Tradersbrief - Downside Limited, KLCI Due for a Rebound

HLInvest

Publish date: Wed, 09 Jan 2019, 05:19 PM

MARKET REVIEW

Asia’s stock markets ended mixed as investors continue to lookout for fresh developments on the ongoing trade talks between the US-China. According to Lu Kang, spokesman at the Chinese foreign ministry, commenting that China is willing to resolve its trade disputes with US “on an equal footing”. Shanghai Composite Index fell 0.26%, while Hang Seng Index and Nikkei 225 gained 0.15% and 0.82%, respectively.

Sentiment on the local front started on a positive note, but succumbed to profit taking activities as soon as the key index hit an intra-day high of 1,686.37 pts; the FBM KLCI slid 0.38% to 1,672.76 pts. Market breadth also turned negative with 404 losers vs. 366 gainers. Market traded volumes were above the 2.0bn mark at 2.31bn, worth RM2.03bn. On the heavy decliners, gloves stocks such as Top Glove, Hartalega and Kossan extended the selling pressure.

Wall Street trended higher following the conclusion of the trade talks between US-China. Investors were slightly optimistic on the trade development as both US and China officials have commented key issues were being addressed and likely working towards an agreement before March. The Dow and S&P500 gained 1.09% and 0.97%, respectively, while Nasdaq climbed 1.08%.

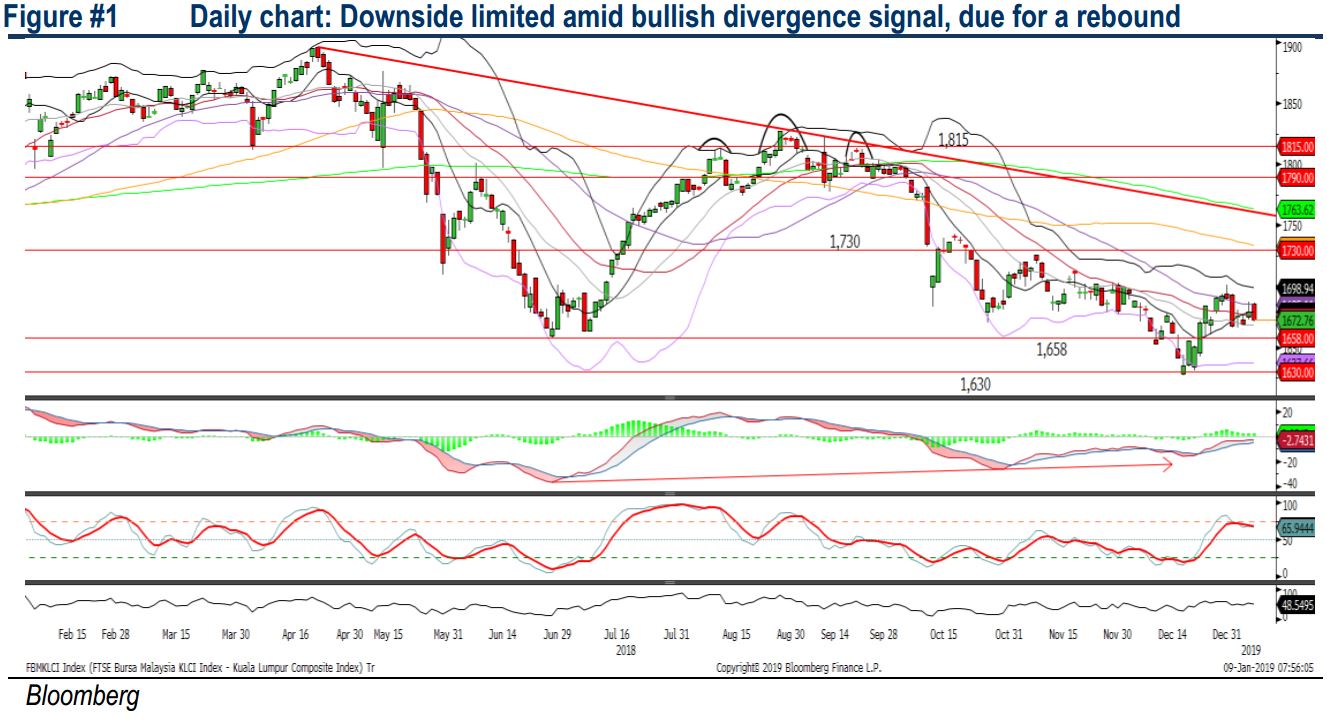

TECHNICAL OUTLOOK: KLCI

The FBM KLCI pulled back yesterday; forming a bearish engulfing candle. However, the MACD Line continues to stay flattish below zero, while ADX indicator (+DMI > -DMI) is mildly positive. Also, the Stochastic oscillator is hovering above 50. With most of the indicators suggesting that the positive momentum is intact, we believe the KLCI could be due for a technical rebound, targeting 1,700-1,730, while support will be set along 1,650-1,665.

