Traders Brief - Consolidation Phase to Persist

HLInvest

Publish date: Thu, 07 Mar 2019, 10:37 AM

MARKET REVIEW

Asia’s stocks markets trended mostly on an upbeat mood after positive stimulus measures announced by Beijing on Tuesday. The stimulus measures include infrastructure spending as well as cuts in taxes and fees, which worth nearly 2 trillion yuan. The Shanghai Composite Index rallied strongly by 1.57% and Hang Seng Index gained 0.46%, but Nikkei 225 fell 0.60%.

Meanwhile, the FBM KLCI trended sideways throughout the session and ended marginally higher by 0.07% to 1,686.82 pts. Market breadth was positive with 532 gainers vs. 328 decliners. 3.16bn shares changed hands throughout the day, worth RM2.53bn. Selected O&G, construction and building materials stocks traded actively higher.

Wall Street ended lower for the third consecutive days as investors were still waiting for more details on the trade front between the US and China, which they speculated that a trade agreements may be reached over the near term. The Dow and S&P500 closed lower by 0.52% and 0.65%, respectively.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI snapped the 6-day losing streak and ended briefly higher. However, the MACD Histogram remains weak, while both the RSI and Stochastic oscillators are still trending lower. Given the weak technical readings on most indicators, we believe the key index could trade range bound within the range of 1,682-1,700 over the near term.

Despite the mild rebound yesterday on KLCI, we believe the sentiment may remain soft on the heavyweights, taking cues from Wall Street overnight. Nevertheless, we expect the small cap and lower liners to sustain its trading activities, especially within the O&G, Sarawak-related and selected semiconductor stocks as the momentum have been building up recently.

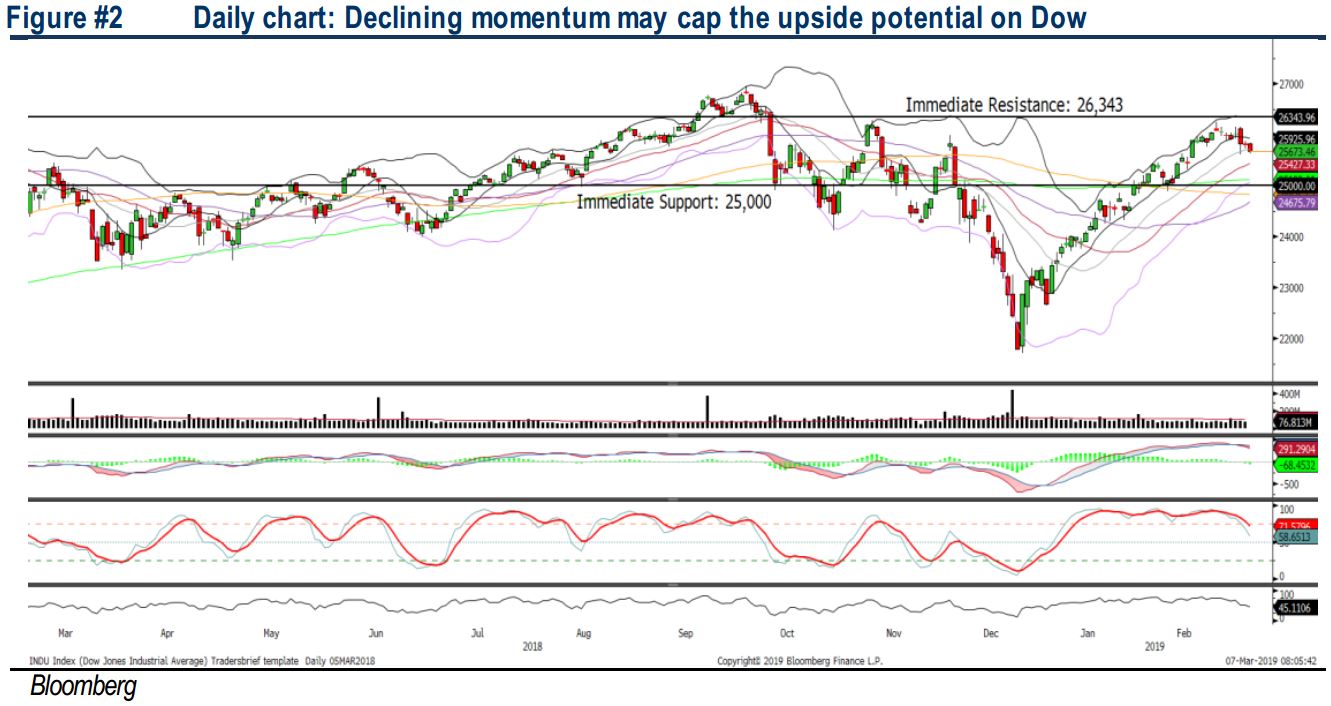

TECHNICAL OUTLOOK: DOW JONES

The Dow extended its pullback phase and continues to hover below the 10D SMA. The MACD Histogram continues to weaken further, while both the RSI and Stochastic oscillators are pointing downwards and fell over the past few sessions. With the weakening bias readings on most of the indicators, we expect the upside to be capped around 26,000-26,343. Support will be located around 25,500, followed by 25,000.

With the lack of fresh catalysts globally, coupled with the still-uncertain trade developments as well as the weaker technical readings on the Dow, we anticipate Wall Street to extend its consolidation phase over the near term. Market participants could be looking towards commentary from ECB’s President (Mario Draghi) on monetary policies later today.

Source: Hong Leong Investment Bank Research - 7 Mar 2019