Tradersbrief - Lack of Fresh Leads

HLInvest

Publish date: Tue, 07 May 2019, 05:13 PM

MARKET REVIEW

Despite Wall Street ended on the positive note on the back of stronger-than-expected 1Q19 US GDP, Asia’s stock markets ended mixed; the Shanghai Composite Index declined 0.77%, but Hang Seng Index rose 0.97%. Meanwhile, Japan stock exchange is shut for a 10-day holiday from April 27 to May 6 to celebrate the enthronement of the country's Crown Prince Naruhito.

On the local front, the FBM KLCI traded lower by 0.06% to 1,637.40 pts. Market breadth was negative with 623 decliners vs. 256 advancers, while market traded volumes was lower at 2.53bn (worth RM1.64bn) as compared to 2.85bn shares (valued at RM2.07bn) traded on last Friday. Nevertheless, we noticed selected consumer stocks such as Yeelee, Spritzer and Carlsberg were topping the gainers list.

Wall Street ended only marginally higher amid the ongoing busy US reporting season, while market participants are staying cautious ahead of several economic data (US nonfarm payroll and factory orders data) as well as prior to the FOMC meeting. The Dow rose 0.04%, while S&P500 and Nasdaq gained 0.11% and 0.19%, respectively.

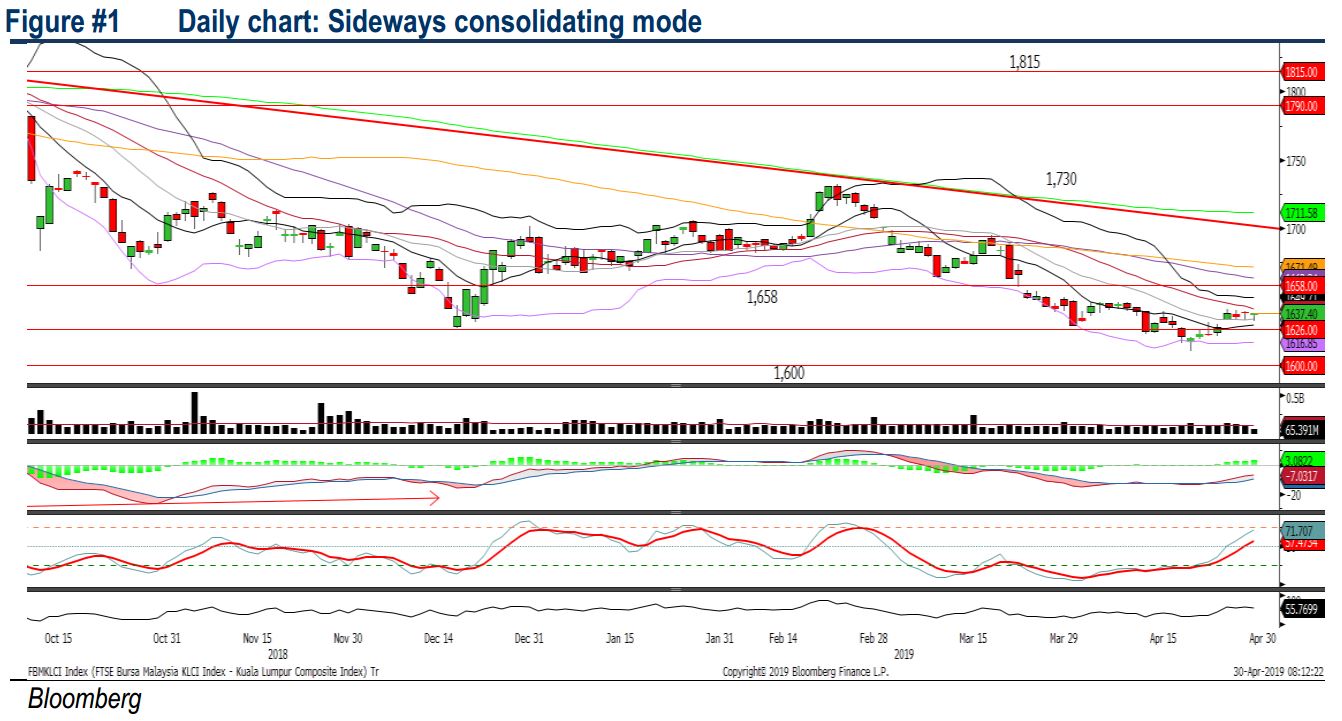

TECHNICAL OUTLOOK: KLCI

The FBM KLCI trended sideways over the past four trading days within a tiny range of 1,632- 1,642. The MACD indicator has been recovering over the past few sessions, but it is still hovering below zero. Meanwhile, the RSI is flattish around 50 and the Stochastic oscillator is trending higher above 50. With the mixed technical readings, we anticipate the KLCI to trend sideways until a committed breakout above 1,640. Resistance will be pegged around 1,658, support will be set along 1,610.

