Traders Brief - KLCI Likely to Trend Sideways

HLInvest

Publish date: Wed, 27 Mar 2019, 05:35 PM

MARKET REVIEW

Asia’s equities mostly rebounded following the sharp decline on Monday as bargain hunting activities emerged. Traders were taking advantage on the selected oversold stocks attributed to the softer global growth outlook by the Fed, coupled with the inverted yield curve. The Nikkei and Hang Seng Index gained 2.15% and 0.15%, respectively, but Shanghai Composite Index fell 1.51%.

Meanwhile, stocks on the local front rebounded marginally; the FBM KLCI added 0.05% to 1,649.94 pts. Market breadth was mildly negative (367 gainers vs. 373 losers). Market traded volumes stood at 2.47bn, worth RM1.77bn. Selected consumer heavyweights such as Nestle, BAT and Dutch Lady were topping the gainers list.

Wall Street charged higher after the opening bell led by energy stocks on the back of rising crude oil prices amid easing fears of a glut in global supplies following a power cut in Venezuela, coupled with the anticipation of a report from EIA on the drawdown of crude inventories this week. The Dow rose 0.55%, while S&P500 and Nasdaq added 0.72% and 0.71%, respectively.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has inched marginally higher, but most of the indicators are still in the negative region. MACD Line is below zero, while both the RSI and Stochastic oscillators are hovering below 50. With the negative technical readings, the KLCI could revisit the support along 1,630, followed by 1,600. Meanwhile, resistance is envisaged around 1,680-1,700.

Despite the FBM KLCI has rebounded marginally yesterday. We believe the downward bias tone would persist over the near term with the unsettled trade developments between the US and China. Also, the slowdown of 2019 economic outlook by the Fed could be significant to affect global sentiment, eventually limiting upside on the KLCI (resistance will be located around 1,680-1,700).

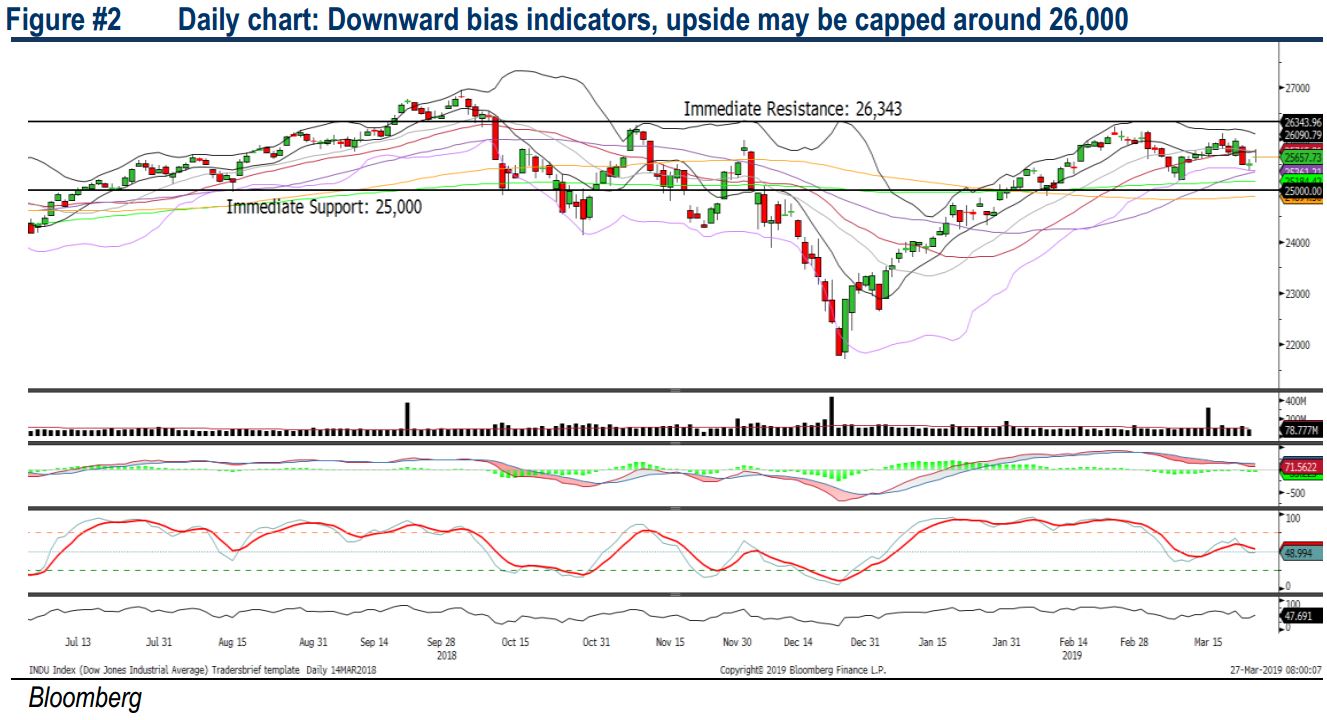

TECHNICAL OUTLOOK: DOW JONES

The Dow has trended higher yesterday, but it is being resisted around 25,816 (SMA30). The MACD Indicator has turned flattish, while the RSI and Stochastic oscillators are hovering below 50. Hence, we opine that the Dow could be trending sideways, with a downward bias mode and the key index may revisit the support along 25,000. Resistance will be pegged around 26,000-26,343.

Although market sentiment has turned slightly positive over the previous session driven by energy stocks, we believe it may be short lived as investors will be focusing on headlines on inverted yield curve which may potentially lead to a slowdown of global growth moving forward. Also, should any negative news emerge on the trade front, it is likely to cap the gains on Wall Street over the near term.

TECHNICAL TRACKER: ECONBHD

Values re-emerge after sliding 54% since GE14. We opine that the 54% meltdown in share prices since GE14 has grossly priced in the headwinds currently faced by the construction sector. Nevertheless, we remain positive on ECONBHD due to: (1) high barrier of entry given the considerable costs of equipment and machinery, as well as the limited availability of experienced operators (2) lower payment risk compared to industry, (3) potential revival of certain mega projects, albeit on a smaller scale (4) sturdy balance sheet (0.04x net gearing end Dec) provides the Group greater flexibility for project execution/expansion and sustainable dividend payment, and (5) at tractive risk-reward profile at 9.8x FY20E P/E (30% lower compared to its peers), with strong outstanding order book of ~RM1bn to provide earnings visibility over the next two years and a decent 3.1% yield.

Source: Hong Leong Investment Bank Research - 27 March 2019