Traders Brief - Crude Oil Dip May Affect Sentiment

HLInvest

Publish date: Mon, 29 Apr 2019, 10:22 AM

MARKET REVIEW

Following the weaker overnight performance on Wall Street, Asia’s stock markets ended mixed. The Nikkei 225 and Shanghai Composite Index declined 0.22% and 1.20%, respectively, while Hang Seng Index added 0.19%. Meanwhile, China President Xi Jinping were addressing broadly on several issues in his welcoming speech during China’s Belt and Road forum last Friday, discussing his plans on national economic reforms, focusing in state subsidies, increase in intellectual property protection, allowing foreign investment in more sectors and avoiding competitive devaluation of yuan.

Similarly, sentiment on the local front was slightly sluggish as the FBM KLCI was fluctuating around the positive and negative territories without any fresh leads in the markets; the key index closed marginally higher by 0.17% to 1,638.38 pts. Market breadth was negative with 495 losers vs. 384 gainers. Market traded volume stood at 2.85bn, worth RM2.07bn. Selected construction stocks such as MRCB, IKHMAS and PTARAS were still traded actively for the session.

Wall Street closed in a positive region with S&P500 and Nasdaq marking fresh highs after the release of stronger-than-expected 1Q19 US GDP of 3.2%, vs. consensus of 2.5%. The Dow rose 0.31%, while S&P500 and Nasdaq added 0.47% and 0.34%, respectively.

TECHNICAL OUTLOOK: KLCI

Over the week, the FBM KLCI has trended higher and we believe the V-shapes rebound may sustain over the near term. The MACD indicator has rebounded strongly in the negative territory, while both the RSI and Stochastic oscillators have advanced above 50; indicating that the positive momentum is in intact. Hence, with the positive technical readings, the KLCI could break above the resistance around 1,640, targeting 1,658. Support will be located around 1,30, followed by 1,610.

Stocks on the local front may continue to stay neutral without any strong catalyst in the market as most of the construction related newsflow may have priced in during the recent technical rebound. Also, with the sudden slump in crude oil prices last week, we may anticipate oil and gas stocks to take a beating this week. The KLCI’s upside likely to be capped along 1,640- 1,658.

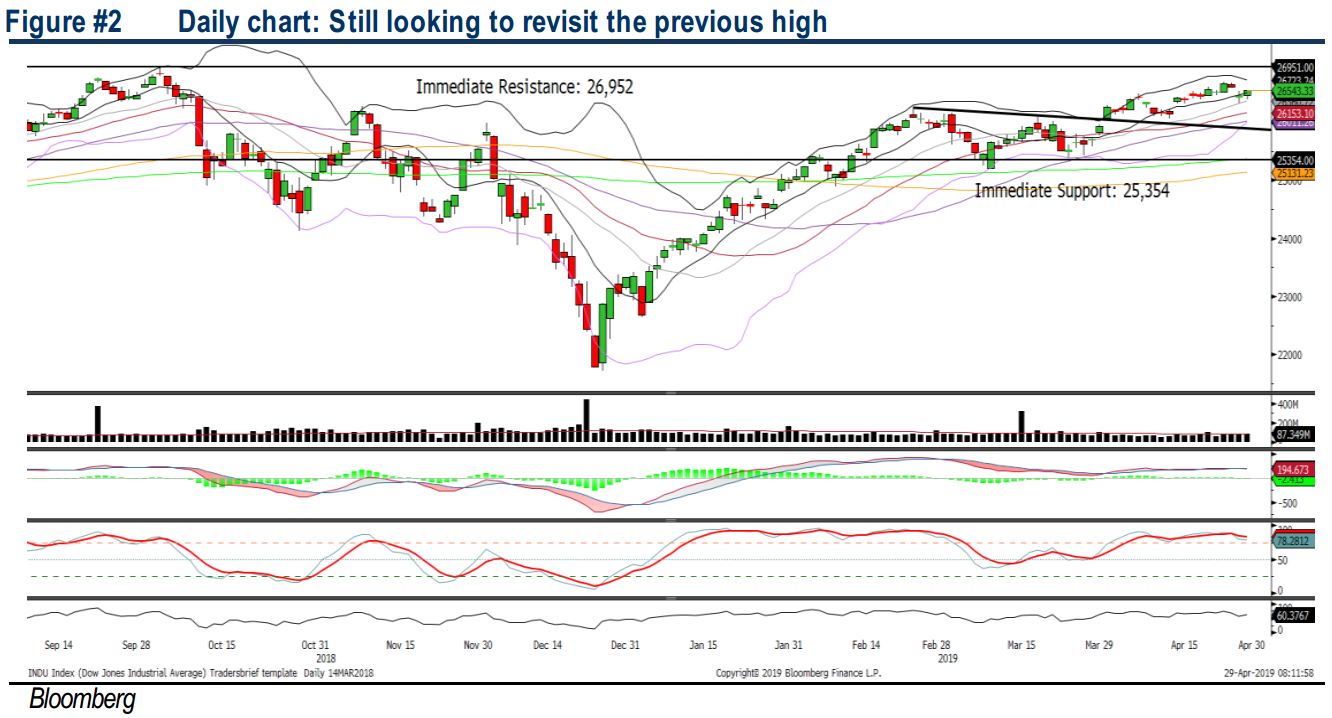

TECHNICAL OUTLOOK: DOW JONES

The Dow has turned flat last week after a slight dip last Thursday. The MACD indicator has issued a negative cross (MACD Line below Signal Line), but both the RSI and Stochastic oscillators are hovering above 50. With the mixed technical readings, we believe the key index could stay rangebound over the near term. Resistance is envisaged around 26,952 (all-time high), while support will be set around 26,000, followed by 25,362 (SMA200).

In the US, stocks are likely to stay afloat with the ongoing US corporate earnings season, coupled with the stronger economic data (1Q19 US GDP) which was released last week in the US. In addition, should there be any form of trade agreement being sealed in the next couple of weeks, we expect further rally in the stock markets. The Dow’s resistance is envisaged around 26,952.

TECHNICAL TRACKER: PANTECH

Sustainable steady earnings growth supported by cheap valuations and decent dividend yield. Pantech recorded commendable FY19 earnings of RM47.1m (-0.2% YoY) despite being slapped with US anti-dumping duties since July 2018. We like the stock driven by potential earnings recovery, underpinned by a likely U.S. shipment suspension uplift, and increased local offshore fabrication activities. Valuations are cheap at 8.3x FY20 P/E (33% below peer) and 0.74x P/B (54% below peer), supported by a steady 10% FY19-21 earnings CAGR and 4.1% DY. Technically, the stock is poised for a positive Cup & handle pattern formation, which could drive share prices higher towards RM0.64-0.68 levels.

Source: Hong Leong Investment Bank Research - 29 Apr 2019