Tradersbrief - Selling Into Strength Could be Seen on KLCI

HLInvest

Publish date: Thu, 10 Jan 2019, 04:54 PM

MARKET REVIEW

Asia’s stock markets ended lower following the statement from Apple, slashing its revenue guidance for iPhone and Apple Watch for 1Q on the back of slower sales in China. The Nikkei 225 and Hang Seng Index fell 0.31% and 0.26%, respectively, while Shanghai Composite Index ended marginally lower by 0.04%. However, the FBM KLCI bucked the regional trend despite Apple’s softer guidance; the FBM KLCI rose 0.46% to 1,675.83 pts. Nevertheless, technology stocks such as Inari and Globetronics were affected the most after Apple slashed its outlook. Meanwhile, market breadth was neutral with 366 advancers vs. 367 decliners, accompanied by 1.76bn (worth RM1.22bn).

Wall Street ended sharply lower following the softer outlook warning from Apple on the back of potential slowing economy in China amid the ongoing trade war, which has led to a decline of 2.83% and 2.48% on Dow and S&P500, respectively. The negative sentiment spilled over towards chipmakers such as AMD and Nvidia, while heavyweights like Caterpillar which has high business exposure in the China were affected as well.

TECHNICAL OUTLOOK: KLCI

Although FBM KLCI performed a technical rebound yesterday amid bargain hunting activities, the MACD Histogram continues to weaken further. Nevertheless, both the RSI and Stochastic oscillators are trending in the positive region (above 50). With the mixed readings from the indicators, we believe FBM KLCI would range bound between the 1,658-1,700 zone over the near term.

We expect the selling pressure to emerge this session, given the weak sentiment from Wall Street, which was affected by Apple guidance and led to sell down in chipmakers. Hence, we believe the KL technology index would suffer another round of sell down, while the FBM KLCI could trend mildly lower with the support zone set around 1,630-1,650.

TECHNICAL OUTLOOK: DOW JONES

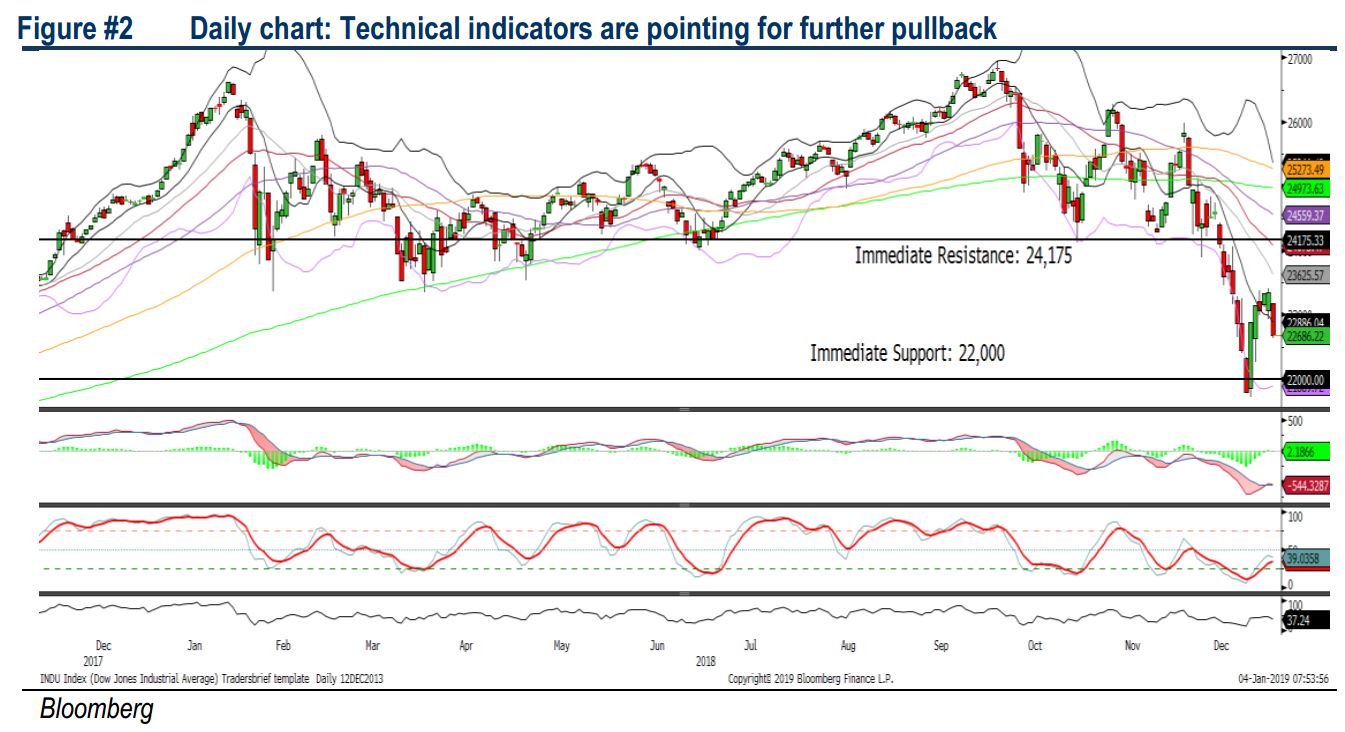

With the Dow retracing yesterday, the MACD Histogram has turned lower, while both the RSI and Stochastic oscillators have hooked downwards. Hence, we opine that the Dow may further pull back over the immediate term, with the support anchored around 22,500, followed by 22,000. Meanwhile, resistance will be pegged around 23,500-24,175.

In the US, we believe that the selling tone may extend over the near term with the weaker than-expected factory data in China and Europe, whilst the corporates in the US could be affected by potential slowing economy in China, translating to weaker earnings moving forward eventually.

Source: Hong Leong Investment Bank Research - 10 Jan 2019

calvintaneng

HONG LEONG PEOPLE VERY SMART

PUBLIC MUTUAL FUNDS MUST SELL ALL QL SHARES AWAY

IF NOT LATER PUBLIC BANK WILL FALL BEHIND HONG LEONG PEOPLE

2019-01-10 17:03