Traders Brief - Cautious Undertone Prevails Ahead of Trade Talks

HLInvest

Publish date: Wed, 08 May 2019, 09:24 AM

MARKET REVIEW

Following a rout in Asian markets on Monday amid recent re-escalation in US-China tensions after Washington said tariffs on Chinese goods will rise on Friday, most markets staged a mild recovery in the early sessions after news stating that the Chinese delegation would resume the trade talks in US on 9-10 May, accompanied by Chinese Vice Premier Liu. Nevertheless, most Asian markets gave up the early gains to end mixed amid speculation that the imposition of fresh levies would upend the global economy as Trump ratchets up pressure to clinch a deal.

Bucking negative regional markets, KLCI rose 6.6 pts to 1639.4, led by gains in Axiata and Digi following news on the proposed merger of Axiata and Norway-based Telenor's Asian operations within their Asean and South Asian markets to create an Asian champion. Sentiment was also boosted by a surprise 25bps OPR cut by BNM amid tightening local financial conditions and concerns over downside risks to the global economy prompted the pre-emptive monetary easing. Trading volume increased to 3.02bn shares worth RM2.25bn as compared to Monday’s 2.79bn shares worth RM1.70bn. Market breadth was positive with 555 gainers as compared to 309 losers.

The Dow slid 473 pts albeit finishing above session lows of 649 pts, disappointing markets that hoped Trump’s weekend tweet threat was just a negotiation tactic. US Trade Representative Robert Lighthizer said the US will hike tariffs from 10% to 25% on USD200bn Chinese imports on 10 May, and President Trump threatened to potentially impose an extra 25% levy on other USD325bn of Chinese goods subsequently.

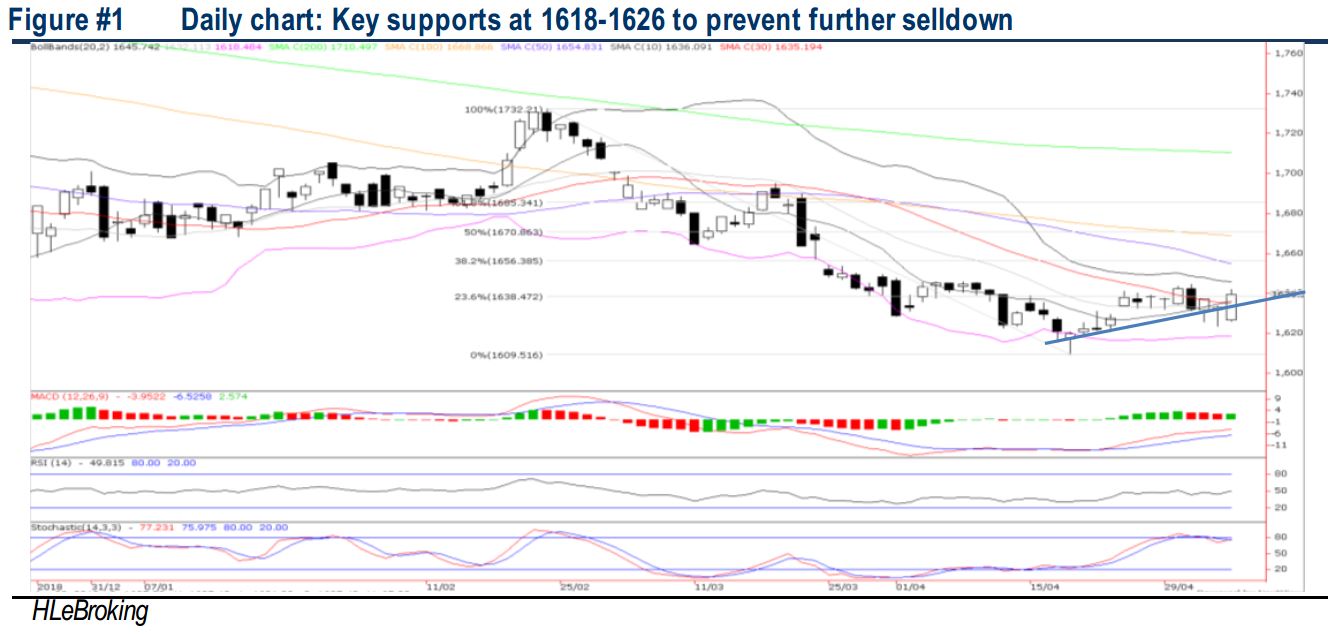

TECHNICAL OUTLOOK: KLCI

Despite wild swings in overseas markets, KLCI managed to sustain its gains from intra-day low of 1626 to end at 1639.4, forming a positive white candle. As the MACD Line is still hovering below the zero level, while both the RSI and Stochastic oscillators are trending sideways, we opine that the KLCI’s upside could be limited around 1654 (50D SMA)-1668 (100D SMA) levels. Supports will be pegged around 1618 (lower Bollinger band) and 1609 (18 April low).

Despite a general positive impact of an OPR cut to our economy and stock markets, we believe the abrupt breakdown in the US-China trade talks and potential intensification of a tariff tit-for-tat would dampen sentiment in the near term, compounded by bearish outlook on Dow after falling below the 20D & 50D SMAs. Also, with Brent crude oil prices sliding below the USD70 level, we may expect weaker trading activities on O&G counters. Meanwhile, we do not anticipate selling spree in banking stocks as the 25 bps cut has been priced in and we expect BNM to stand pat on the OPR at 3.00% for the rest of 2019.

TECHNICAL OUTLOOK: DOW JONES

Although the Dow staged an intraday rebound from a low of 25789 to end at 25965 (thus forming a hammer candle), we still believe downside risks prevail in the short term amid the closure below 20D & 50D SMA, compounded by the formation of MACD dead cross as well as weakening momentum oscillators. Resistance will be located around 26100/26400/26952 while supports are pegged along 25700 followed by 200D SMA near 25400.

Although the Dow managed to recover losses intraday for the past two sessions after a tariff tweet from the eccentric President Trump wrought havoc to global markets, immediate market response suggests that the latest escalation of the trade war was a complete surprise to investors. Hence, we expect a bumpy ride in the near term before a trade deal is reached. The Dow’s resistance is located around 26400-26952 while supports fall on 25400-25700.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we had squared off our positions in 2Q19 stock picks on KIMLUN (23.1% gain) and EATECH (4% loss) as well as technical tracker, PANTECH (5% loss).

TECHNICAL TRACKER: GADANG

Potential prelude to more infrastructure works. GADANG had entered into a pre-bid consortium agreement with DWL Resources Bhd to bid for infrastructure works in the next 12 months. With GADANG involved a lot in the civil engineering and construction works, we do not rule out the possibility of this consortium to bid for future ECRL works. Besides, GADANG’s sizeable orderbook of RM1.3bn as end-Feb19 could sustain them for another 3-4 years based on FY18 construction revenue. Technically, GADANG is up trending with a short term consolidation breakout above RM0.83, next resistance is located around RM0.92-0.94, with a LT target at RM1.00. Support at RM0.79-0.805, with a cut loss set below RM0.78.

Source: Hong Leong Investment Bank Research - 8 May 2019