Traders Brief - Cautious ahead of the FOMC meeting outcome

HLInvest

Publish date: Wed, 19 Dec 2018, 11:14 AM

MARKET REVIEW

Asian markets ended lower following overnight slump in Wall Street as investors fretted over a gloomy global economic outlook. Meanwhile, a key speech by Chinese President Xi to commemorate the 40th anniversary of China’s economic reforms did little to assuage the fall in SHCOMP (-0.82% to 2576.7). Xi called for China to "stay the course" on its current path of reform and emphasized that no one can ‘dictate’ reforms to China.

Tracking lower regional markets and overnight Dow, KLCI tumbled as much as 14.7 pts to 1626.9 before paring the losses to 6.3pts at 1635.3. Trading volume increased to 2.27bn shares worth RM1.91bn as compared to Monday’s 1.47bn shares worth RM1.18bn. Market breadth was negative with 222 gainers as compared to 699 losers, driven by heavy losses in FBMSCAP (-2.95%) and FBMACE (-1.73%).

After sliding 1004 pts in previous two days, the Dow rallied as much as 335 pts to 23928 but the gains were narrowed to 83pts, ending the volatile session at 23675 as investors gear up to a crucial FOMC policy announcement at 2am on Thursday. Meanwhile, sentiment was also gripped by a possible government shutdown and diving oil prices amid worries of slowing global growth and weakening oil demand coupled with soaring crude output from US shale fields, overshadowed the curbs by OPEC+ coalition that includes Saudi and Russia.

TECHNICAL OUTLOOK: KLCI

On the back of a 2-day 4.1% rout in Dow, KLCI continued its fall for a 4th straight session at 1635.3. We expect volatility to prevail ahead of the FOMC meeting outcome tomorrow, with KLCI likely to reach an inflection zone near 1614 (14 Nov 2016) to 1626 (18 Dec low) levels, which could attract oversold bargain hunting activities during the window dressing period. However, a fall below 1614 will witness further slide towards 1590 zones. Conversely, a strong breakout above 1665 (10D SMA) will spur further recovery towards 1678 (20D SMA) and 1700 psychological barrier.

On the local front, sentiment is likely to remain tepid as local and external headwinds should continue to buffet domestic equities. Rising US-China trade turmoil and a slowing global economy, coupled with subdued commodity prices that exacerbate Malaysia’s persistent weak fiscal profile and the weakening corporate earnings are main drags. Major supports are set at 1614-1626 whilst resistances are near 1665-1678.

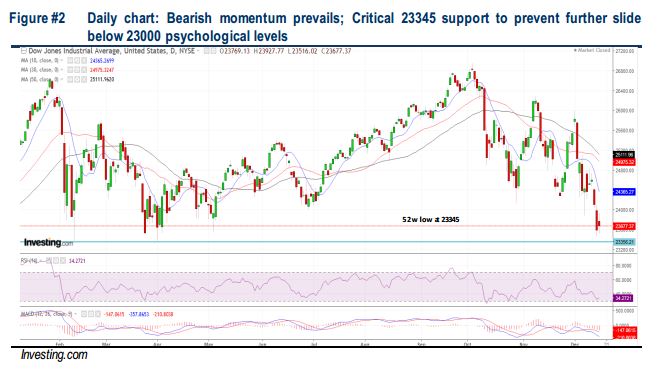

TECHNICAL OUTLOOK: DOW JONES

Despite a mild 83-pt technical rebound to 23675 overnight (-2.3% YTD and -12.2% from all time high of 26952), near term technical outlook remains weak as the MACD Histogram continues to expand negatively below zero. Unless the Dow can reclaim above 10D SMA near 24300 decisively, the index is likely to retest 23345 (52W low) over the near term, before staging a meaningful rebound, given the cautious trading sentiment and lack of strong technical positivity signs. Conversely, a strong breakout above 24300 will lift index towards 24800-25000 territory.

In the US, recent market skittishness was largely attributed to concerns over sluggish global economic expansion, escalating US-China trade tensions and growing worries that the Fed's plan to raise interest rates could be too much for the economy and stock market to handle. Overall, Wall Street is expected to continue experiencing bouts of volatility as the Fed is widely expected to raise rates by 25 bps tomorrow. However, expectations for further rate hikes in 2019 have dampened and could cushion further slump in financial markets (likely to reduce the quantum of previously scheduled 3 hikes) amid concerns of a potential slowdown in economic growth.

Source: Hong Leong Investment Bank Research - 19 Dec 2018