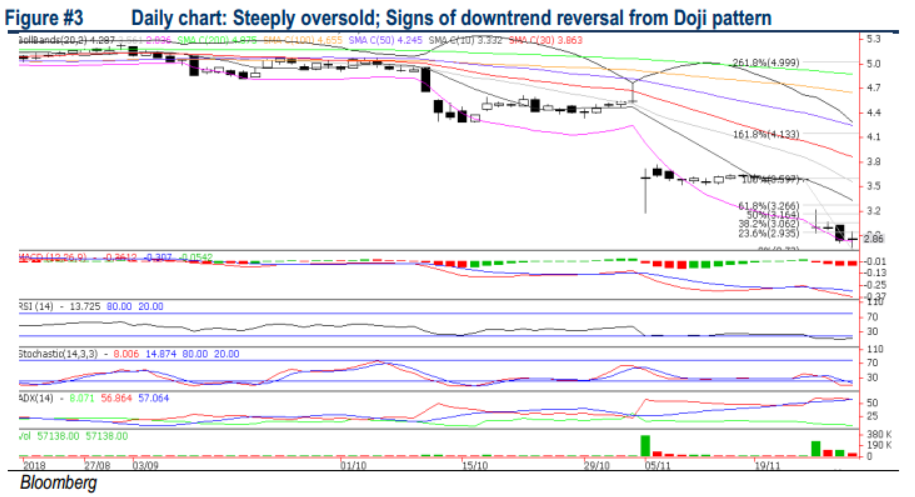

TECHNICAL OUTLOOK: GENTING MALAYSIA

An attractive proxy for short term rebound as negatives mostly discounted. GENM’s market capitalisation saw a massive RM9.7bn or RM1.63 collapse in Nov amid concerns over mid to long term earnings jeopardy (prompted our analyst to slash RM788m in FY18-20 core earnings) following a series of negative newsflow i.e. the Budget 2019 additional new casino taxes, its legal proceedings against Disney and Fox (seeking minimum US$1bn or RM4.2bn damages) and the RM1.8bn impairment related to the US tribal casino project investment (or Mashpee’s notes). Although share price could remain pressure due to 3Q18 headlines RM1.3bn loss and uncertainties until the fate of outdoor theme park is crystallized along with the gaming tax hike impact, we believe these risks have been largely priced in, given undemanding valuations at 0.84x P/B (48% below 10Y average of 1.6x) and 14.5x FY19 P/E (16% below 10Y average of 17.2x). We see good entry levels near RM2.76-2.86.

Source: Hong Leong Investment Bank Research - 3 Dec 2018