Traders Brief - Weakness to prevail on Bursa Malaysia

HLInvest

Publish date: Wed, 05 Dec 2018, 04:25 PM

MARKET REVIEW

Key regional benchmark indices ended on a mixed note despite the trade truce between the US and China as market participants were still having concerns and questions over the details of the trade agreement between President Trump and President Xi. The Shanghai Composite Index and Hang Seng Index rose 0.42% and 0.29%, respectively, while Nikkei 225 plunged 2.39%.

Tracking the uncertain environment following the fresh trade developments, profit taking activities emerge as expected and the FBM KLCI retreated 0.28% to 1,694.99 pts. Market breadth was negative with 525 decliners vs. 282 advancers, accompanied by 2.44bn shares traded for the day, valued at RM2.08bn. We noticed that selected banking (Alliance and Allianz) and telco (TM and Timecom) stocks traded actively higher.

Although the 90-day trade truce has started, Wall Street ended in a bearish note as traders noticed the US 3-year bond yield has risen above the US 5-year bond yield, speculating a slowdown in economic activities would follow. This contributed investors to flee on banking stocks, translating to a sharp fall in Dow (-3.10%) and S&P500 (-3.24%), while Nasdaq declined 3.80%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI trended sideways yesterday and the MACD indicator remained below the zero level. Despite the RSI oscillator hovering around 50, we think KLCI could trade on a downward bias mode, tracking the negative sentiment from Wall Street. Should KLCI violate below 1,673, next support will be at 1,658. Meanwhile, if the KLCI surges above 1,700, next resistance will be pegged along 1,730.

Selling pressure is likely to spill over on the local front and the FBM KLCI could face further weakness below the stiff resistance along 1,700 psychological level. Hence, traders may look into defensive utilities and high dividend yield sectors for the time being. Meanwhile, O&G stocks will remain volatile with the fluctuations of Brent oil prices ahead of the OPEC meeting

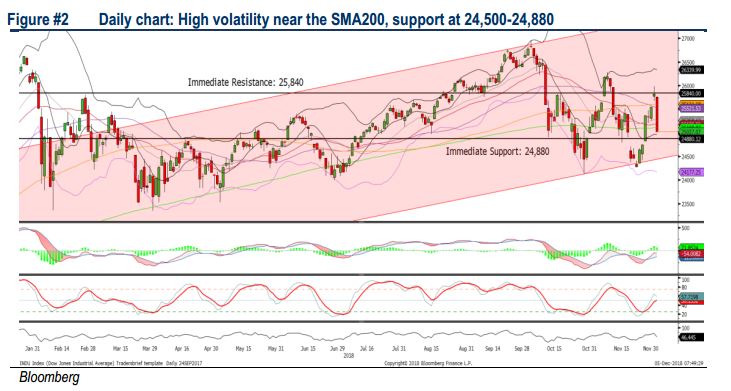

TECHNICAL OUTLOOK: DOW JONES

As expected the Dow hit the resistance along 25,840-26,000 resistance zone and pullback sharply yesterday. The MACD Indicator is still hovering below the zero level and the RSI has hooked below 50; suggesting that the negative momentum is picking up and the Dow could remain weak over the near term. The immediate support will be located around 24,880, followed by 24,500.

In the US, following the recent trade discussions between US and China, investors are still having a cautious tone as vague and conflicting messages from the White House economic advisers have dampened the optimism on the fresh breakthrough. Also, without any clear statement or strategy from President Xi Jinping, market tone will remain uncertain over the near term. Hence, the Dow’s downside risk will persist at least for the near term.

Source: Hong Leong Investment Bank Research - 5 Dec 2018