Mplus Market Pulse - 07 Nov 2024

MalaccaSecurities

Publish date: Thu, 07 Nov 2024, 10:36 AM

Market Kicks Off Strong With Trump 2.0

Market Review

Malaysia: The FBMKLCI (+0.83%) Advanced Further as Heavyweights in the Utilities and Industrial Products & Services Sectors, Boosted Sentiment on the Local Bourse. Sentiment on the Local Front Improved as Trump Has Won the US Elections, Technology (+6.18%) Was the Strongest Sector, Led by GREATEC (+20.0 Sen).

Global Markets: The Wall Street Hit Fresh Highs, the US Treasury Yield Surged, and the Dollar Index Had Its Best Day Since 2022, as Investors Cheered Donald Trump’s Return to the Presidency. Meanwhile, the European Markets Closed Lower, While Asian Markets Ended on a Mixed Note.

The Day Ahead

The FBMKLCI Rebounded as the Market Responded Positively to Donald Trump’s Win as POTUS. Similarly, Wall Street Gained Momentum as Traders Digested Trump’s Return to the White House and the Republicans’ Victory in the US Senate. We Believe That Most US Corporations Will be Early Beneficiaries, Given the Anticipation of a Lower Tax Environment Under Trump’s Administration. Also, the Market Will Closely Monitor Tonight’s FOMC Meeting, Which Could Trigger a Spike in the VIX Index. In the Commodities Market, Brent Crude Oil Traded Flat Around USD 75 Per Barrel. Meanwhile, Gold Prices Saw a Significant Pullback, Trading at USD 2,664, as Investors Reduced Exposure to Safe-haven Assets Amid a Surge in the Dollar Index. At the Same Time, CPO Prices Continued Their Rally, Closing Above the RM 4,900 Level.

Sector Focus: Given Wall Street’s Strong Overnight Performance, We Believe the "Trump Trade" Could Spill Over to the Local Bourse, Particularly in the Technology Sector in the Near Term. While We Anticipate That the O&G Sector May Trade Flat, Given Current Crude Oil Prices, We Maintain a Positive View on Glove Stocks, as the Ringgit Is Likely to Depreciate in the Near Term Following Trump’s Victory. Additionally, We Favour the Construction, Building Materials, Property, and Utilities Sectors as We Enter the Corporate Earnings Season.

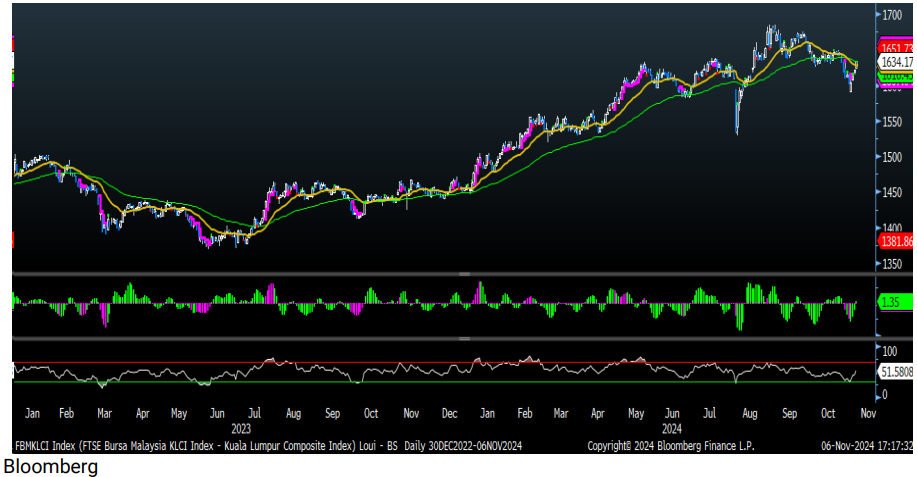

FBMKLCI Technical Outlook

The FBM KLCI index closed higher towards the 1,634 level. The technical readings on the key index were positive, with the MACD histogram formed positive bars, and the RSI hooked above 50. The resistance is envisaged around 1,649-1,654, and the support is set at 1,614-1,619.

Company Briefs

3REN Bhd (3REN) climbed 11.5 sen on its ACE Market debut on Wednesday to close at 39.5 sen, up 41.07% from its initial public offering price (IPO) of 28 sen. The counter opened at 33.5 sen, up 19.6% or 5.5 sen. The stock traded between 33 sen and 40 sen throughout the day. At the closing price of 39.5 sen, the company was valued at RM256.8m. The counter was the most actively traded stock on the local bourse, with 181.04m shares changing hands. (The Edge)

The Federal Court has dismissed a businesswoman's appeal against a Court of Appeal decision that overturned a High Court ruling awarding her RM200,000 in damages from CTOS Data Systems Sdn Bhd (CDS), a subsidiary of CTOS Digital Bhd (CTOS). A three-member apex court bench, led by Court of Appeal president Tan Sri Abang Iskandar Abang Hashim, denied leave (permission) for Suriati Mohd Yusoff to appeal, finding that the five questions of law posed did not meet the threshold for hearing on their merits. The bench also ordered Suriati to pay costs of RM30,000 to CDS. (The Edge)

Pharmaniaga Bhd (PHARMA) has revised its regularisation plan to address its Practice Note 17 (PN17) status, by adjusting its capital reduction and excluding warrants from its rights issue. The plan now includes a RM520m capital reduction, as well as a rights issue set to raise up to RM353.516m. Prior to this, the pharmaceutical group had proposed a share capital reduction of RM180m as well as a rights issue with free warrants to raise RM354.6m. The revision removes the free warrants from the rights issue, which Pharmaniaga said is to mitigate dilution risks. (The Edge)

