Traders Brief - KLCI Likely to Rebound Further

HLInvest

Publish date: Mon, 22 Apr 2019, 12:03 PM

MARKET REVIEW

Asia’s stock markets (Japan, Korea and China) ended on a positive note, while most of regional stock markets such as Australia, Hong Kong, Singapore and Indonesia were closed for Good Friday public holiday. Also, the sentiment was boosted by the overnight positive performance on the Dow on the back of decent US corporate earnings. The Nikkei 225 and Shanghai Composite Index rose 0.50% and 0.63%, respectively.

Similarly, stock markets on the local front ended mildly higher; the FBM KLCI gained 0.14% to 1,622.07 pts as bargain hunting activities persisted on selected heavyweights such as Genting Malaysia. Meanwhile, overall market traded volume stood at 2.52bn shares, valued at RM1.69bn. Market breadth was positive with advancers leading decliners by a 9-to-5. We noticed IWCITY and EKOVEST traded actively amid the revival of Bandar Malaysia project.

Meanwhile, stock markets in the region of US and Europe were mostly closed for Good Friday public holiday. Generally on the weekly basis, stock markets were gaining traction without any negative surprises from the US-China trade developments. Also, the positive week was lifted by the better-than-expected US corporate earnings season. The Dow and Nasdaq gained 0.56% and 0.76%, while S&P500 slipped 0.08% on the weekly basis.

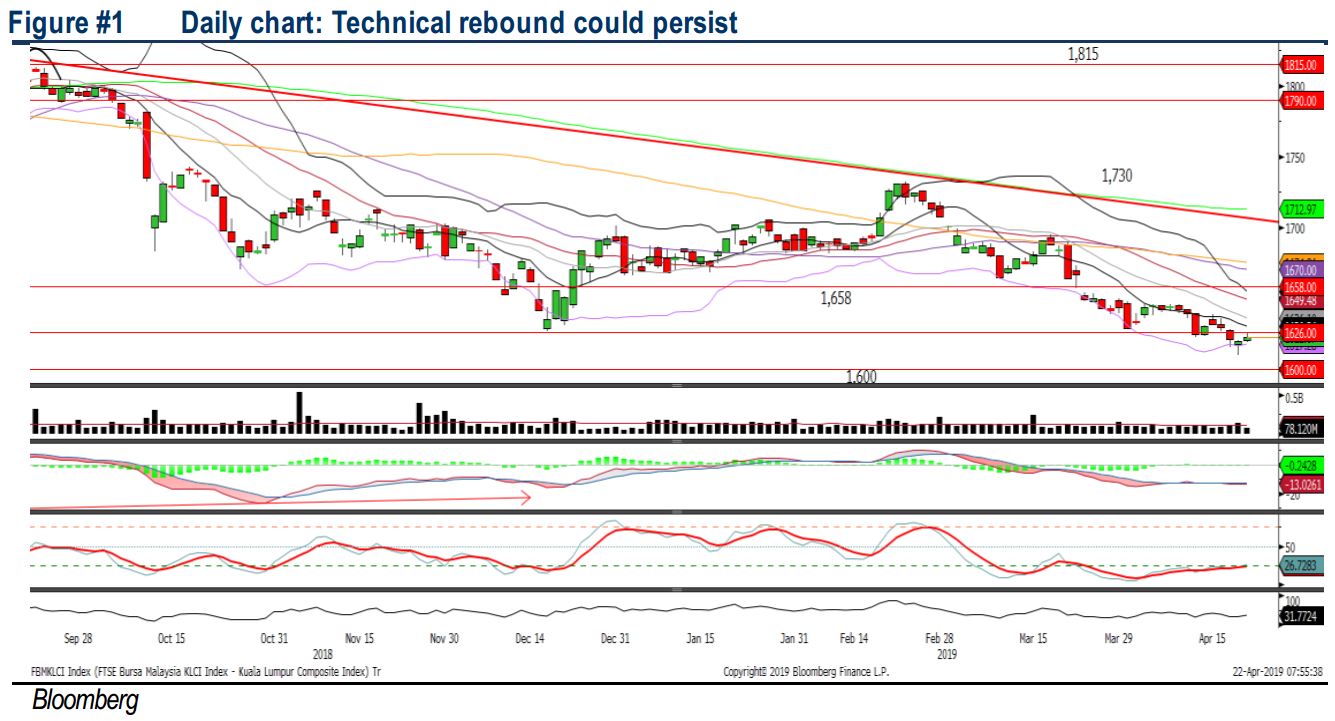

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded slightly higher after forming a hammer candle along 1,600-1,610 zone. The MACD indicator is hovering sideways below the zero level, while RSI and Stochastic are hooking higher after surpassing the oversold region. We may anticipate further technical rebound on the KLCI towards 1,640-1,650, while support will be anchored around 1,610, followed by 1,600.

