Traders Brief - Sentiment Pointing to Bargain Hunting Activities

HLInvest

Publish date: Fri, 19 Apr 2019, 04:42 PM

MARKET REVIEW

Tracking the sideways trend in the US, Asia’s stock markets ended on negative note ahead of the Good Friday holiday as well as without any fresh leads from the US-China trade developments. However, according to news sources, senior US and Chinese officials are scheduling more face-to-face talks to reach a deal before early May. The Shanghai Composite Index and Hang Seng Index fell 0.40% and 0.54%, respectively, while Nikkei 225 lost 0.84%.

Most of the stocks on the local front were still trading in the negative region, while the FBM KLCI trended lower towards the intraday low of 1,609.83 pts, before paring down partial losses to end at 1,619.73 pts. Market breadth was negative with 451 decliners vs. 397 advancers, accompanied by 2.89bn shares traded for the session worth RM2.17bn. Nevertheless, export driven corporates within the technology (Inari, Gtronic, Pentamaster) and selected rubber related stocks like Karex were traded actively higher on the back of weaker ringgit.

Asia’s stock markets ended higher on the back better-than-expected retail sales data (rose 1.6% in March, the strongest gain since Sept 2017). Meanwhile, sentiment was boosted by selected stronger-than-expected US corporates (Honeywell and United Rentals, coupled with two new IPO, Zoom and Pinterest, which surged 72.2% and 28.4%, respectively. The Dow and S&P500 gained 0.42% and 0.16%, respectively, while Nasdaq ended flat.

TECHNICAL OUTLOOK: KLCI

After declining from the recent peak of 1,695, the FBM KLCI has finally formed a hammer candle around the 1,600-1,614 support region; suggesting a potential rebound over the near term. The MACD Indicator, however is still expanding below zero. Both the RSI and Stochastic oscillators are oversold. Hence, with the potential hammer candlestick, coupled with the oversold indicators, we may anticipate they key index to rebound, at least for the near term towards the resistance around 1,640. Support will be at 1,600.

Tracking the decent upward move from Wall Street, coupled with the already-oversold KLCI, we opine that the sentiment on the local may turn mildly positive as we believe bargain hunting activities may emerge. Traders may focus in banking heavyweights after being beaten down recently, while export-oriented like rubber-related and technology should be focused amid weakening bias ringgit.Tracking the decent upward move from Wall Street, coupled with the already-oversold KLCI, we opine that the sentiment on the local may turn mildly positive as we believe bargain hunting activities may emerge. Traders may focus in banking heavyweights after being beaten down recently, while export-oriented like rubber-related and technology should be focused amid weakening bias ringgit.

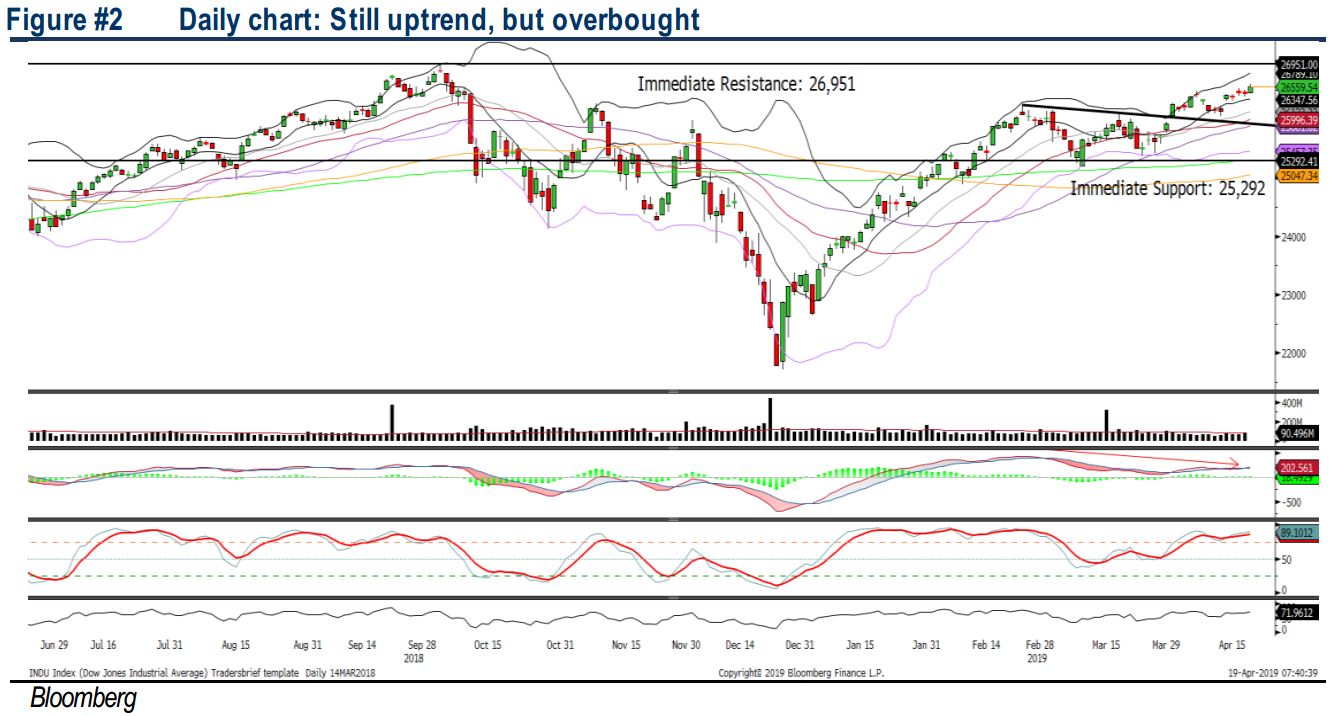

TECHNICAL OUTLOOK: DOW JONES

The Dow has been trending higher after surpassing above the immediate resistance of 26,500, well supported above the most of the moving averages (SMA10, SMA50 and SMA200). Meanwhile, the MACD Indicator continues to expand positively above zero. However, the Stochastic and RSI oscillators are in the overbought region. We believe traders will need to be cautious on the uptrend move on the Dow as it may warrant a pullback over the near term based on the overbought momentum oscillators. The next resistance will be located around 26,951. Support will be located around 26,000.

We observed that the current US corporate earnings season are still fairly supporting the sentiment on Wall Street, we believe the concerns over a slowing economy could have been priced in the stock markets, at least for the near term. Nevertheless, investors are still waiting for the US-China trade tension to be resolved; should there be any unforeseen negative surprises, we may expect another round of profit taking activities over the near term.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we had squared off our technical tracker positions on SUNWAY (due to expiry; +3.7% return) and SCOMNET(+13.5% return), as well as our 2Q19 stock pick SAPNRG (hit stop loss with a -5.9% return).

Source: Hong Leong Investment Bank Research - 19 Apr 2019