Traders Brief - Consolidation Phase Could Extend

HLInvest

Publish date: Tue, 05 Mar 2019, 09:40 AM

MARKET REVIEW

Key regional benchmark indices surged positively after China commented in offering lower tariffs on US farm, chemical, auto and other products as part of a trade deal that could be nearing its completion; investors are speculating that President Xi could sign with President Trump over the near term. The Shanghai Composite Index advanced 1.12%, while Nikkei 225 and Hang Seng Index rose 1.02% and 0.51%, respectively.

On the local front, the FBM KLCI continues to retrace below 1,700 as further profit taking activities emerged. Market breadth was mildly negative with 448 decliners vs. 426 gainers. Market traded volumes stood at 3.14bn, worth RM2.16bn. Nevertheless, O&G stocks such as Dayang, Perdana and Carimin and semiconductor stocks such as Pentamaster and Vitrox were in the active and gainers list, respectively.

Wall Street traded higher at the opening bell on the back of the headlines that the trade deal between the US and China was nearing a completion. However, investors were deploying a “sell-on-news” strategy as on the back of scepticism on the global economic recovery in US and China, coupled with headwind such as Brexit, which may dampen the business sentiment moving forward. The Dow and S&P500 fell 0.79% and 0.39%, respectively.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has pulled back below the 1,700 psychological level and the MACD indicator has formed a “dead cross”, suggesting that the negative momentum is picking up. Also, both the momentum oscillators (RSI and Stochastic) are trending lower. Hence, with the weakening technical readings on indicators, we expect the key index to remain soft over the near term. Resistance will be located around 1,700, followed by 1,730. Meanwhile, support will be anchored around 1,682, followed by 1,666.

The negative sentiment on Wall Street could spill over towards stocks on the local bourse and the KLCI is likely to pullback further. With the foreign trade participation staying in the negative region over the past 5 trading days (5-day cumulative outflow of RM597), we expect the upside to be capped along 1,700. In the meantime, traders may lookout to take profit on selected O&G and export-oriented stocks which have rallied recently.

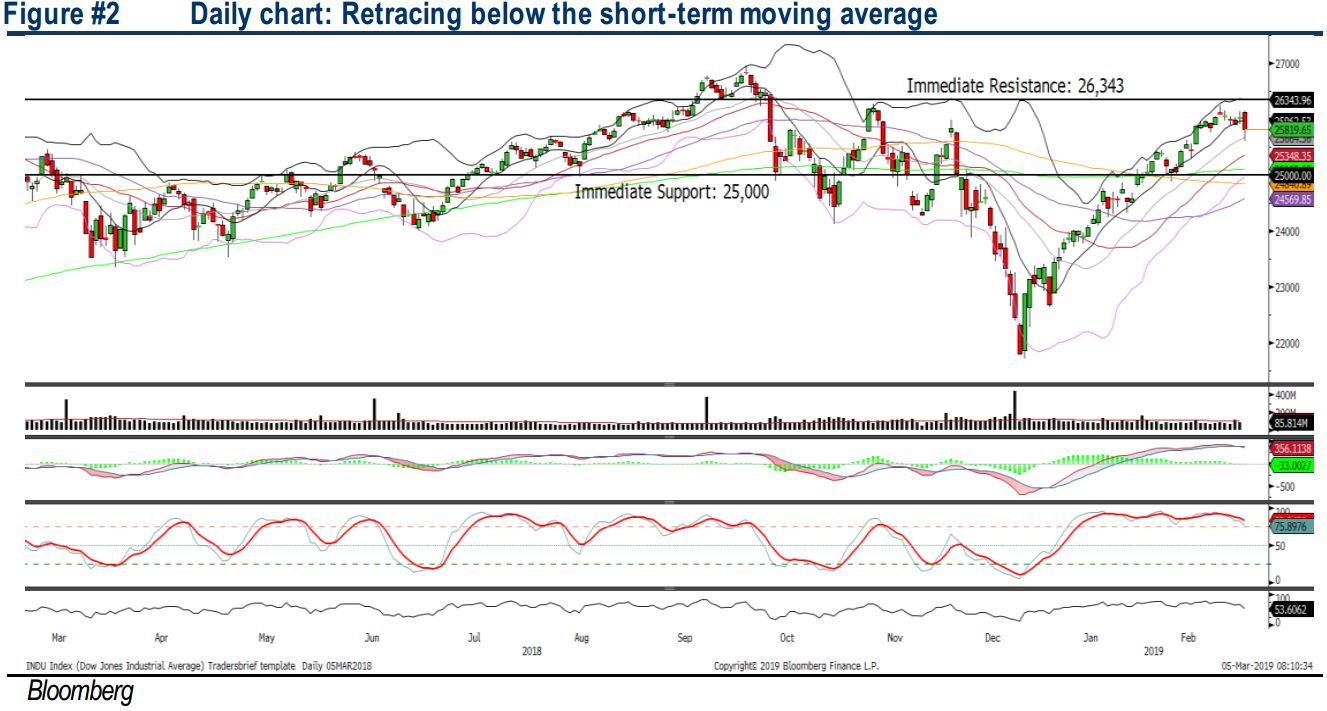

TECHNICAL OUTLOOK: DOW JONES

The Dow has pulled back below the 26,000 psychological level and the MACD indicator continues to decline yesterday. Also, both the RSI and Stochastic oscillators have fallen below the overbought region; indicating that the momentum is weakening. The Dow’s resistance will be located around 26,000-26,300, while the support will be pegged along 25,000-25,100.

Despite the trade deal could be ending soon with China and US striking a deal as early as this month, we believe most of the positive catalysts have been priced in following the V-shape rebound started since December last year. Also, investors will be focusing on the rollback of tariffs by both president Trump and President Xi over the near term to reassess the trade developments moving forward. The Dow could extend the retracement towards 25,000 amid overbought technicals.

Source: Hong Leong Investment Bank Research - 5 Mar 2019