Tradersbrief - 20190130 - Still in the Retracement Mode

HLInvest

Publish date: Wed, 30 Jan 2019, 04:14 PM

MARKET REVIEW

Most of the regional benchmark indices ended lower amid renewed concerns over slowing China’s economic activities as well as resurfacing of trade tensions between US and China after US Department of Justice filed criminal charges on Monday to officially request the extradition of the CFO of Huawei, Meng Wanzhou. Mild selling pressure emerged Shanghai Composite Index (-0.10%) and Hang Seng Index (-0.16%), but Nikkei 225 gained 0.08%.

Meanwhile, tracking the regional performances, the FBM KLCI traded mostly in the negative path and closed softer by 0.42% to 1,690.41 pts amid profit taking activities ahead of Chinese New Year long holiday. Market breadth was negative with 487 decliners vs. 299 advancers. Market traded volumes stood at 2.33bn, worth RM2.03bn. Despite softer crude oil prices, we noticed Carimin Petroleum (+19.2%) traded actively higher for the session, remains uptrend intact.

Wall Street closed mixed despite positive corporate earnings coming from 3M, Allergen and Verizon as market participants were taking a cautious stance while digesting Apple results, which was announced after market closing. The Dow rose 0.21%, while S&P500 and Nasdaq lost 0.15% and 0.81%, respectively.

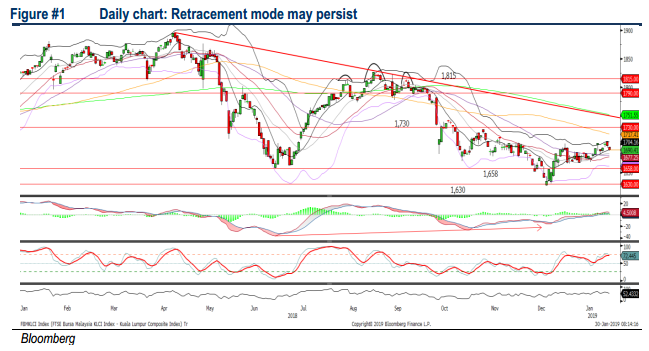

TECHNICAL OUTLOOK: KLCI

The FBM KLCI pulled back for the second day after securing above the 1,700 psychological level last Friday. The MACD indicator turned flattish over the past two days and the Stochastic oscillator is still overbought. With the technical readings turning weaker, we anticipate further retracement on the key index with the support located around 1,680, followed by 1,666. Meanwhile, resistance will be envisaged around 1,700 and 1,730.

On the local bourse, we expect the profit taking activities to be extended this week ahead of the Chinese New Year long break. Meanwhile, with the recovery of Brent oil prices above USD60, there could be increased trading activities amongst O&G stocks. Nevertheless, sentiment will likely to remain cautious on the broader market ahead of the trade discussions.

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to trend sideways below the SMA200 and the MACD Indicator stayed flattish. Meanwhile, the Stochastic oscillator is overbought. Hence we believe that the Dow’s upside could be capped over the near term along the 24,965 (SMA200). Support will be anchored around 24,000, followed by 23,500.

In the US, the ongoing corporate earnings will be one of the key factors to determine the market direction at least for the near term. Besides, market participants will be focusing on the outcome of the trade discussion between the US and China this week as trade tensions have resurfaced recently after DoJ filed criminal charges against Huawei’s CFO. The Dow is overbought and facing stiff resistance around 24,965 (SMA200).

Source: Hong Leong Investment Bank Research - 30 Jan 2019