WTI - Slowing Global Economy Dampens Sentiment

HLInvest

Publish date: Tue, 29 Jan 2019, 10:02 AM

WTI slumped 24.8% in 2018 amid concerns of slowing global economy and surging production supply from the US & OPEC, coupled with a broad-based USD strength (weighed down on the USD-sensitive commodity). Beginning 2019, oil prices staged a strong 20% rebound to USD54.5 (21 Jan) from USD45.4 (end 2018 closing), driven by favourable catalysts such as OPEC production cuts (including Russia) to keep 1.2m bpd and positive optimism of the US-China trade talks China coupled with a dovish remarks by Fed. However, oil prices witnessed a 4.6% pullback from YTD high to end at USD52 overnight due to weak US corporate profit forecasts and deteriorating China economic indicators stoked concern about the global economy, bruising a market already anxious about booming American oil supplies. Last Friday, Baker Hughes said oil rigs jumped by 10 after falling 33 rigs over the prior three weeks.

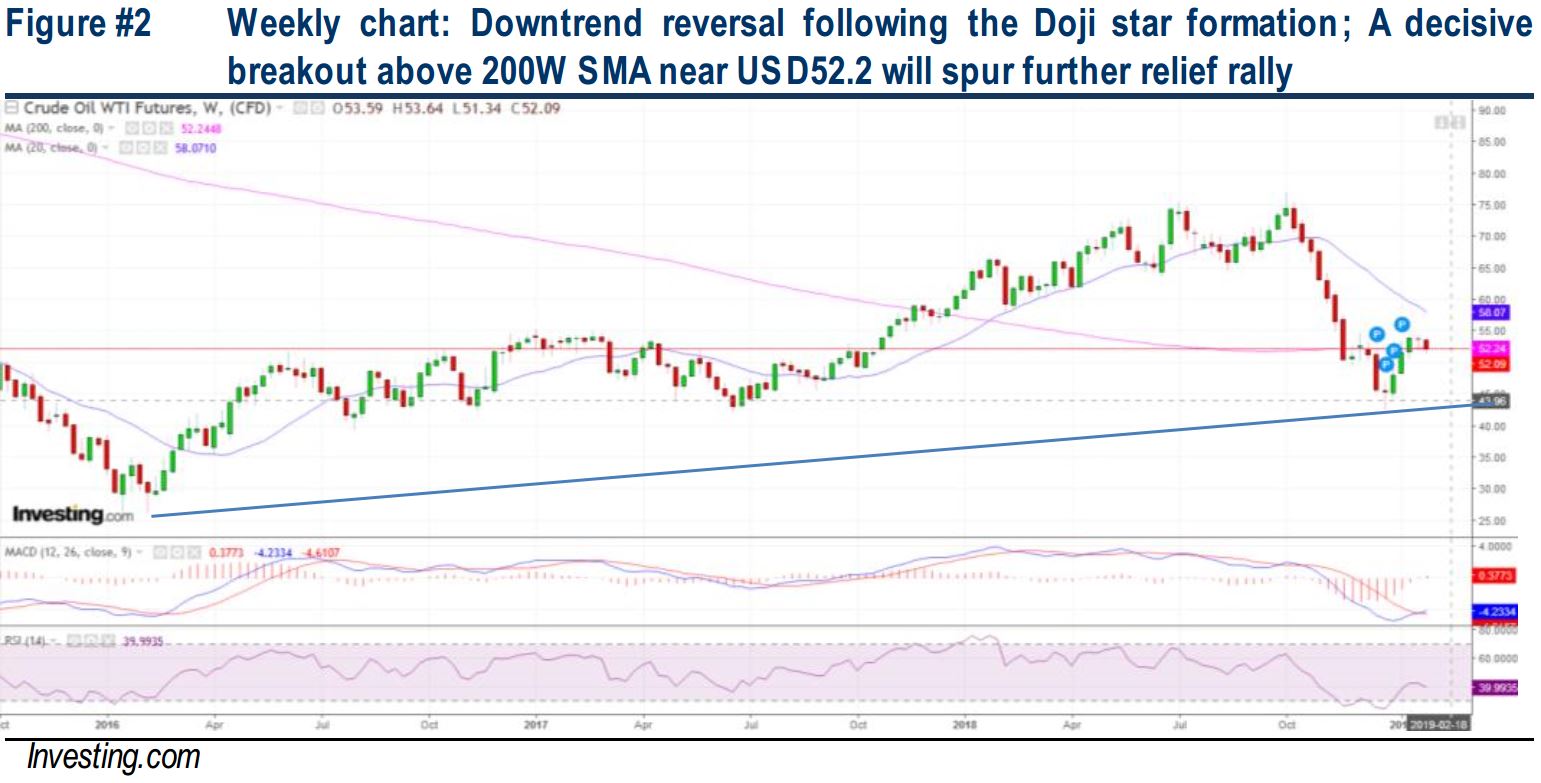

More sideways consolidation after recent technical rebound from 18M low of USD42.4 (24 Dec). Following the recent surge of 22.6% from USD42.4 to USD52 overnight, WTI is likely to engage in short term consolidation due to softening daily technical. Nevertheless, we remain optimistic of further advance in the mid to long term given the rounding bottom (daily chart) and Doji star (weekly chart) formations. A strong breakout above USD52.3 (200W SMA) could see oil prices further uptrend towards USD55-56 levels in the medium term and before retesting our LT objective towards USD59-60 zones.

Source: Hong Leong Investment Bank Research - 29 Jan 2019