Tradersbrief - Rangebound Mode to be Expected

HLInvest

Publish date: Thu, 10 Jan 2019, 04:52 PM

MARKET REVIEW

Asia’s stock markets ended on a bullish tone following the conclusion of the US-China trade talks, which extended into an unscheduled third day discussions. Global sentiment turned positive with the anticipation of a potential trade deal to be struck soon; the Nikkei 225 rose 1.10%, while Hang Seng Index and Shanghai Composite Index advanced 2.27%, and 0.71%, respectively.

On the local front, the FBM KLCI bucked the regional trend as profit taking activities was observed on selected Petronas heavyweights (PCHEM and PETGAS) and banking stocks. Market breadth, however was positive with 429 advancers vs. 361 decliners. Market traded volumes stood at 3.02bn (100-day average: 2.12bn), worth RM2.52bn. We noticed most of the semiconductor-related stocks rebounded in line with global chipmakers sentiment.

Wall Street extended its gains for the fourth consecutive days after the conclusion of the trade discussions between China and the US, coupled with the released of December FOMC meeting minutes, reaffirming investors that the Fed remained patient on the interest rate outlook. Besides, the strong recovery in crude oil also lifted the sentiment on Wall Street; the Dow and S&P500 increased 0.39% and 0.41%, respectively.

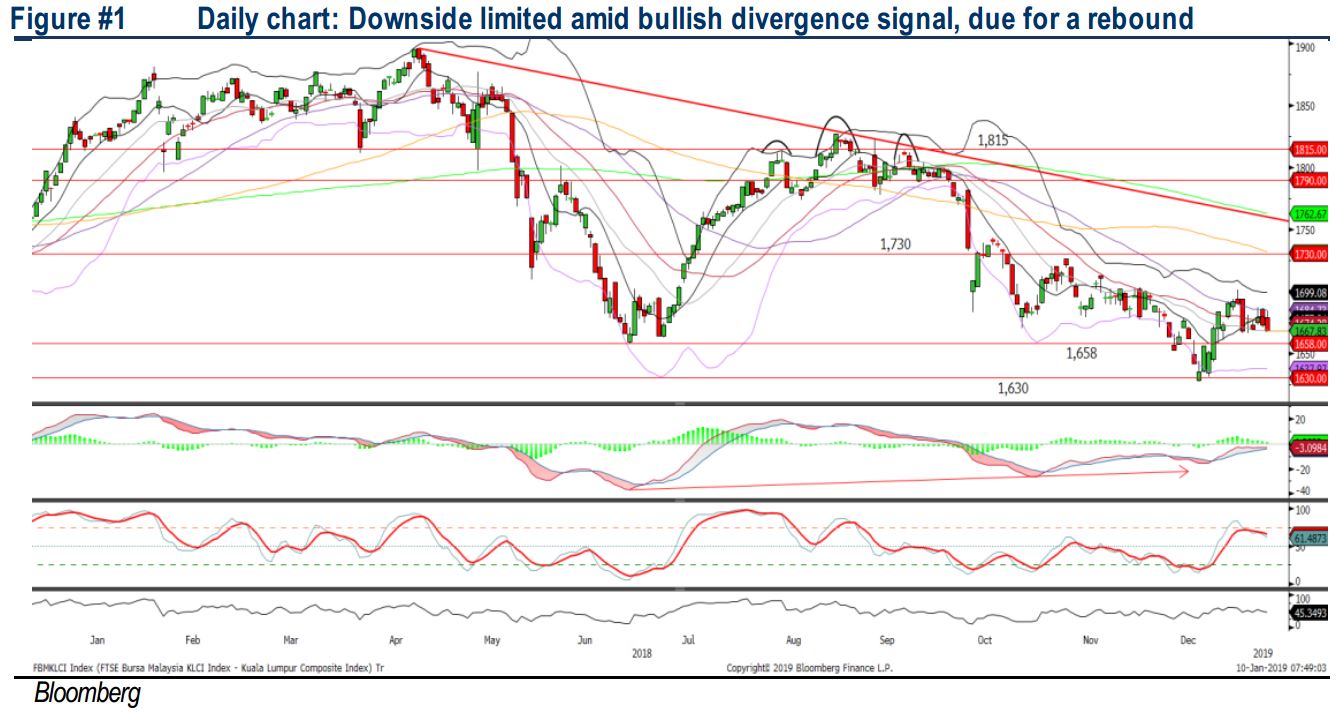

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended lower for the second consecutive trading days and the MACD Line is trending below the zero level, while MACD Histogram continues to weaken further. Nevertheless, the Stochastic is hovering above 50; indicating positive momentum is intact. We opine that the downside risk could be limited along 1,630-1,650 levels, while resistance will be pegged along 1,687-1,700.

