Traders Brief - Window dressing activities may emerge

HLInvest

Publish date: Fri, 21 Dec 2018, 11:49 AM

After the US Federal Reserve increase interest rates for the fourth time in 2018 and Jerome Powell projected another 2 hikes for next year (reduced from 3 hikes projected earlier), Asia’s stock markets traded lower for the session. Shanghai Composite Index and Hang Seng Index fell 0.52% and 0.94%, while Nikkei 225 plunged 2.84%.

Following the Fed’s interest rates hike and outlook statement, stocks on the local front trended lower, tracking the negative sentiment from stock markets regionally as well as Wall Street overnight. Market breadth was slightly bearish with 463 decliners vs. 334 gainers. Overall traded volumes stood at 2.00bn, worth RM1.59bn. Nevertheless, we noticed selected semiconductor-related such as Frontken and Vitrox traded actively higher.

Wall Street trended lower for the second consecutive days after the Fed concluded the FOMC meeting with an interest rates hike, coupled with its plan to unwind its balance sheet. Also, President Trump threaten a partial government shutdown spooked the stock markets, contributed to a sharp drop overnight. The Dow and S&P500 declined 1.99% and 1.57%, respectively, while Nasdaq fell 1.63%.

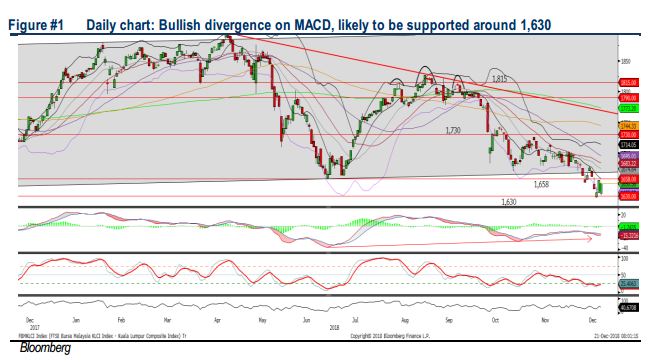

TECHNICAL OUTLOOK: KLCI

Following a few rounds of selling pressure on the FBM KLCI, we have seen some support around 1,630 on the back of window dressing activities. Despite the MACD Indicator is hovering below zero, we noted a bullish divergence is forming on the MACD. Also, the Stochastic oscillator is hovering within the oversold region and the RSI is trending slightly below 50. We may anticipate that the key index to trade within the region of 1,630-1,658. Should there be a breakout above 1,658, next resistance will be at 1,680. Meanwhile, support will be located around 1,620-1,630.

On the local front, we expect the spillover of negative trading tone from Wall Street overnight. Also, with the Brent crude oil prices trading significantly below USD70 (Budget 2019’s assumption), traders may take the opportunity to further reduce exposure within oil and gas sector. Nevertheless, the potential window dressing activities that may emerge in the month of December could lend some support on KLCI, limiting the near term downside risk around 1,620-1,630.

TECHNICAL OUTLOOK: DOW JONES

Following the violation below the lower band of the upward channel, the Dow trended negatively and MACD Indicator expanded negatively below zero. Despite both the RSI and Stochastic oscillators are suggesting that the Dow oversold, the upside rebound will be limited as the key index has moved below most of the important moving averages. With technical readings negative on the Dow, we expect the upside to be capped along the resistance 24,175, while support will be pegged around 22,200.

In the US, we think downside risk may persist after digesting the Fed’s move on the interest rates hike and potential of 2 more hikes in 2019 (more hawkish-than-expected) and softer economic expansion moving forward. Moreover, should there be any resurfacing of unsettled trade developments news in the media, it may dampen stock markets and market volatility could increase as the major indexes are almost traded in the bear market territories.

Source: Hong Leong Investment Bank Research - 21 Dec 2018