Traders Brief - Still Trading in a Consolidation Phase

HLInvest

Publish date: Wed, 17 Apr 2019, 10:47 AM

MARKET REVIEW

Asia’s key benchmark indices ended on a higher note as People’s Bank of China decided on resumption of cash injections into the financial system, alleviating earlier concerns on tightening liquidity. Also, traders were fairly positive ahead of the release of China’s 1Q19 GDP and the US-Japan trade talks. The Nikkei 225 rose 0.24%, while Shanghai Composite Index and Hang Seng Index increased 2.39% and 1.07%, respectively.

Meanwhile, the FBM KLCI traded marginally lower at 1,629.46 pts (-0.11%) and sentiment on the local front turned negative as profit taking activities emerged further on the broader market. market breadth was negative with 475 decliners vs. 375 gainers, accompanied by 2.49bn shares traded for the day, worth RM1.79bn.

Wall Street ended on a higher note on the back of on-going better-than-expected US corporate earnings, coupled with a boost from Boeing after a report from FAA suggesting that the Boeing 737 Max software is “operationally suitable” after the recent update. The Dow and S&P500 gained 0.26% and 0.05%, while Nasdaq increased 0.30%.

TECHNICAL OUTLOOK: KLCI

After hitting resistance along 1,640 two days ago, the KLCI retraced lower and the MACD indicator stayed flattish. However, both the RSI and Stochastic oscillators are showing an uptick move (albeit below 50). Hence, with the oversold and recovering technical, we believe that the KLCI could be due for a technical rebound with the resistance set along 1,640-1,650, support will be located around 1,600-1,614.

We believe sentiment on the local front could remain cautious as market participants are selling on news following the revival of ECRL. Meanwhile, Tun Mahathir commented that “Malaysia does not need a high-speed-rail for now” may further pressure the recent rally on construction stocks. The FBM KLCI’s upside could be capped along 1,647-1,650 over the near term.

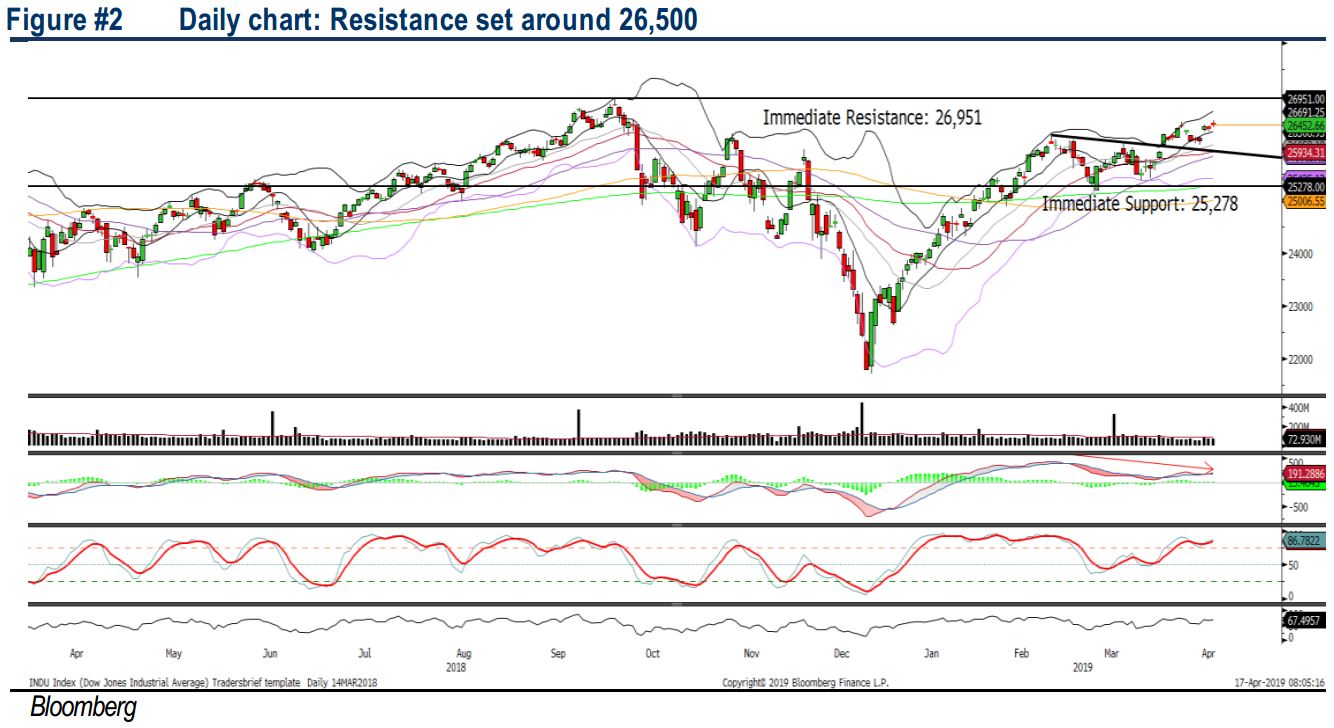

TECHNICAL OUTLOOK: DOW JONES

Despite the Dow climbed higher yesterday, the MACD indicator has turned flattish and formed a bearish divergence signal (higher high on Dow, but lower high on indicator). Meanwhile, the Stochastic oscillator is overbought and the Dow’s upside could be limited over the near term. Resistance will be envisaged around 26,500, while support is anchored along 26,000.

In the US, we opine that the market sentiment will be driven mainly by the on-going US corporate earnings season and market participants will be on a lookout for outlook guidance for 2Q19 onwards. Hence, should there be any negative management guidance in US corporates, it may kept a lid on Wall Street performances. At the same time, the uncertain progress on the US-China trade front is likely to dampen sentiment on Wall Street.

TECHNICAL TRACKER: PHARMANIAGA

Risk-reward profile is becoming more compelling after diving 52% post GE14. We remain optimistic that PHARMA would still able to clinch the contract (albeit with modifications) premised on: (i) impeccable track record in L&D following huge amount of investment in its supply chain management to ensure efficient deliveries to public hospitals and clinics; (ii) the unattractive thin margins (~1.0-2.0%) from the concession business will discourage participation from other distributors due to high barriers of entry; (iii) highly unlikely that with PH’s financial position would undertake huge investments to emulate PHARMA’s model t o ensure operational effectiveness and timely deliveries; (iv) increasing non-concession contributions from Indonesia’s market due to huge population over 270m people and (v) attractive risk-reward profile at 9.6x FY19E P/E and 1.2x P/B, which are 37% and 38% lower compared to its peers, supported by an attractive FY19-20 DYs of 7.4%.

Source: Hong Leong Investment Bank Research - 17 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|