We believe the buying interest may stay tepid over the near term as traders could be adapting to the T+2 environment for the time being. Also, the lack of fresh catalysts in the markets could be capping the upside potential on the local bourse. Investors are likely to stay side lines ahead of the heavy reporting season in May.

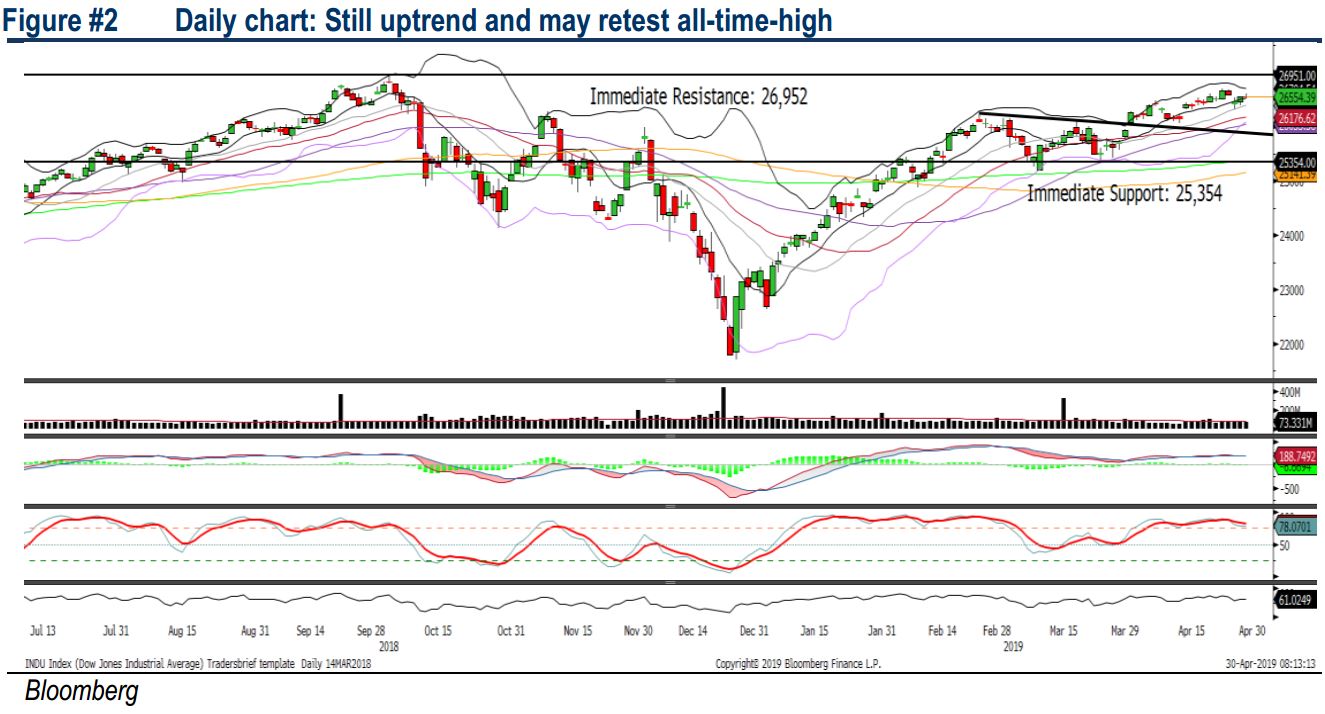

TECHNICAL OUTLOOK: DOW JONES

Despite the Dow closed slightly higher yesterday, it is still hovering sideways, below the immediate resistance of 26,696. The MACD indicator is mildly negative after the death cross last week, but both the RSI and Stochastic oscillators are hovering above 50. The Dow’s resistance is pegged around 26,700-26,952. Support will be set along 26,000.

With the S&P500 and Nasdaq marking its all-time-high for a few sessions recently, we believe it may attract profit taking activities over the near term. At this juncture, investors are awaiting more clarity on the trade developments as there are several ongoing trade discussions between the US and China that may provide further clues on the trade resolution moving forward. On a side note, traders will monitor for clues on interest rate outlook in the upcoming FOMC meeting.

Source: Hong Leong Investment Bank Research - 7 May 2019