Traders Brief - Technical Rebound in Store

HLInvest

Publish date: Thu, 28 Mar 2019, 04:29 PM

MARKET REVIEW

Asia’s stock markets trended mixed, despite positive overnight Wall Street as lingering growth concerns were limiting the upside potential on the selected key regional benchmark indices. The Hang Seng Index and Shanghai Composite Index gained 0.56% and 0.85%, respectively, but Nikkei 225 dropped 0.23%.

Meanwhile, sentiment on the local front was negative with the FBM KLCI declining 0.44% to 1,642.73 pts. Market breadth was still negative as there were 404 decliners vs. 393 gainers, accompanied by market traded volumes of 2.07bn, worth RM1.71bn. Nevertheless, we noticed selected O&G stocks (Dayang and Penergy) traded actively higher following the rise in crude oil prices.

Wall Street ended softer as investors remain fearful of a potential economic activities slowdown moving forward on the back of a drop in the US 10-year treasury yield below 2.40% (14-month low). However, most of the major indexes managed to rebound off the intraday low with the help of bargain hunting activities throughout the session.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI traded higher at the start of the session, but selling pressure picked up and closed lower for the day. The MACD Indicator expanded negatively below zero, while both the RSI and Stochastic are in the oversold position. Hence, with the oversold technical readings, we anticipate the KLCI may be due for a technical rebound. Nevertheless, mid-term view are still negative as it has formed lower high and lower low formation. Next support will be at 1,600-1,630. Resistance will be pegged around 1,680.

On the local front, we believe it is likely to go through a rough patch of trading activities as investors will be focusing on the news headlines commenting on the inverted yield curve which may lead towards a potential weakness in economic activities moving forward. Nevertheless, traders may selectively look out for construction related stocks as there could be a positive surprise on a potential revival on ECRL moving forward.

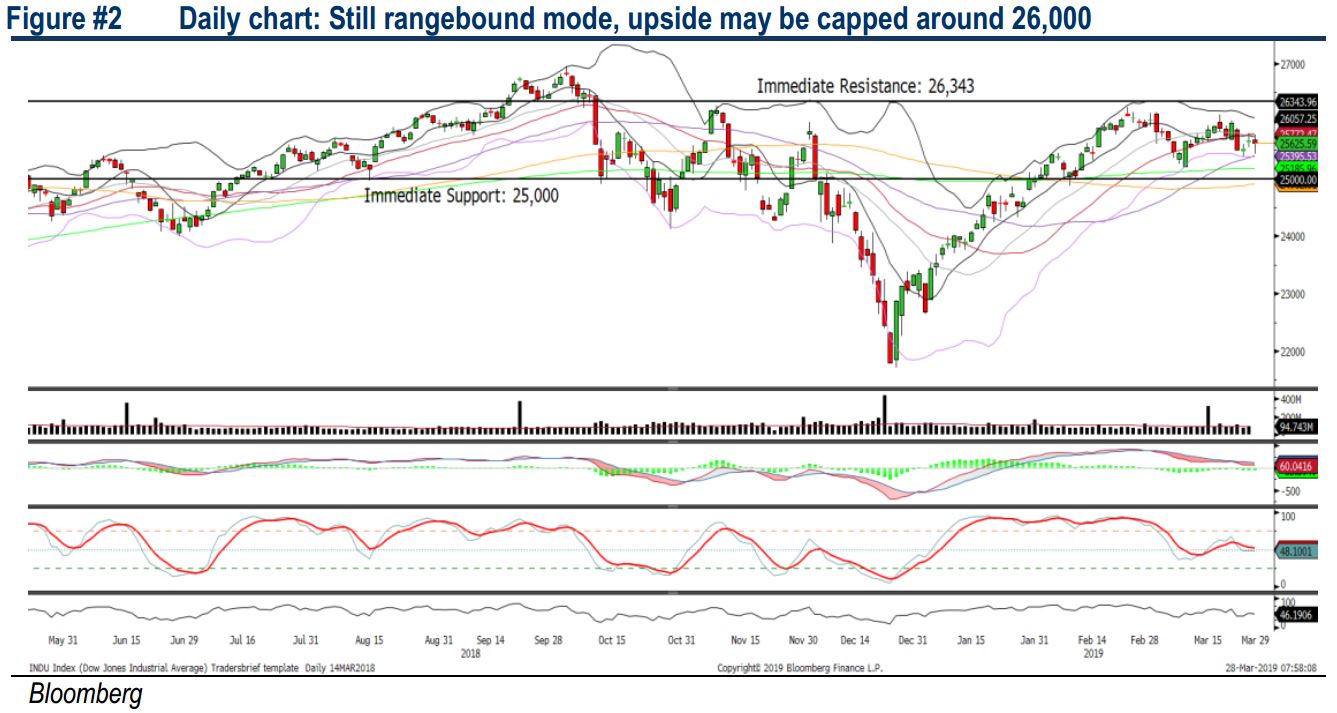

TECHNICAL OUTLOOK: DOW JONES

The Dow trended mildly lower for the session, but has been forming few small bodied candles over the past three trading days. The MACD Indicator has turned flattish above zero, but both RSI and Stochastic oscillators are hovering below 50. Hence, we believe the upside will be limited over the near term. Support will be located around 25,000, while resistance will be envisaged around 26,000-26,343.

In the US, we believe the negative sentiment could persist with traders monitoring the situation of the yield curve. Also, the uncertain trade developments between the US and China is likely to cap the upside of Wall Street at least for the near term. At the same time, market participants will watch out for the US 4Q GDP data that will be released later today to gauge the status of the economy.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we had squared off entirely our remaining quarterly picks, DKSH (4.4% gain) and CCM (6.1% gain). We also closed the technical trackers picks ie. GFM (5% loss), PHARMA (2.6% loss) and D&O (1.4% loss) due to weakening technicals. Our outstanding positions are SUNWAY, QES and ECONBHD.

Source: Hong Leong Investment Bank Research - 28 March 2019