We believe the bargain hunting activities on the local are likely to persist on the back of the revival of Bandar Malaysia project, which may boost the sentiment on construction and related sectors such as building materials segment. Nevertheless, market participants will be watching closely on the US-China trade progress, which may increase trading volatility in the market. The FBM KLCI’s resistance will be envisaged around 1,640-1,650.

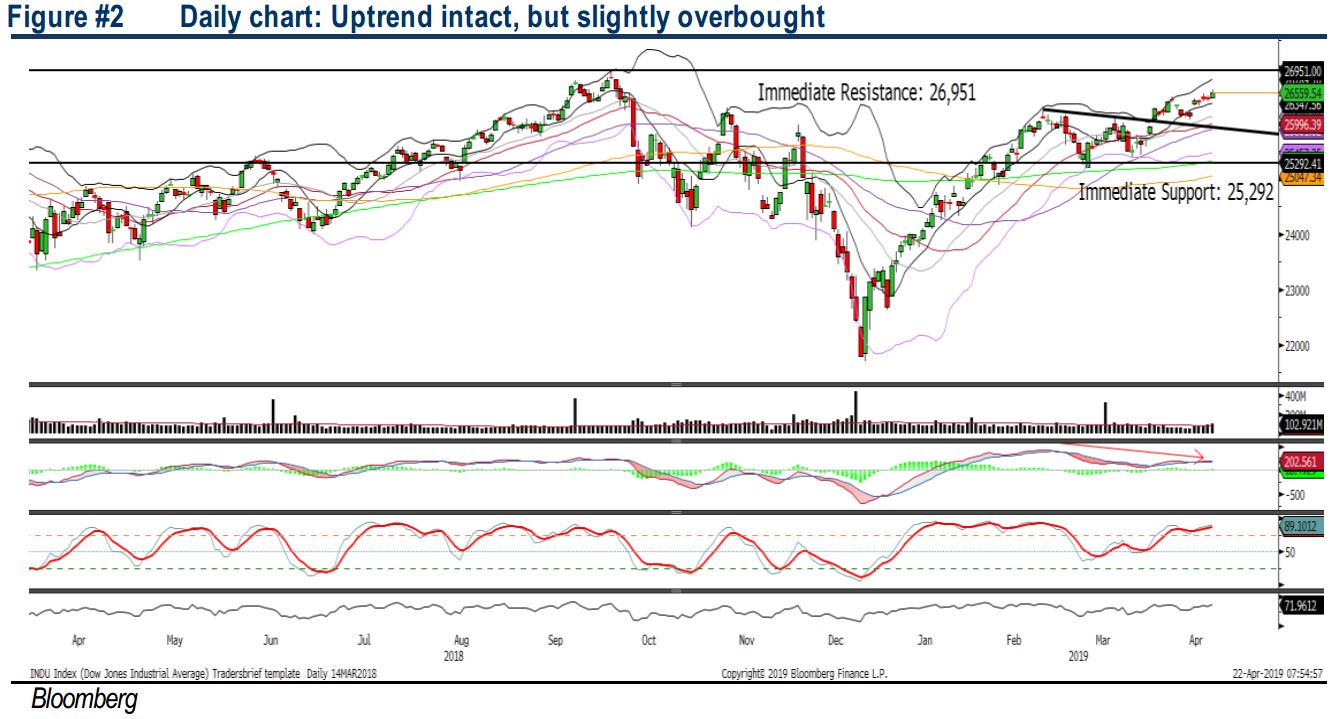

TECHNICAL OUTLOOK: DOW JONES

The Dow extended its uptrend move for the week and the MACD Indicator is hovering above zero. However, both the RSI and Stochastic oscillators are in the overbought position. Hence, we believe the Dow may trend higher but with a limited move as the momentum oscillators are overbought. The resistance is envisaged around 26,951-27,000. Support will be set around 26,500, followed by 26,000.

