Traders Brief - Volatility Increase and Downward Bias on KLCI

HLInvest

Publish date: Tue, 11 Dec 2018, 04:23 PM

MARKET REVIEW

Asia’s stock markets ended on a negative note as China’s trade data registered significantly below consensus over the weekend, coupled with rising trade concerns between US and China. The Nikkei 225 plunged 2.12%, while Hang Seng Index and Shanghai Composite Index declined 1.19% and 0.82%, respectively.

Tracking the negative performance on Wall Street last week as well as the negative regional performances, the FBM KLCI lost 1.03% to 1,663.31 pts. Market breadth was negative with decliners leading advancers by a ratio of more than 3-to-1, accompanied by market traded volumes of 2.65bn, worth RM1.37bn. Also, we noticed some of the software-related companies such as MYEG and Prestariang were traded lower as PH-government continues to review/ cancel some of the major concessionaire projects.

Following the significant decline last week, Wall Street trended lower at the start of the session in a volatile manner led by banking heavyweights and Apple shares amid intensifying trade tensions between US and China. The Dow declined more than 500 points before turning marginally higher by 0.14%, Meanwhile, S&P500 and Nasdaq rose 0.18% and 0.74%, respectively on a broad base rebound.

TECHNICAL OUTLOOK: KLCI

The upside of FBM KLCI is likely to be capped near the 1,680 and could trend lower as it has violated the previous support at 1,680, while the MACD indicator has issued a bearish crossover below zero. Also, both the RSI and Stochastic oscillators are trending below 50. Hence, we believe the KLCI upside will be limited around 1,680-1,700, while the support will be set along 1,658, followed by 1,630.

Although Wall Street rebounded to close higher, we believe the unsettled trade developments and the negative sentiment could continue to weigh on the local markets, limiting the upside potential on FBM KLCI. Internally, the ongoing review of the concessionaire projects by PH government may also pose downside risk towards previous inked agreements for selected corporates.

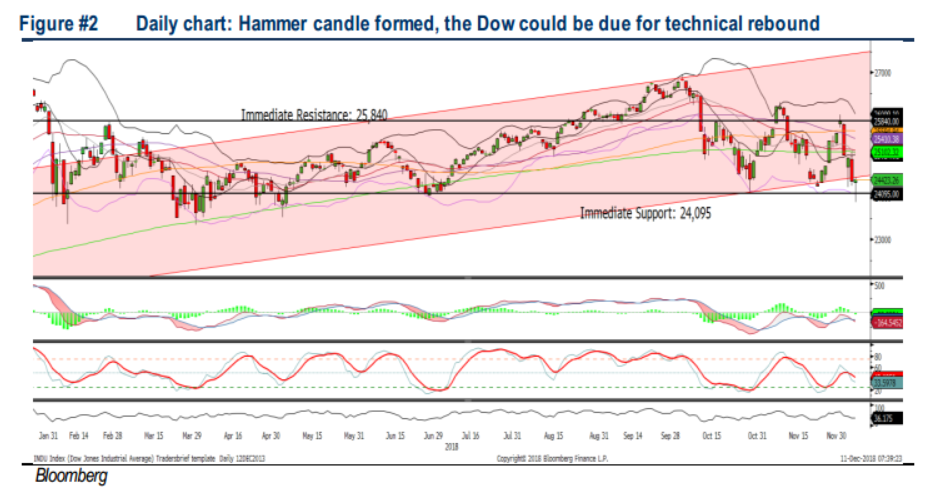

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to trade below the SMA200 level with the continuation of trade concerns between the US and China. The MACD Indicator has issued a “dead” cross below the zero level, while the RSI is hovering below the 50 level. However, the Dow has formed a hammer candle after trading towards the 24,000 level. Hence, the Dow may perform a technical rebound over the near term. Nevertheless, with the negative technical readings on both RSI and Stochastic oscillators, the Dow’s upside will be capped around 25,106 (SMA200), while support will be pegged around 23500-24,000.

After the arrest of Huawei’s CFO, the volatility increase on Wall Street as the arrest is being viewed as a potential hindrance to the US and China arriving at a permanent deal on trade. However, as we have noticed the broad base rebound on Wall Street yesterday, bargain hunting activities may emerge over the near term, but Dow’s upside will be capped along the SMA200 as market participants will still be wary on the trade developments between US and China, capping the upside potential on Wall Street, eventually after a brief rebound.

Source: Hong Leong Investment Bank Research - 11 Dec 2018