Traders Brief - Taking a Mild Breather

HLInvest

Publish date: Wed, 20 Mar 2019, 05:23 PM

MARKET REVIEW

Key regional benchmark indices ended mixed ahead of the two-day FOMC meeting as investors stay cautious, awaiting further information on the interest rate and economy outlook from the Fed’s officials. The Hang Seng Index rose 0.19%, while Hang Seng Index and Nikkei 225 slipped 0.18% and 0.08%, respectively.

Meanwhile, stocks on the local front ended on a subdued note as compared to the past few trading days with the FBM KLCI sliding 0.19% to 1,687.68 pts and market traded volume has dropped below 3bn mark at 2.89bn shares traded for the session, worth RM1.76bn compared to 3.26bn, worth RM1.96bn on Monday. Market breadth was negative as decliners outpaced advancers by a ratio of near to 3-to-1.

Wall Street closed on a mixed note as investors were on the sidelines ahead of the conclusion of the FOMC meeting, in order to gauge the tone of the Fed’s officials on the interest rate outlook. The sentiment was clouded by the uncertain trade developments between the US and China, which capped the gains on Caterpillar Inc and Boeing, which are more trade sensitive. The Dow slipped 0.10%, while S&P500 closed flat.

TECHNICAL OUTLOOK: KLCI

After the technical since 12th of March on the KLCI, it has taken a breather yesterday. The MACD Line is hovering below zero and the Stochastic oscillator is hovering below 50. With the technicals are still mixed, we anticipate that the KLCI to consolidate over the near term within the range of 1,680-1,700. Should the KLCI violates below 1,680, next support will be located around 1,666.

We believe the profit taking activities recently could be viewed as a healthy retracement phase after the short term technical rebound and overheated market last week. Overall, investors will be looking out for clarity over the interest rate outlook and trade developments between the US-China over the near term. However, should the KLCI surges above the 1,700, next target will be at 1,730.

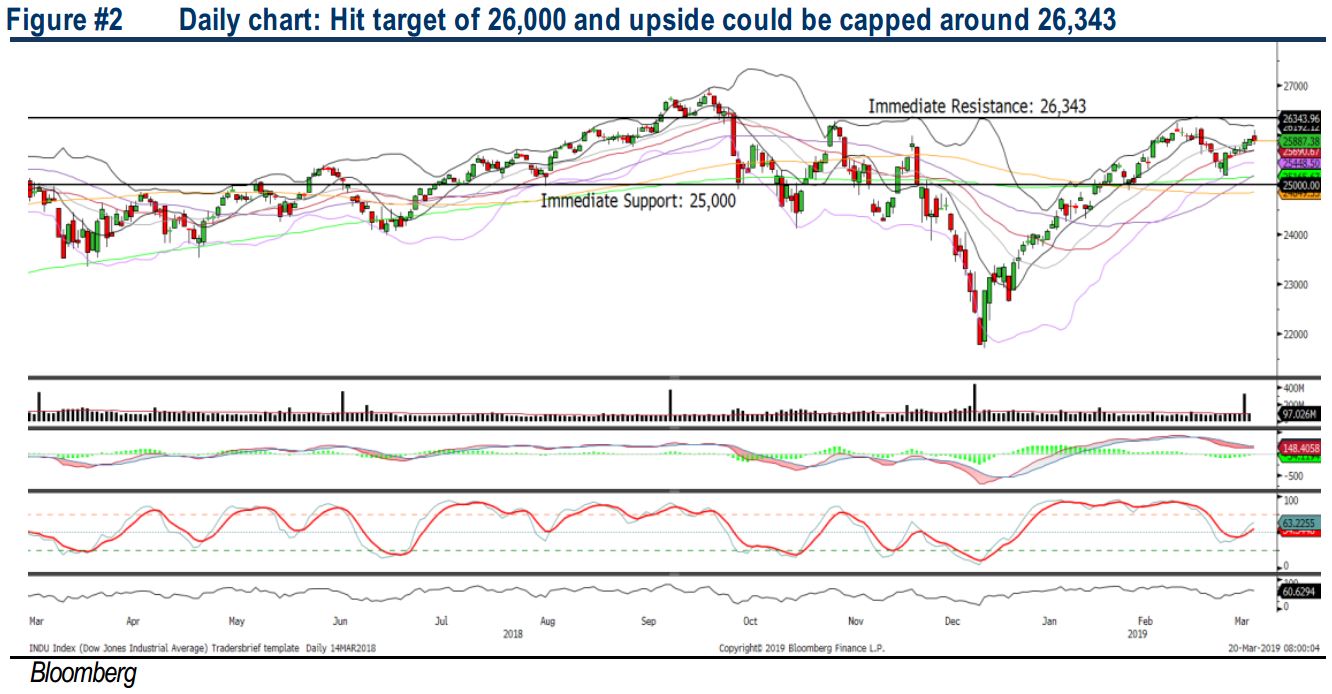

TECHNICAL OUTLOOK: DOW JONES

The Dow traded higher for the session but retraced after hitting the high of 26,109.68 pts. The MACD Histogram has turned flattish. Nevertheless, both the RSI and Stochastic oscillators are hovering above 50. Hence, with the mixed technical readings and uncertain sentiment, we opine that the upside of the Dow could be capped near the 26,000-26,343. Support will be set around 25,500, followed by 25,000.

In the US, investors will remain cautious until more positive developments are being seen on the trade developments between the US and China. Also, the Fed’s meeting would provide a clearer understanding on the interest rate path and economy activities moving forward. The Dow could range bound within the 25,500-26,000 over the near term under this cautious environment.

TECHNICAL TRACKER: QES BERHAD

Cheaper entry to automation, test and equipment (ATE) segment with solid balance sheet and earnings growth. Despite rising 18.6% YTD, we expect QES to advance further towards RM0.27-0.305 in the medium to long term after staging a bullish downtrend line breakout yesterday, premised on its (i) cheap valuations at 11.8x FY19 P/E (37% discount to peers’ of 18.8x P/E), supported by a strong 22% FY18-20 EPS CAGR and RM53m net cash (28% of market cap); (ii) three new high margins automated products in the pipeline i.e. Fully Automated Vision Inspection System (FAVIS), Automated Wafer Packing System (AWPS) and Automatic Wafer Identification (AWID) to drive its manufacturing segment post FY20; (iii) strong recurring income from its distribution and maintenance businesses (averaging c60-70% to sales); (iv) well-diversified clientele with more than 2400 customers (Malaysia and Asia markets) mainly in the semiconductor, E&E and automotive industries and (v) relatively insensitive to forex fluctuations, as 55-60% of its revenues are quoted in USD with natural hedging from its USD-denominated purchases (c.60%).

Source: Hong Leong Investment Bank Research - 20 Mar 2019