In the US, based on the technical indicators, it is still suggesting that the uptrend is intact and most of the indices may trend higher over the near term. Also, we believe the recent better than-expected US corporate earnings would be able to sustain the momentum at least for the near term. Hence, the Dow may retest the all-time-high at 26,951 level.

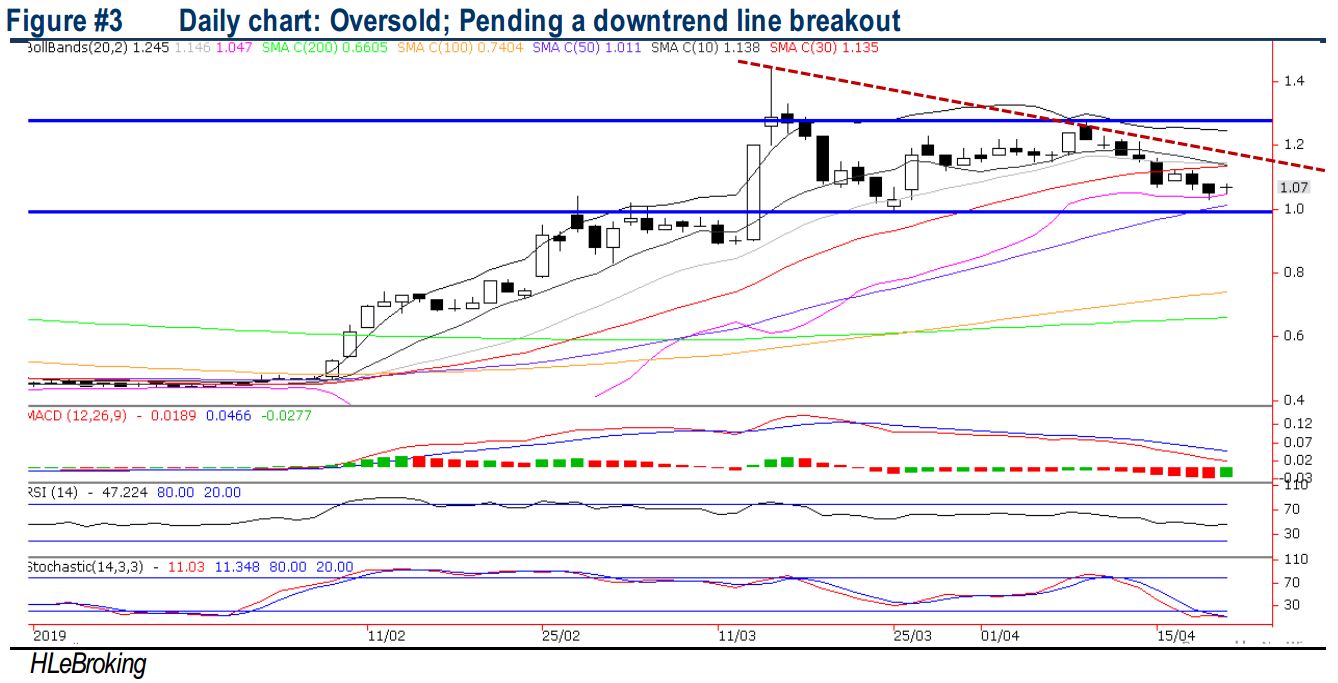

TECHNICAL TRACKER: NAIM

A good proxy for the Sarawak infrastructure play. NAIM’s share price has rallied by 140% YTD, mirroring the 148% surge of its 26%-owned associate, Dayang. Notwithstanding the huge rally, NAIM’s share price is still undervalued as we opine that investors have yet to fully appreciate the embedded values of its construction and property businesses. Indeed, adjusted for its stake in DAYANG (RM336m market cap), the current implied value of RM214m market cap (Naim’s market cap of RM550m-RM336m) on its core businesses is only 5.4x P/E against its Sarawak’s peers of 9-10x! Given its robust construction order book of RM1.9bn, positive prospects of Dayang and resilient earnings from its property division (despite the challenging outlook) coupled with the expectations of more pump-priming activities before Sept 2021 state election, market could assign a higher rating on NAIM. Currently, the stock is trading at 0.43x P/B, 63% lower against its Sarawak’s peers. Technically, the stock is poised for a downtrend line breakout above RM1.18 to advance further towards RM1.28 levels.

Source: Hong Leong Investment Bank Research - 22 Apr 2019