Traders Brief - Upside limited, downward bias

HLInvest

Publish date: Fri, 03 May 2019, 02:17 PM

MARKET REVIEW

Despite the negative performance on Wall Street following the FOMC meeting (which indicated that the central bank is not considering a cut in interest rates at this juncture), most of the Asia’s stock markets ended on a positive note; the Shanghai Composite Index and Hang Seng Index rose 0.52% and 0.83%, respectively.

In tandem with the profit taking activities on Wall Street, the FBM KLCI ended lower by 0.61%, 1,632.24 pts. Market breadth was still negative with decliners led advancers by a ratio of 3-to- 1. Market traded volumes stood at 2.68bn, worth RM1.95bn. On the gainers list, Lafarge Malaysia was traded higher on the back of a takeover offer by YTL Cement at RM3.75 a share, while HUME Industries added 11.3% for the session.

Wall Street ended lower for the second consecutive day following comments from the Fed’s Chairman on the interest rates outlook. Traders were also on the side lines awaiting for any conclusion related to the ongoing trade discussions between US and China. The Dow and S&P500 declined 0.46% and 0.21%, respectively, while Nasdaq slipped 0.16%.

TECHNICAL OUTLOOK: KLCI

Following the flag formation breakout, it has reversed and formed a bearish engulfing candle and the sentiment has turned negative. The MACD Line is hovering below zero and MACD Histogram has turned mildly lower. Also, both the RSI and Stochastic oscillators have hooked lower. With the slightly negative technical readings, the upside is likely to be capped along 1,640-1,658, while support will be pegged around 1,630, followed by 1,610.

Tracking overnight Wall Street’s performances, coupled with the weakening crude oil prices, we may expect further spillover of the selling pressure on local bourse on heavyweights and O&G stocks; the latter may succumbed to selling interest due to overnight weakening crude oil prices. Also, we believe the volatility could increase throughout the upcoming reporting season on Bursa Malaysia. The FBMKLCI’s resistance is located around 1,640-1,658.

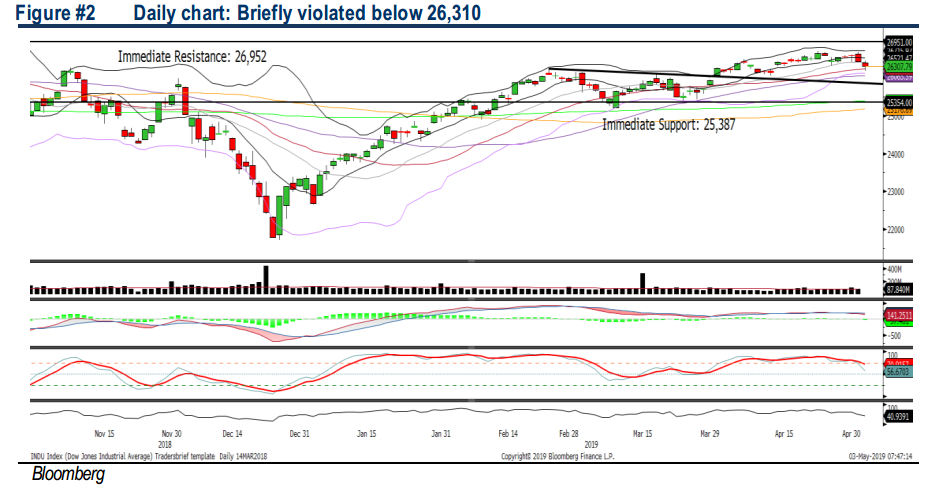

TECHNICAL OUTLOOK: DOW JONES

The Dow has fallen for the second day and briefly violated below 26,310 level. The MACD indicator has turned lower over the past few sessions. Besides, both the RSI and Stochastic oscillators have turned lower yesterday as well. We opine that the current retracement may persist over the near term and upside resistance is envisaged around 26,500-26,952. Support will be located around 26,000.

We believe the sentiment on Wall Street would remain cautious amid the ongoing US reporting season, coupled with the uncertain US-China trade developments, as there are still some structural issues to be resolved in the upcoming meetings before both of the nations could strike with a trade agreement. The Dow’s resistance is located around 26,500-26,952.

TECHNICAL TRACKER: ECONBHD

Improving sector dynamics and oversold positions. Following a 22% slump in 7 trading days to RM0.625 from YTD high of RM0.80 (18 Apr), ECONBHD provides an attractive risk - reward profile at 12.3x FY20E P/E (18% lower against peers), supported by superior ROE, coupled with robust order book ~RM1bn (after secured RM620m contracts in 9MFY19). Overall, ECONBHD remains the market leader in the piling and foundation with its expertise in undertaking complex and larger scale jobs. After a sluggish 1HFY19 (mainly due to the variation orders, cost overrun and impairment of its trade receivables), 2HFY19 and FY20-21 earnings are expected to improve further, backed by solid RM1bn order book and potential more job replenishments as the sector dynamics have turned positive following the revival of ECRL and Bandar Malaysia. Technically, ECONBHD may be due for a downtrend reversal to test RM0.70-0.78 territories after a brief consolidation.

Source: Hong Leong Investment Bank Research - 3 May 2019