Traders Brief - Selling Pressure May Extend on FBM KLCI

HLInvest

Publish date: Mon, 10 Dec 2018, 09:01 AM

MARKET REVIEW

Most of the Asia’s stock markets trended slightly higher as the Fed could potentially slowdown the pace of the interest rates hike after the December meeting. Also, the OPEC meeting which concluded on Thursday, agreed to decrease oil production. The Nikkei 225 and Shanghai Composite Index added 0.82% and 0.03%, respectively, but Hang Seng Index fell 0.35%.

On the local front, despite strong rebound on Wall Street overnight, sentiment was negative as selling pressure persisted on selected heavyweights as US-China trade tensions escalated; the FBM KLCI slipped 0.17% to 1,680.54 pts. Market breadth was negative with 427 losers vs. 292 gainers. Market traded volumes stood at 1.91bn, worth RM1.51bn.

Wall Street ended on a negative note following the renewed tensions on trade disputes between the US and China following the arrest of Huawei’s CFO, coupled with weaker-than expected jobs reports. The Dow and S&P500 dropped 2.24% and 2.33%, respectively, while Nasdaq plunged 3.05%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has turned lower over the past week and the negative momentum may continue to dominate for this week as MACD indicator has been hovering below zero last week. Meanwhile, both the RSI and Stochastic oscillators trended below the 50-level last week. With most of the indicators pointing towards, we opine that the KLCI’s upside will be capped along 1,700, followed by 1,730. Support will be envisaged around 1,658, followed by 1,630.

On the local front, we think selling pressure could persist, tracking the negative tone on Wall Street as well as the escalating trade tensions between the US and China. However, trading activities may be seen within the O&G stocks with the speculation of higher Brent oil prices this week.

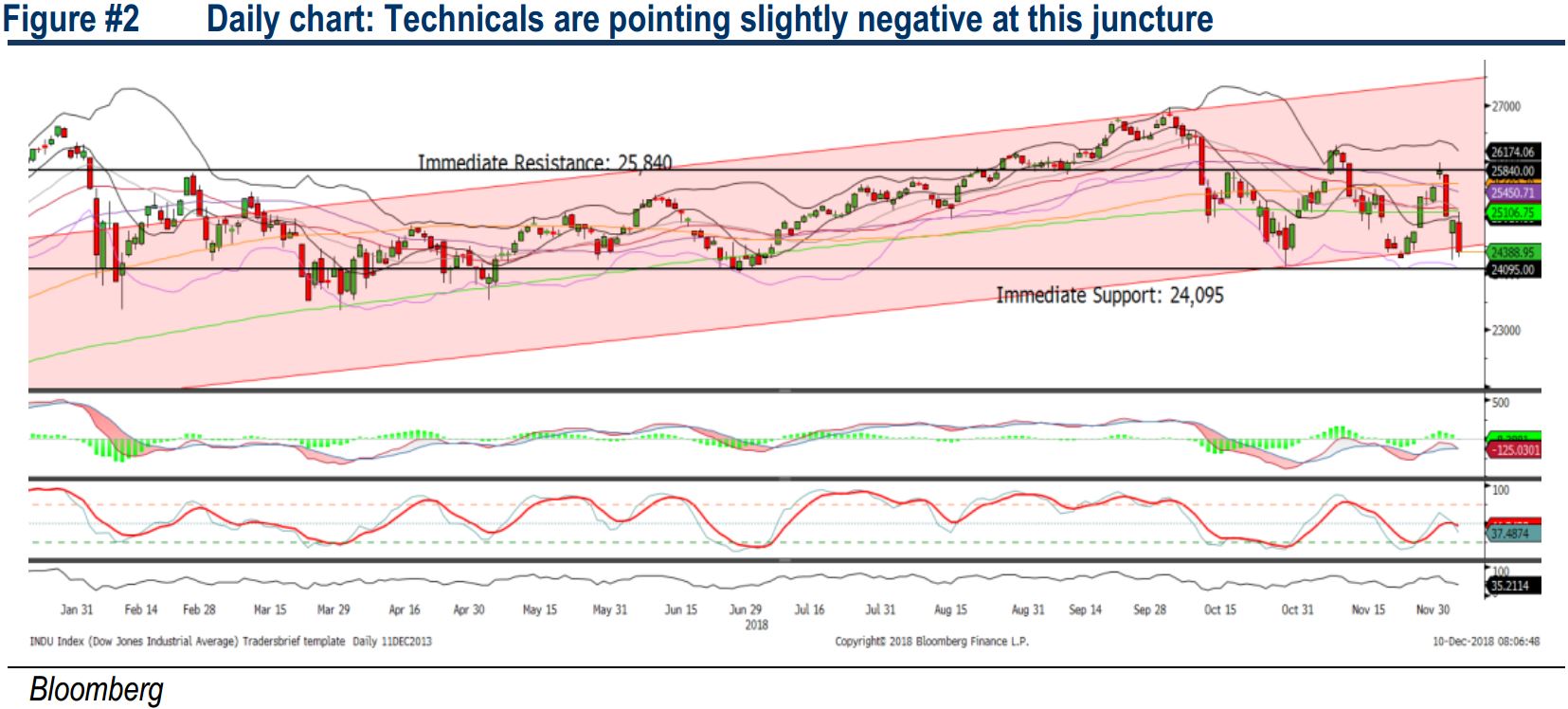

TECHNICAL OUTLOOK: DOW JONES

The Dow revisited the SMA200 level at 25,106 before retreating towards the lower band of the upward channel around 24,340. The MACD indicator is trending lower below zero, while both the RSI and Stochastic oscillators are below 50; suggesting that the negative momentum is intact. With that, we believe the Dow is likely to violate below the upward channel, targeting the next support at 24,095. Meanwhile, resistance will be set around 25,500-25,840.

In the US, we believe market volatility is likely to increase despite the 90-day trade truce period following the arrest of Huawei’s CFO, which contributed towards escalation of trade tensions between the US and China. The only feel good factor over the weekend that may limit the downside risk is the better-than-expected production cutting outcome by the OPEC and the non-OPEC meeting last week.

Source: Hong Leong Investment Bank Research - 10 Dec 2018