Traders Brief - KLCI Finding Support Around 1,700

HLInvest

Publish date: Mon, 04 Mar 2019, 09:07 AM

MARKET REVIEW

Despite a private survey (Caixin/ Markit Manufacturing PMI stood at 49.9 in February) suggested that China’s manufacturing sector shrank for the third straight month, Asia’s key benchmark indices ended positively after MSCI commented that it will increase the weighting of Chinese mainland shares to its global benchmark from 5% to 20% later this year. Shanghai Composite Index jumped 1.80%, while Nikkei 225 and Hang Seng Index rose 1.02% and 0.63%, respectively.

Meanwhile, the FBM KLCI bucked the regional trend as it fell 0.41% to 1,700.76 pts. Market breadth, however was positive with 486 gainers vs. 460 losers, accompanied by 2.91bn shares traded for the session (worth RM2.35bn). We observed most of the O&G stocks were topping the active list and traded mostly higher.

Wall Street gained momentum as US 4Q18 GDP grew stronger-than-expected at 2.6% annualized rate of gains (Bloomberg consensus: median at 2.2%). Also, with the decreasing trade tensions between US and China, coupled with more dovish stance from Federal Reserve have lifted the sentiment overall for both January and February 2019; the Dow and S&P500 increased 0.43% and 0.69%, respectively.

TECHNICAL OUTLOOK: KLCI

After retracing from the recent high near 1,732, the FBM KLCI could be finding support near the 1,700 level as the key index briefly crossing above that psychological level last week. However, most of the technical indicators are suggesting that the momentum is weakening. Hence, key index may trend sideways before it may recover towards resistance near 1,730. Meanwhile, support will be located around 1,682.

Although the sentiment could recover amid the easing tensions on the trade front, the uninspiring 4Q18 financial results may drag the stocks on bursa Malaysia at least for the near term, limiting the upside potential on KLCI. Nevertheless, we believe stocks related to export oriented and O&G are likely to be focused as ringgit is still hovering above the RM4.00/USD level, while Brent crude oil is stable above USD65.

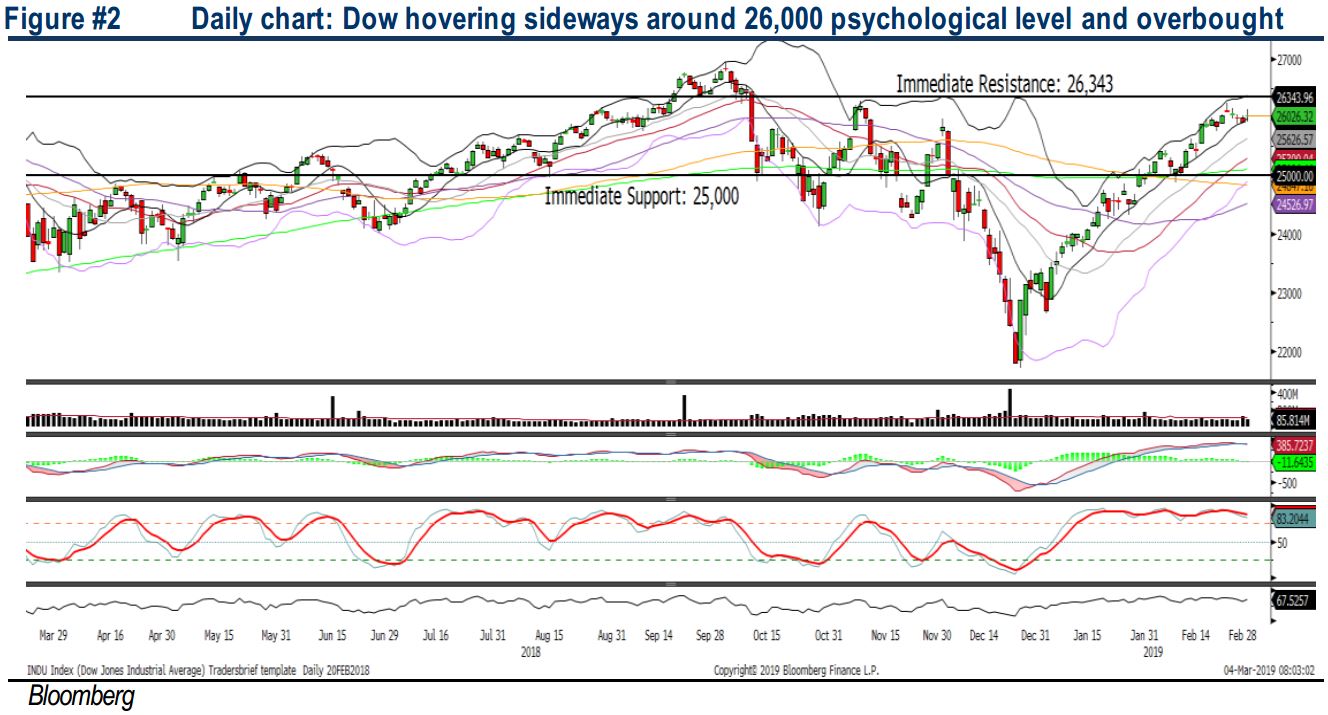

TECHNICAL OUTLOOK: DOW JONES

The Dow rose marginally above the 26,000 psychological level last week and is trending above the SMA200 at 25,106 level. However, the MACD indicator has formed a dead cross last week, while both the RSI and Stochastic oscillators are overbought. Should the key index violates below 25,106, next support will be located around 24,500. Meanwhile, the resistance will be envisaged around the 26,500.

On Wall Street, investors may stay optimistic on the trade development as President Trump extended the key trade deadline and White House economic advisor Larry Kudlow commented that both the US and China is near to a historic trade agreement. However, the already overbought situation on the major indexes could be due for a pullback after rebounding strongly from the bottom in December, limiting the upside potential eventually. The Dow may range between 25,914-26,241 over the near term.

TECHNICAL TRACKER: CLOSED POSITIONS

Last Friday, we squared off our 1Q19 stock pick, TALIWRKS (+10.2% gain) after hitting our R2 target at RM0.865.

Source: Hong Leong Investment Bank Research - 4 Mar 2019