Tradersbrief - Small Cap Stocks Could Take a Breather

HLInvest

Publish date: Wed, 20 Feb 2019, 08:58 AM

MARKET REVIEW

Sentiment across Asia stock markets was mixed on the back of renewed trade tensions as trade talks continue in Washington this week. China claimed that the US is attempting to block its technology development by alleging that Chinese mobile network gear may pose a cybersecurity threat to foreign countries that are rolling out new internet systems. The Nikkei 225 and Shanghai Composite Index rose marginally by 0.10% and 0.05%, respectively, while Hang Seng Index declined 0.42%.

Tracking the bullish performance on Wall Street last week, the FBM KLCI managed to trend higher above the 1,700 psychological level; the key index rose 0.82% to 1,706.56 pts. Market breadth was encouraging with 517 advancers, 385 decliners, while 366 traded unchanged. Market traded volume stood at 2.81bn, worth RM2.36bn. Construction sub-indices (+3.14%) outperformed the market led by IJM and Gamuda, rising 5.6% and 2.5%, respectively. Also, WZSATU jumped 14.1% to 36.5sen after the uplifting of bauxite mining ban.

Stocks in the US gained mildly higher after President Trump indicated once again that he may extend the March deadline and fuelling optimism amongst investors that a potential trade deal could be struck over the near term. Also, he commented that the trade discussions are going well between US and China. The Dow and S&P 500 eked our marginal gains of 0.03% and 0.15%, respectively, while Nasdaq added 0.19%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended firmer above the 1,700 level; suggesting that the positive momentum is intact. The MACD indicator has issued a golden cross signal above zero, while both the RSI and Stochastic oscillators are hovering above 50. Hence, with the healthy technical readings, we believe the key index could retest the 1,730 resistance level. Meanwhile, support will be anchored around 1,700, followed by 1,682.

Following the bullish breakout of 1,700 psychological level yesterday, we opine that the big cap stocks may gain traction over the near term, eventually lifting the FBM KLCI. Sentiment on the broader market, however may take a mild breather as investors may lock in their gains after a decent rally on small cap and lower liners over the past few weeks.

TECHNICAL OUTLOOK: DOW JONES

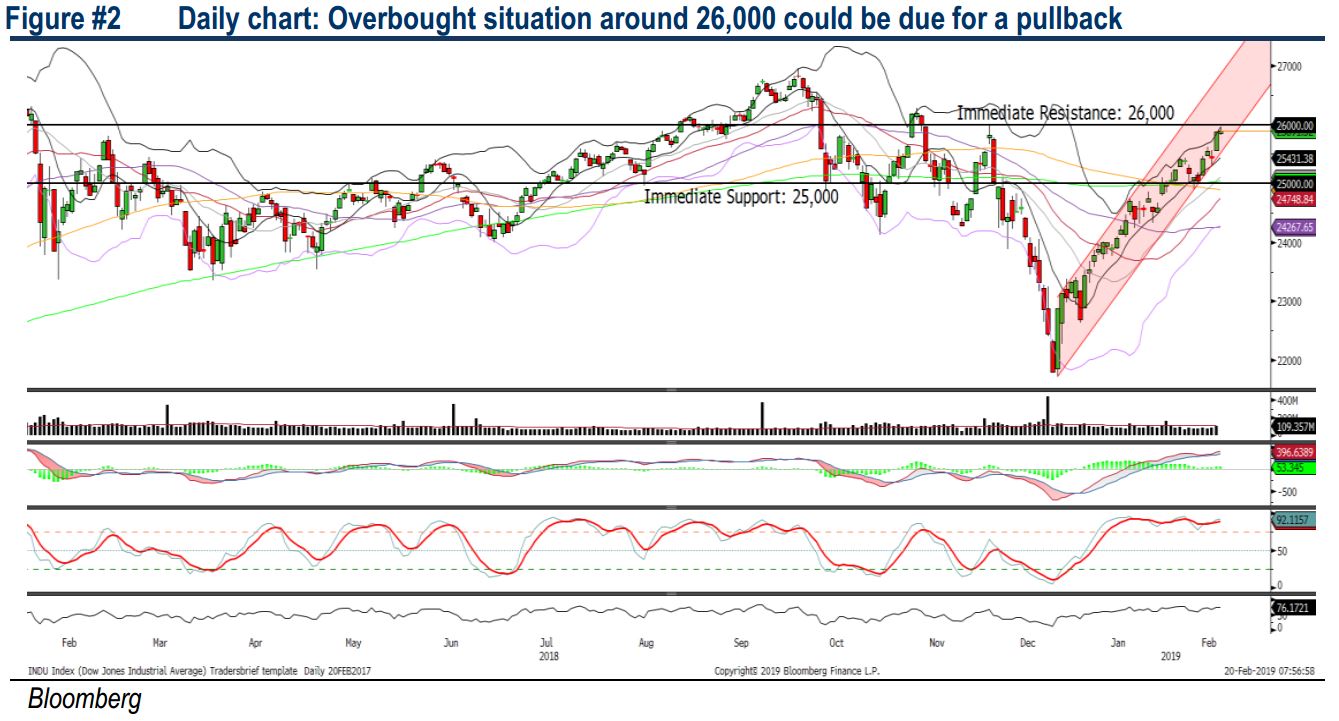

The Dow trended sideways near the psychological level of 26,000. The MACD Indicator stayed above the zero level, but both the RSI and Stochastic oscillators are suggesting that the Dow is overbought; indicating that the upside could be limited and the key index could be due for a pullback over the near term. Immediate resistance will be located around 26,000, followed by 26,500. Support will be set around 25,000.

In the US, stock markets are likely to stay mixed and trending sideways in view of the uncertain trade situation, despite President Trump suggested that both the US and China could reach an agreement before the key trade deadline (1st of March). With the Dow at an overbought region near the 26,000 psychological level, we may expect slowdown in buying support over the near term.

TECHNICAL TRACKER: CLOSED POSITION

We took profit on PECCA at RM0.94 (+14.6% gains) on 19 Feb after hitting R2 upside target.

Source: Hong Leong Investment Bank Research - 20 Feb 2019