Traders Brief - Extended range bound consolidation

HLInvest

Publish date: Mon, 11 Mar 2019, 08:54 AM

MARKET REVIEW

Led by an overnight 0.8% slip on Dow and a 4.4% rout in SHCOMP to 2970 (-0.84% WoW and -5.1% from 52W high of 3129 on 7 Mar), Asian markets tumbled last Friday amid fears of decelerating global economic growth after alarming Chinese trade data (Feb exports slid 20% YoY). Sentiment was also dampened by fears that the US and China may not be as close to a trade deal in the near term and ECB’s downgrade of the Eurozone 2019 growth to 1.1% from Dec forecast 1.7% as well as announcing a fresh round of stimulus to aid banks in the region.

In tandem with growing evidence that the economy was slowing further and falling Asian markets, KLCI fell 7.1 pts at 1679.9 (-1.23% WoW), triggered by selloff in TENAGA, CIMB, PMETAL, PETGAS and SIMEPLT. Trading volume decreased to 2.61bn shares worth RM2.22bn as compared to Thursday’s 3.05bn shares worth RM2.41bn.

Dow skidded as much as 221 pts amid sluggish jobs report and a slump in Chinese exports coupled with a downgrade in Eurozone GDP added to concerns about slowing global growth. Sentiment was also cautious due to uncertainties lingered over a US-China trade deal as Washington and Beijing have yet to set a date for a summit to complete any tentative agreement. Despite narrowing losses to only 23 pts at 25450 (-2.2% WoW) on technical rebound, the Dow still recorded its 5th consecutive sessions of decline.

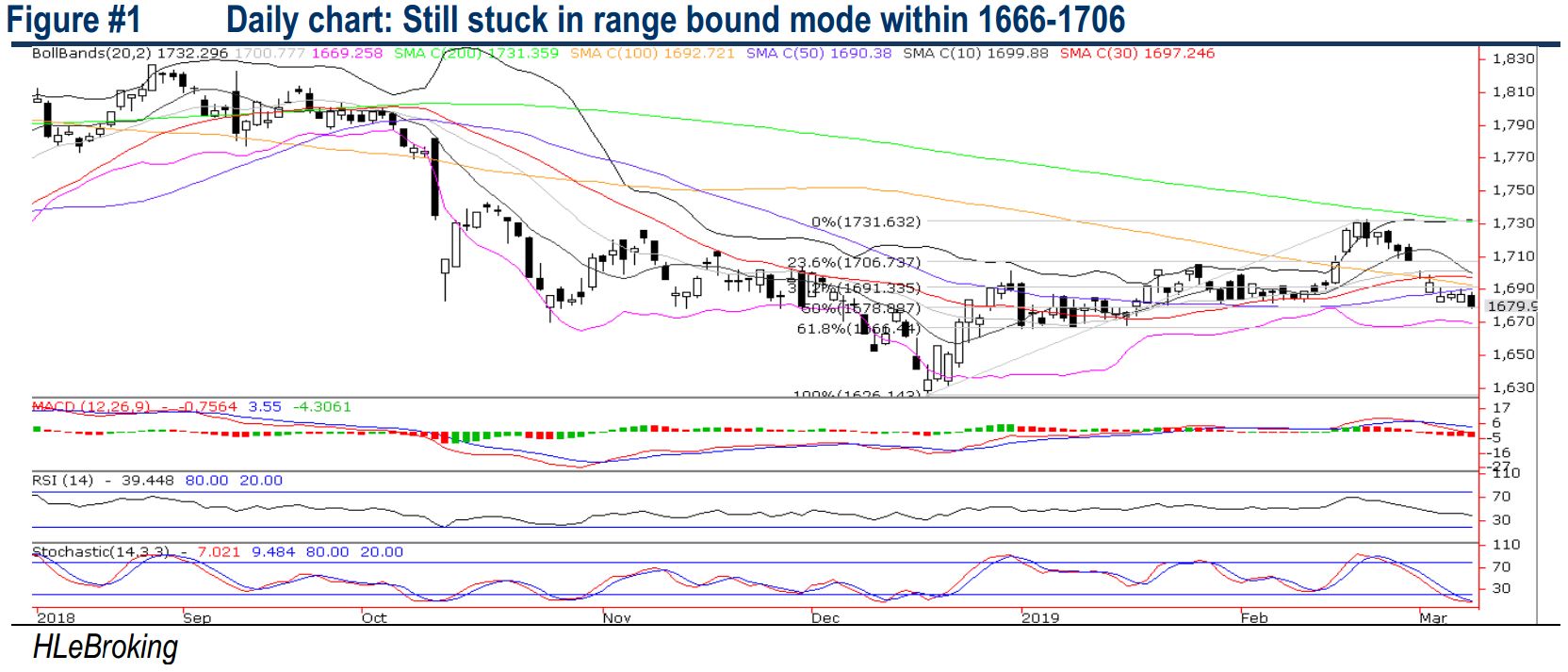

TECHNICAL OUTLOOK: KLCI

We see KLCI to range bound in the short term following the recent 3% or 52 pts pullback to 1680 from YTD high of 1732 (22 Feb), as near term outlook has turned decidedly negative after violating multiple key SMAs and compounded by the bearish MACD. A decisive violation below next supports at 1666-1670 levels will trigger further retracements towards 1651 (76.4%), which we believe should cushion further downside due to a grossly oversold stochastic indicator. Conversely, a strong reclaim above the 1692 (38.2% FR) levels could arrest the downtrend and revive KLCI upward momentum to test 1700/1707 levels.

The disappointing economic data from Europe and China last week coupled with a 2.2% weekly fall on Dow are likely to cement a negative trend for financial markets in the near term, with major focus remain whether Trump and Xi are able to finalise the trade deal by end Mar. On the local bourse, as blue chips consolidate, the renewed trading focus on the building materials and construction sector is likely to prevail on hopes for revision in government contracts after a severe correction on both sectors after GE14.

TECHNICAL OUTLOOK: DOW JONES

After violating the 20D SMA (25,723), the Dow extended its pullback from YTD high of 26270 to end lower for the 5th straight session at 25450. The MACD Histogram expanded negatively, while the Stochastic oscillators are hovering at oversold positions with mild signs of bottoming up as Dow managed to narrow the 221-pt loss to 23-pt towards the end last Friday. A decisive breakout above the 25,700 zones would spur the index higher to retest 26,000-26300 levels. Meanwhile, support will be pegged around 25,000-25,128(SMA200).

In the US, an extended consolidation is likely to prevail to recalibrate of overly optimistic expectations as sentiment would remain edgy following recent poor economic data from the US, China and the Eurozone. Meanwhile, uncertainty lingered over a U.S.-China trade negotiation although Trump advisors said on Sunday that the US-China talks are making ‘Headway,’ and President Trump and President Xi would meet to ink a deal probably by end March or April.

Source: Hong Leong Investment Bank Research - 11 Mar 2019