Tradersbrief - Range Bound Mode After Apple’s Guidance

HLInvest

Publish date: Thu, 03 Jan 2019, 05:10 PM

MARKET REVIEW

Asia’s stock markets started the year on a negative tone as investors digested China’s December manufacturing data, which was weaker-than-expected. The selling pressure activities continue with Nikkei 225 falling 0.31%, while Shanghai Composite Index and Hang Seng Index declined 1.15% and 2.77%, respectively.

Similarly on the local front, the FBM KLCI ended in the negative territory in tandem with the regional markets; the FBM KLCI lost 1.33% to 1,668.11 pts. Market breadth was negative as decliners outpaced advancers by a ratio of 2-to-1. Market traded volumes stood at 1.68bn, worth RM0.95bn. We noticed most of the Hang Seng put warrants were topping the gainers list amid the negative regional sentiment.

Wall Street kicked off 2019 on a volatile trading session, where the Dow declined near to 400 points before climbing higher by 18.78 pts (+0.08%) to end at 23,346.24 pts for the day amid bargain hunting activities. Meanwhile, S&P500 and Nasdaq rose 0.13% and 0.46% led by banking and energy stocks; the latter traded higher on the back of a jump in crude oil prices.

TECHNICAL OUTLOOK: KLCI

Following the sharp fall yesterday on the FBM KLCI, it has formed a bearish candle violating the support around 1,670. However, with the MACD Indicator suggesting that the bullish divergence signal is intact, we believe the downside could be limited around 1,630-1,650 levels. Nevertheless, both the RSI and Stochastic oscillators are mixed at this juncture; indicating that the FBM KLCI may range bound over the near term. Resistance will be located around 1,670-1,700.

With the bargain hunting activities on Wall Street overnight, we may anticipate slight rebound on broader market. However, semiconductor-related stocks could be expecting higher trading activities after Apple slashed revenue guidance moving forward. Nevertheless, O&G stocks may rebound as Brent oil trended higher in the previous session.

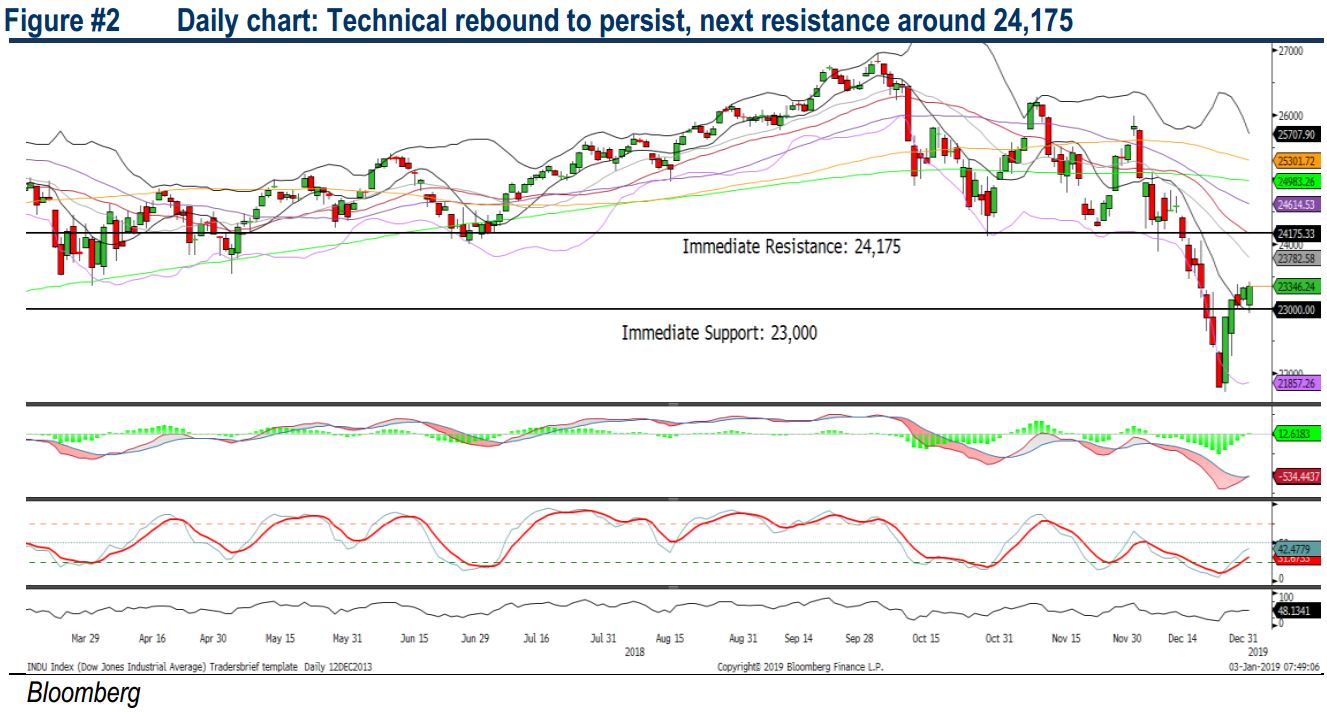

TECHNICAL OUTLOOK: DOW JONES

The Dow rebounded off the 23,000 level amid bargain hunting activities and the MACD Indicator formed a positive crossover signal. Meanwhile, both the RSI and Stochastic oscillators are trending higher towards 50; momentum is trending up over the past few sessions. Although the Dow may rebound higher, the upside could be capped around 24,175, followed by 24,983 (SMA200). Support will be set along 23,000, followed by 22,500.

Despite the bargain hunting activities in the US, we may see limited upside as Apple warned on softer 1Q results as iPhone and Apple Watch sales may disappoint in a letter to investors by CEO Tim Cook. This has led to after-market sell down in technology sector and we may expect the Dow to trade range bound within 22,500-24,175 over the near term.

Source: Hong Leong Investment Bank Research - 3 Jan 2019