Traders Brief - Further rebound to be expected

HLInvest

Publish date: Tue, 08 Jan 2019, 09:42 AM

MARKET REVIEW

On the back of slightly calmer trade backdrop as fresh discussions were initiated by China, trade tensions fizzled off mildly and most of the benchmark indices trended higher for the session. The Nikkei 225 rose 2.44%, while Shanghai Composite Index and Hang Seng Index gained 0.72% and 0.82%, respectively.

Similarly, market sentiment was positive after the opening bell, boosting the FBM KLCI towards an intraday high of 1,687.13 pts before ending at 1,679.17 pts (+0.56%). Market breadth was positive as advancers led decliners by a ratio of 2-to-1, accompanied by 2.50bn shares traded for the session, valued at RM1.92bn.

Following a strong recovery on Wall Street last week amid the Fed’s dovish comments and trade optimism after resumption of trade discussions between US-China as well as recovering crude oil prices, the Dow and S&P500 rose another 0.42% and 0.67%, respectively, while Nasdaq advanced 1.26%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended slightly higher and the ADX indicator has given a positive crossover signal. Meanwhile, the MACD Line is trending nearer towards zero, while both the RSI and Stochastic oscillators are hovering above 50. With all the technical readings pointing towards a positive direction, we believe the upside reward would be greater at this juncture. Resistance will be envisaged around 1,700, followed by 1,730, while the support will be set along 1,650, followed by 1,630.

We believe the local stock market likely to trade on an upbeat tone following the positive overnight performance on Wall Street, coupled with the optimism that some trade deals could be struck in the ongoing trade talks between US-China. Moreover, the firmer Brent oil (USD57.33) recovery over the past few days could lend a support on O&G stocks over the near term.

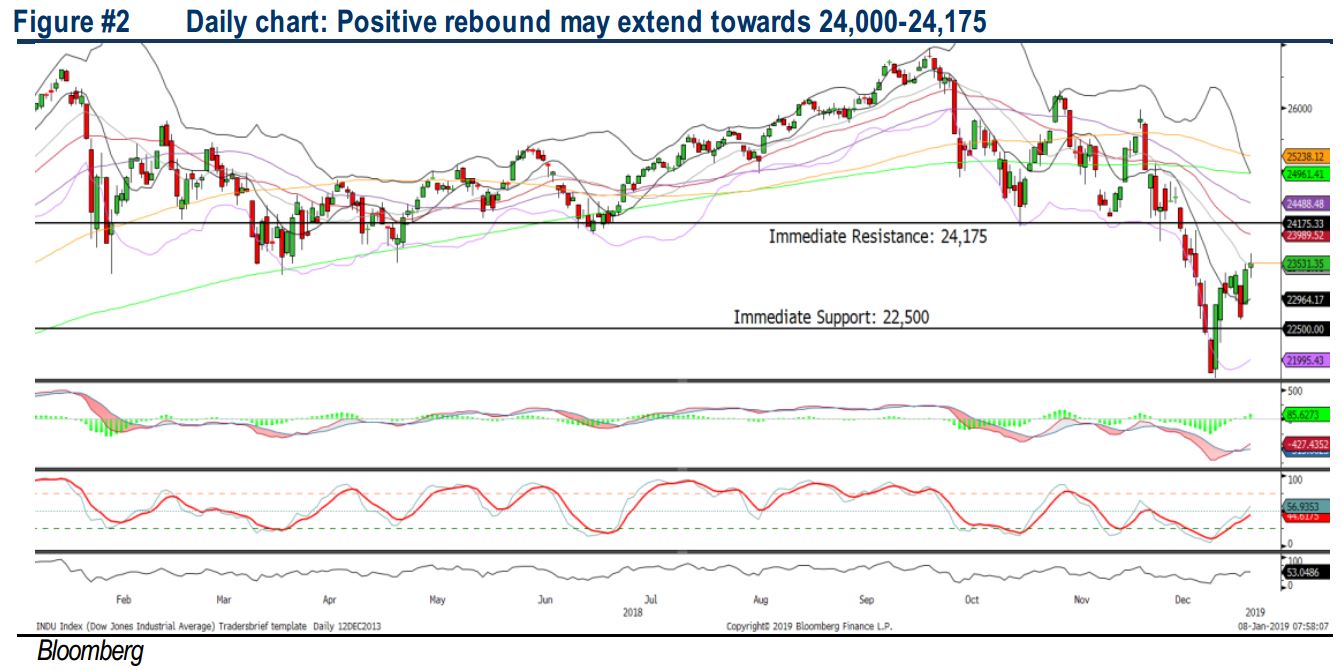

TECHNICAL OUTLOOK: DOW JONES

The Dow has extended its rebound and the MACD Indicator is recovering. Meanwhile, both the RSI and Stochastic oscillators have crossed above 50, suggesting that the positive momentum is intact. We may anticipate further rebound on the Dow towards the resistance of 24, 000- 24,175. Meanwhile, support will be located around 23,000, followed by 22,500.

In the US, we remain hopeful on the recent V-shape rebound and anticipate further extension of the relief rally in view that US Secretary of Commerce Wilbur Ross commented that there is a “very good chance” the US will get a “reasonable settlement” that addresses all of the key issues during an interview. Hence, we could expect the Dow to trade higher over the near term.

Source: Hong Leong Investment Bank Research - 8 Jan 2019