The net profit of biscuit maker Hup Seng Industries Bhd (HUPSENG) rose 32.65% yo-y in the third quarter ended Sept 30, 2024 (3QFY2024) to RM17.27m — its highest quarterly net profit since the company was listed in 2000 — from RM13.02m a year ago, boosted by higher sales from increased production capacity following the commercial run of a new oven. Revenue for the quarter grew 10.87% to a record high of RM104.43m compared to RM94.19m in 3QFY2023, thanks to improved sales in both the domestic and export markets. Hup Seng declared a second interim dividend of two sen per share and a special dividend of one sen per share. (The Edge)

Lotte Chemical Titan Holding Bhd (LCTITAN) reported larger third quarter losses, dragged by inventory write-downs, higher losses from its 40%-owned associate Lotte Chemical USA Corp due to a maintenance shutdown, and increased foreign exchange losses. Net loss for the three months ended Sept 30, 2024 (3QFY2024) widened to RM246.42m from RM55.58m in 3QFY2023. Revenue slipped to RM1.95bn from RM1.96bn, mainly due to lower sales volume, which was partly offset by higher average product selling price. No dividend was declared during the quarter. (The Edge)

Security-based ICT provider Datasonic Group Bhd (DSONIC) has proposed to undertake bonus issues of up to 1.55bn warrants on the basis of one warrant for every two shares held by shareholders. The entitlement date and the exercise price of the warrants will be announced later, said Datasonic. It has also proposed an allocation of options under its employee share option scheme (ESOS) that was established in 2021 to its executive deputy chairman and CEO Datuk Abu Hanifah Noordin (who has an indirect stake of 8.35%), independent non-executive director Tunku Datuk Nooruddin Tunku Shahabuddin and executive director Erna Ismail. The number of ESOS options to be offered will be determined at the discretion of its ESOS Committee after considering performance targets, appraisals and past and future contributions. (The Edge)

Haily Group Bhd (HAILY) has secured a contract worth RM89.9m from Mah Sing Group Bhd (MAHSING) to build terrace homes for a housing project in Taman Tiara Indah, Johor Bharu, Johor, which pushes the value of its outstanding orders past RM1bn. The latest win raised the group's new project wins for 2024 to RM617.31m, over twice its 2023 total of RM272.14m. The latest job involves the construction of 366 units of double-storey terrace homes, two power substations, two show unit, and a guard house, which make up Parcels 2A and 2B of the housing project. (The Edge)

AMMB Holdings Bhd's (AMBANK) wholly-owned subsidiaries, AmBank (M) Bhd and AmBank Islamic Bhd, have set up debt programmes to raise up to RM7bn to finance their working capital, among others. The units have lodged a Commercial Papers Programme and an Islamic Commercial Papers (ICP) programme with the Securities Commission Malaysia. The first has a nominal value of RM4bn, while the second has one of RM3bn. The programmes have been assigned short-term ratings of P1 by RAM Rating Services Bhd. (The Edge)

Direct selling company DXN Holdings Bhd (DXN), which sells health and wellness products, said on Wednesday it plans to charter a Gulfstream G550 corporate jet from its major shareholder that will cost up to US$6.60m (RM29.06m) a year to expand its global business. The aircraft is owned by LSJ Logistics Ltd, a whollyowned unit of LSJ Global Sdn Bhd, which is also a major shareholder of DXN, making the deal a related party transaction. LSJ Global, which holds 68.12% in DXN, is controlled by DXN executive chairman and founder Datuk Lim Siow Jin. (The Edge)

JAKS Resources Bhd (JAKS) has agreed to pay RM5m, cash, within 12 months to Star Media Group Bhd (STAR) to settle their legal dispute over the development of a parcel of land in Section 13, Petaling Jaya. JAKS Resources will also transfer the title of Tower A to Star Media within three years. If it fails to transfer ownership by the deadline, it will be liable to pay Star Media a 5% annual interest payment on the sum of RM134.5m until the transfer is completed. (The Edge)

Source: Mplus Research - 7 Nov 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-21

DSONIC2025-01-21

JAKS2025-01-21

MAHSING2025-01-20

3REN2025-01-20

AMBANK2025-01-20

AMBANK2025-01-20

AMBANK2025-01-20

AMBANK2025-01-20

CTOS2025-01-20

DSONIC2025-01-20

DSONIC2025-01-20

DSONIC2025-01-20

DSONIC2025-01-20

DSONIC2025-01-20

DXN2025-01-17

AMBANK2025-01-17

AMBANK2025-01-17

MAHSING2025-01-16

AMBANK2025-01-16

DSONIC2025-01-15

AMBANK2025-01-15

AMBANK2025-01-15

AMBANK2025-01-15

AMBANK2025-01-15

AMBANK2025-01-15

CTOS2025-01-15

DSONIC2025-01-15

DSONIC2025-01-15

MAHSING2025-01-15

MAHSING2025-01-15

MAHSING2025-01-14

MAHSING2025-01-14

PHARMA2025-01-13

AMBANK2025-01-13

CTOS2025-01-13

DXN2025-01-13

DXN2025-01-13

DXN2025-01-13

DXN2025-01-13

DXN2025-01-13

DXN2025-01-13

JAKS2025-01-13

MAHSING2025-01-10

AMBANK2025-01-10

AMBANKMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Jan 08, 2025

Created by MalaccaSecurities | Jan 08, 2025