Tradersbrief - Likely to Perform a Technical Rebound

HLInvest

Publish date: Wed, 02 Jan 2019, 04:59 PM

MARKET REVIEW

Despite the positive trade news that President Donald Trump had a “long and very good call” with Chinese President Xi Jinping, Asia’s stock markets ended mostly mixed on final day of 2018, while most of the major markets around the world registered calendar year declines. The Hang Seng Index gained 1.34% on final trading day, but declined 13.6% for 2018. Also, Shanghai Composite Index and Nikkei 225 lost 24.6% and 12.1%, respectively for the year. Meanwhile, China’s manufacturing activity in December contracted more-than-expected; official manufacturing PMI stood at 49.4 (vs. consensus of 49.9).

After a few rounds of window dressing activities started since 18-Dec, the FBM KLCI ended the final day of 2018 on a softer note; the FBM KLCI slipped 0.1% to 1,690.58 pts. Market breadth, however was positive with 429 advancers vs. 361 decliners. Market traded volumes stood at 1.57bn worth RM1.33bn. Despite the stronger ringgit, we noticed selected technology related stocks such as VITROX, VS, MI Equipment were traded actively higher.

Wall Street traded positively following Trump-Xi conversation on the trade front; the Dow and S&P500 rose 1.15% and 0.85%, respectively for the final day of 2018, but declined 5.6% and 6.2% for the calendar year 2018 after a sharp fall in 4Q on the back of Jerome Powell’s “still hawkish” stance and ongoing trade concerns.

TECHNICAL OUTLOOK: KLCI

Although the FBM KLCI ended lower on 31-Dec, most of the technical indicators are suggesting that the trend is recovering. The +DMI is hovering above -DMI, while MACD indicator is recovering towards the zero level. Meanwhile, both the RSI and Stochastic oscillators are above 50. Hence, we anticipate that the key index could trend higher after a mild retracement. Support will be located around 1,650, followed by 1,630. The resistance will be pegged around 1,700-1,730.

We believe the pullback on the FBM KLCI may persist over the immediate term, but based on the technical readings on the MACD indicator, which suggested a bullish divergence could mean that the key index having limited downside risk, potentially leading to a “January effect” bounce. The support will be pegged around 1,630-1.650.

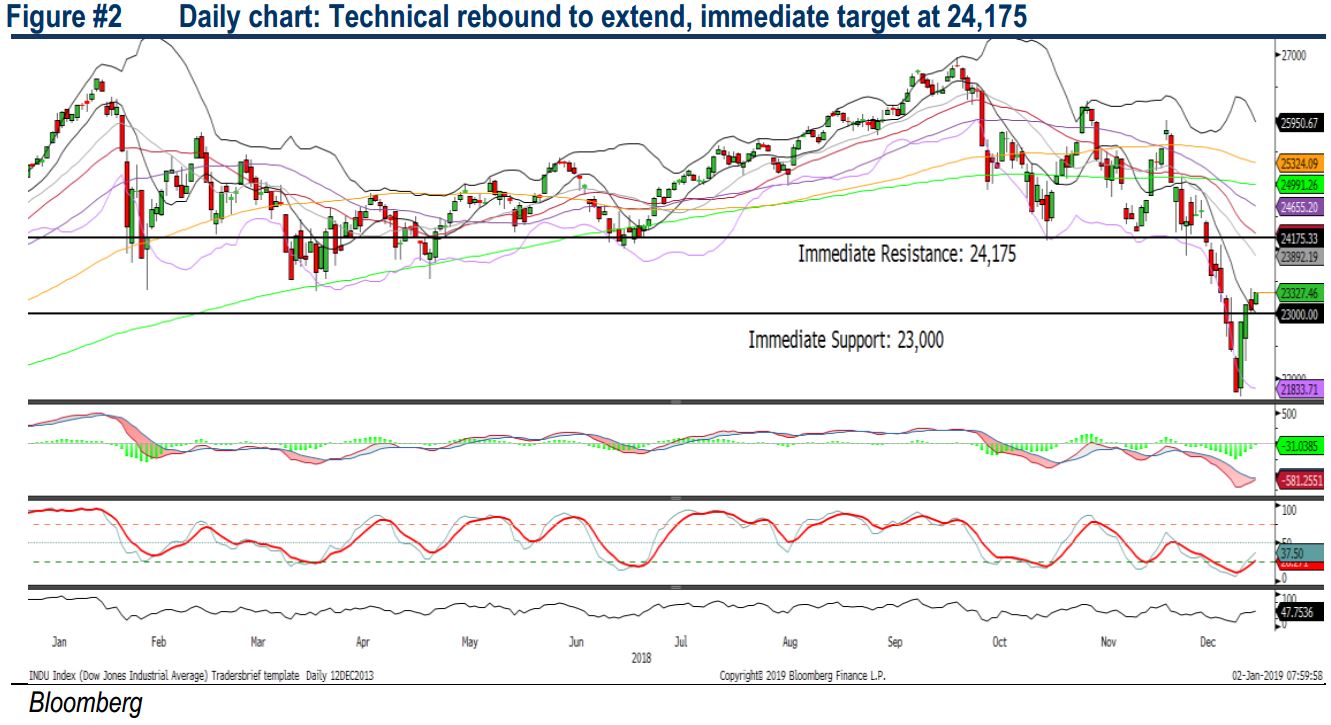

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to hover below the SMA200 despite a rebound on Monday. The MACD indicator is below zero, but both the RSI and Stochastic are trending higher over the past few sessions. We opine that the Dow may rebound higher over the near term, but upside might be limited around 24,175, followed by 24,991 (SMA200). Support will be set along 23,000, followed by 22,500.

In the US, the Dow could rebound after severe selling activities throughout the month of December, but trading activities will be focusing on corporate earnings season, which will be starting on 14-Jan, which could provide direction for the markets. In the meantime, we expect the volatility may persist during the 90-day trade truce period as markets are still headlines driven at this moment.

Source: Hong Leong Investment Bank Research - 2 Jan 2019