Traders Brief - Breakout Momentum Could Sustain Towards 1,700

HLInvest

Publish date: Tue, 22 Jan 2019, 04:56 PM

MARKET REVIEW

Asia’s stock markets ended on a positive note despite China’s GDP grew at 6.6% in 2018 (lowest official data in 28 years). Nevertheless, the GDP came in within consensus expectation. The Shanghai Composite Index and Hang Seng Index added 0.56% and 0.39%, respectively. Last Friday, tracking the overnight positive Wall Street performance, stocks on the local bourse managed to gain traction and traded mostly higher.

The FBM KLCI rose 0.55% to 1,692.22 pts, while market breadth was positive with 486 gainers vs. 369 losers. Market traded volumes stood at 3.05bn, worth RM2.12bn. Selected bashed down stocks within the construction sector such as Econpile and Protasco managed to surge higher amid severe oversold signals.

Last Friday, Wall Street trended positively after China proposed to buy more goods from US over the next 6 years by a combined value of over USD1 trillion, and the deal would aim to reduce trade deficit to zero by 2024. The Dow and S&P500 rose 1.38% and 1.32%, respectively, while Nasdaq gained 1.03%. Meanwhile, Wall Street was closed on Monday for public holiday.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI experienced a sideway consolidation breakout following the 11-day range bound move between the 1,666-1,687. The MACD Line has crossed above zero, while MACD Histogram has gained momentum. Meanwhile, both the RSI and Stochastic oscillators trended above 50; suggesting that the positive momentum is intact. We expect the key index to retest the resistance around 1,700, followed by 1,730, while support will be pegged around 1,666 followed by 1,658.

We believe the market sentiment may stay positive over the near following fresh developments from the trade front as China proposed to reduce trade deficit over the next couple of years. Also, technical indicators on FBM KLCI have suggested further upside might be seen around 1,700. Traders may lookout for bashed down stocks within export related stocks on the back of weaker ringgit tone and O&G stocks amid firmer crude oil prices.

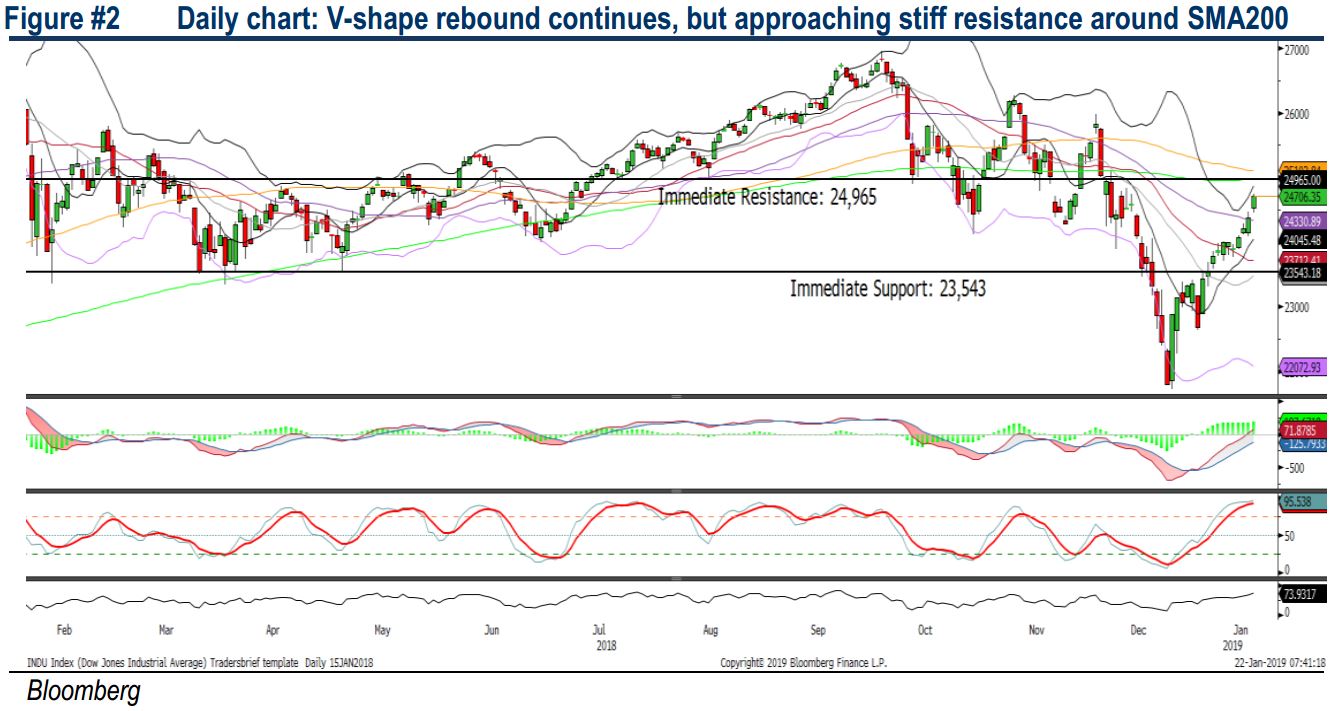

TECHNICAL OUTLOOK: DOW JONES

The Dow extended another week of upward rebound, surpassing the 24,000 psychological level last week and most of the technical indicators are turning positive (MACD Line crossed above zero). Meanwhile, the RSI and Stochastic oscillators are trending within the overbought regions and we believe the Dow could face with profit taking activities around the 24,965 level (SMA200). Should the Dow surge above 24,965, next resistance is envisaged to be around 25,500. On the flip side, support will be located around 24,000.

In the US, we expect the rebound to extend over the near term amid optimism on trade fronts after report from Bloomberg suggested that Chinese officials would increase imports from the US to narrow their trade differences to zero by 2024. Also, energy shares will be under traders’ radar on the back of decent recovery in crude oil prices, while trade-related bashed down stocks will be able to gain momentum, at least for the near term.

Source: Hong Leong Investment Bank Research - 22 Jan 2019