Traders Brief - Downward Bias Mode Likely to Emerge

HLInvest

Publish date: Tue, 15 Jan 2019, 08:55 AM

MARKET REVIEW

Asia’s stock markets trended in the negative region amid the weaker-than-expected China December trade data, where the exports and imports fell 4.4% (biggest monthly drop in 2 years) and 7.6% (biggest contraction since Jul-2016), respectively. The Shanghai Composite Index and Hang Seng Index 0.71% and 1.38%, respectively, but Nikkei 225 added 0.97%.

Meanwhile, sentiment on the local front was in tandem with regional performances; the FBM KLCI slid 0.42% led by Petronas-related heavyweights. Market breadth was negative as profit taking activities emerge across the board after a decent relief rally last week; there were nearly two decliners for every stock that advanced. Market traded volumes was slightly lower at 2.18bn, worth RM1.42bn.

Wall Street ended the session on a softer note following an unexpected drop in China’s December trade data and investors were cautious ahead of the US corporate earnings season that has started yesterday. Also, the government shutdown continues to add towards the weakness on Wall Street; the Dow and S&P500 fell 0.36% and 0.53%, respectively, while Nasdaq lost 0.94%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI remained in a sideways mode over the past 8 days; trapped between the 1,666-1,687 levels. The MACD Line is hovering below zero, while both the RSI and Stochastic oscillators are turning weaker. If the key index could surge above 1,687, it may retest the next resistance around 1,700. The support will be anchored around 1,666, followed by 1,650.

We believe the negative sentiment on Wall Street could spill over to stock on the local bourse and profit taking activities could extend for another session on the back of weaker China’s trade data, coupled with stronger ringgit (dampen exporters’ outlook). Also, with the retracement of Brent oil prices, O&G sector is likely to endure mild pullback over the near term.

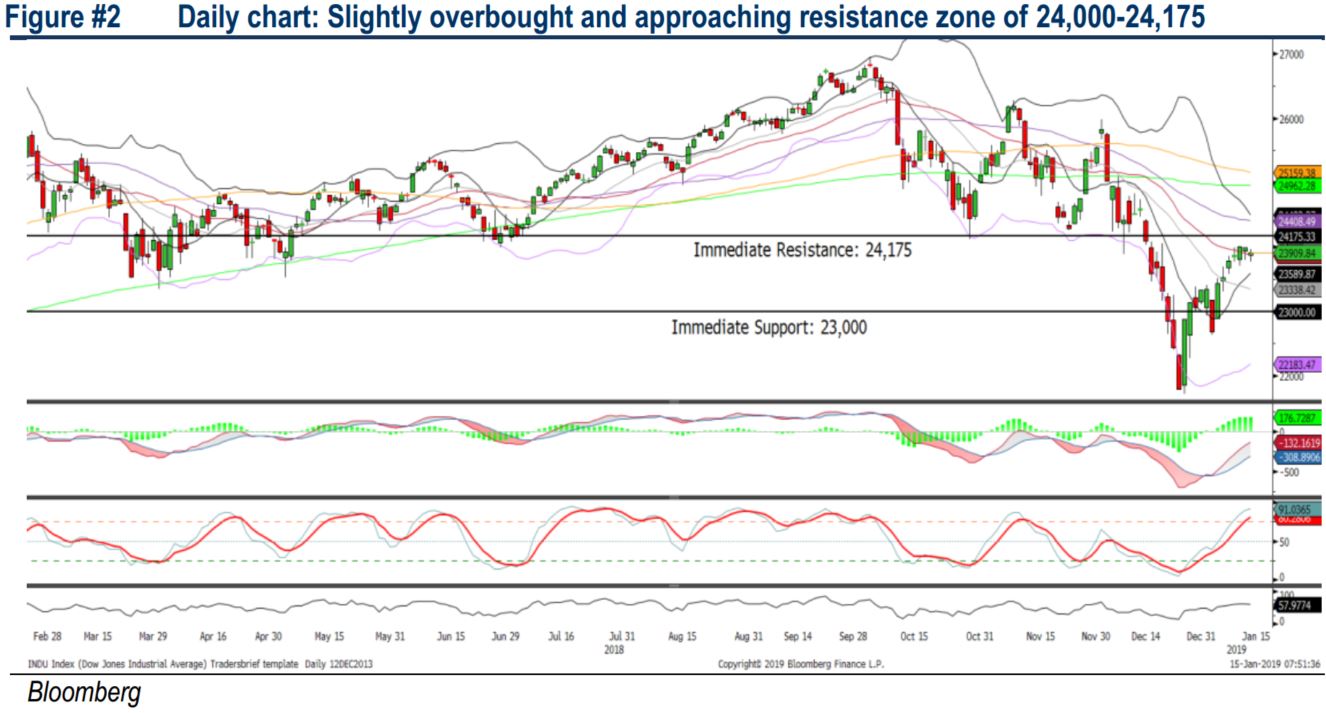

TECHNICAL OUTLOOK: DOW JONES

Despite the Dow continuing to extend its V-shape rebound over the past two weeks; it is approaching the resistance zone of 24,000-24,175. The MACD Line is trending nearer towards zero, but the Stochastic oscillator is suggesting that the Dow is overbought. We may anticipate a pullback on the Dow over the near term. Support will be pegged around 23,500, followed by 23,000. Nevertheless, if the key index could surpass 24,963 (SMA200), it will turn uptrend.

In the US, investors are likely to stay cautious during the US corporate earnings season and China’s trade data is likely to dampen the sentiment over a short period of time. Meanwhile, should there be any reopening news of the US government shutdown, it may cheer the stock markets on a positive note and the Dow could be lifted above the 24,000 psychological level.

Source: Hong Leong Investment Bank Research - 15 Jan 2019