After a mild pullback yesterday, we expect stocks to rebound today amid the fresh developments on trade front. We also believe O&G sector could trend higher amid firmer crude oil prices overnight. Also, the FBM KLCI is likely to have limited downside at this juncture as bullish divergence was spotted between the MACD and KLCI over the past 6 months.

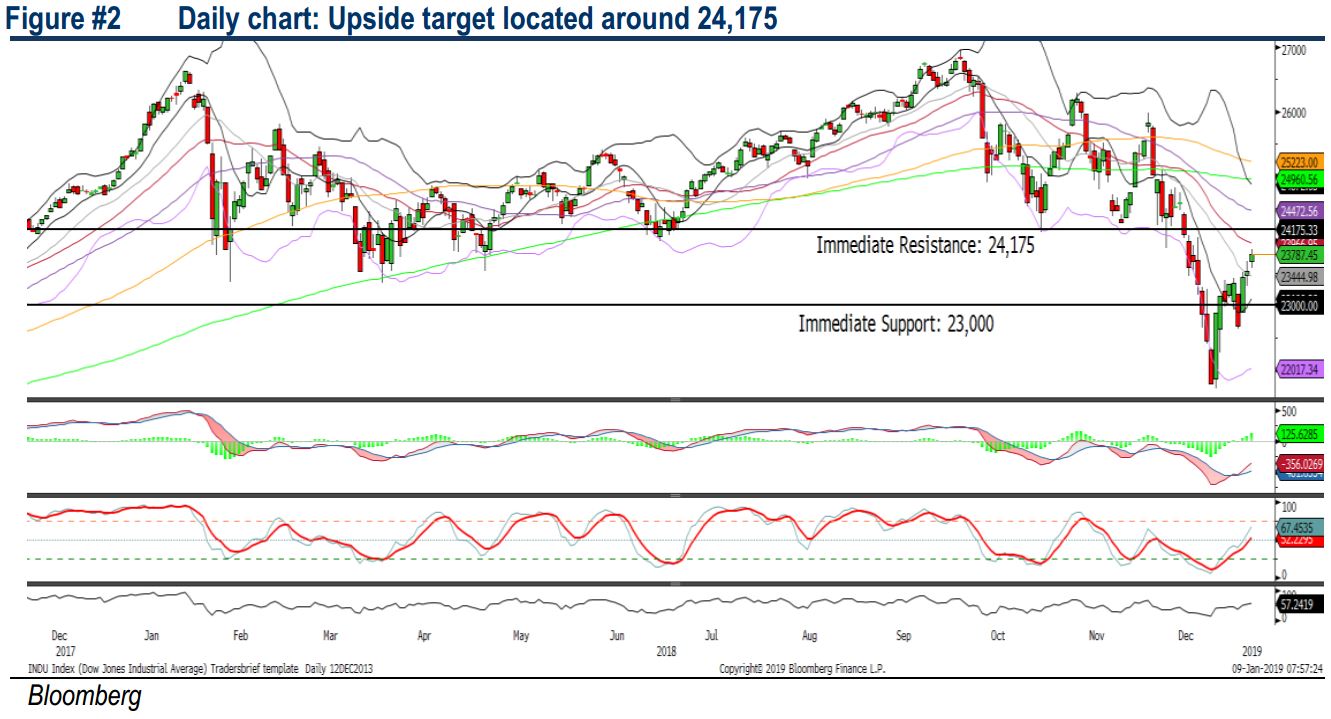

TECHNICAL OUTLOOK: DOW JONES

The Dow extended its V-shape rebound yesterday and the MACD indicator is trending higher (but hovering below zero). Also, both the RSI and Stochastic oscillators are on the rise. We expect the Dow to further extend the rebound and retest the resistance along 24,000-24,175, followed by the SMA200 at 24,960 in the mid-term. Support will be anchored around 23,000- 23,500.

In the US, we opine that the recovery may sustain as trade developments were seen optimistic at this juncture with comments from US and China officials pointing towards a potential deal by March. The Dow could continue its rebound towards 24,000-24,175. Nevertheless, investors would turn their focus now on the upcoming reporting season, which generally starts in mid January.

Source: Hong Leong Investment Bank Research - 9 Jan 2019