We believe positive sentiment on Wall Street may spill over towards stocks on the local bourse and the FBM KLCI could retest the recent high of 1,687. Also, traders may focus within the O&G stocks on the back of firmer recovery in Brent oil prices, adding 4.63% overnight to USD61.44.

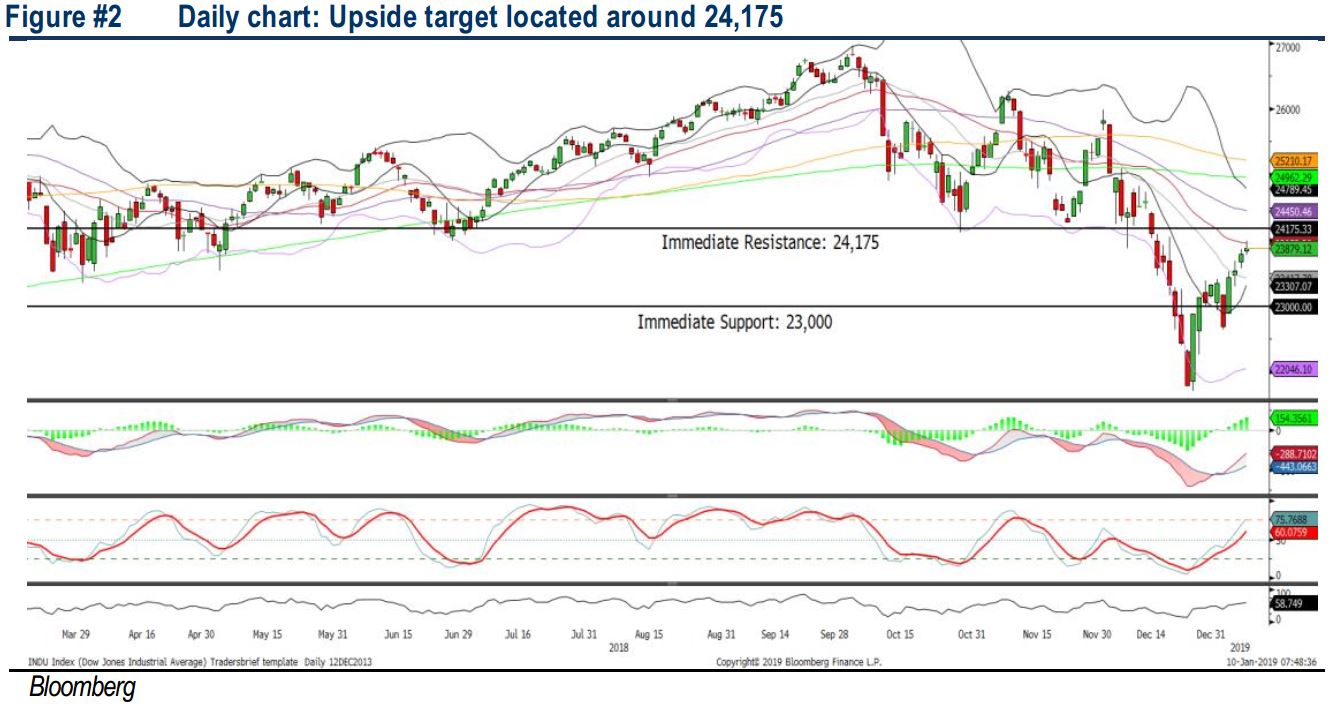

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to trade higher but at a milder pace (candle formation is getting smaller). Despite the MACD Line is recovering towards zero and both the RSI and Stochastic are rising above 50, we believe it could be hitting near the resistance zone of 24,000-24,175 and may attract traders to take profit over the near term. Meanwhile, support will be set around 23,500, followed by 23,000.

After several days of bullish rebound and hitting near the resistance region of 24,000-24,175 zone for the Dow, we may anticipate profit taking activities to emerge over the near term. Should there any be negative surprises from corporate earnings next week or negative trade developments over the near term, we may expect increase volatility moving forward.

Source: Hong Leong Investment Bank Research - 10 Jan 2019