Traders Brief - KLCI Could Violate Below 1,600

HLInvest

Publish date: Tue, 14 May 2019, 09:30 AM

MARKET REVIEW

Following the higher tariffs (from 10% to 25%) being imposed on USD200bn Chinese goods last Friday, most of the Asia’s stock markets ended on a softer note as selling pressure extended. The Shanghai Composite Index and Nikkei 225 declined 1.21% and 0.72%, respectively, while Hong Kong stock exchange was closed for holiday.

On the local front, stocks were traded in a bearish tone as Dow futures plummeted more than 1.5% during the Asia’s session as market participants were negative on the recent trade developments. Market breadth was bearish with decliners leading advancers by a ratio of near to 6-to-1, while market traded volumes stood at 2.48bn, worth RM1.65bn.

Wall Street has ended substantially lower for the session after China retaliated with raising tariffs on USD60bn worth of US imports, effective in 1st of June, targeting a broad range of agricultural products. With the countermeasure by China, investors turned more bearish on equities and the Dow and S&P500 dived 2.38% and 2.41%, respectively, while Nasdaq plummeted 3.41%.

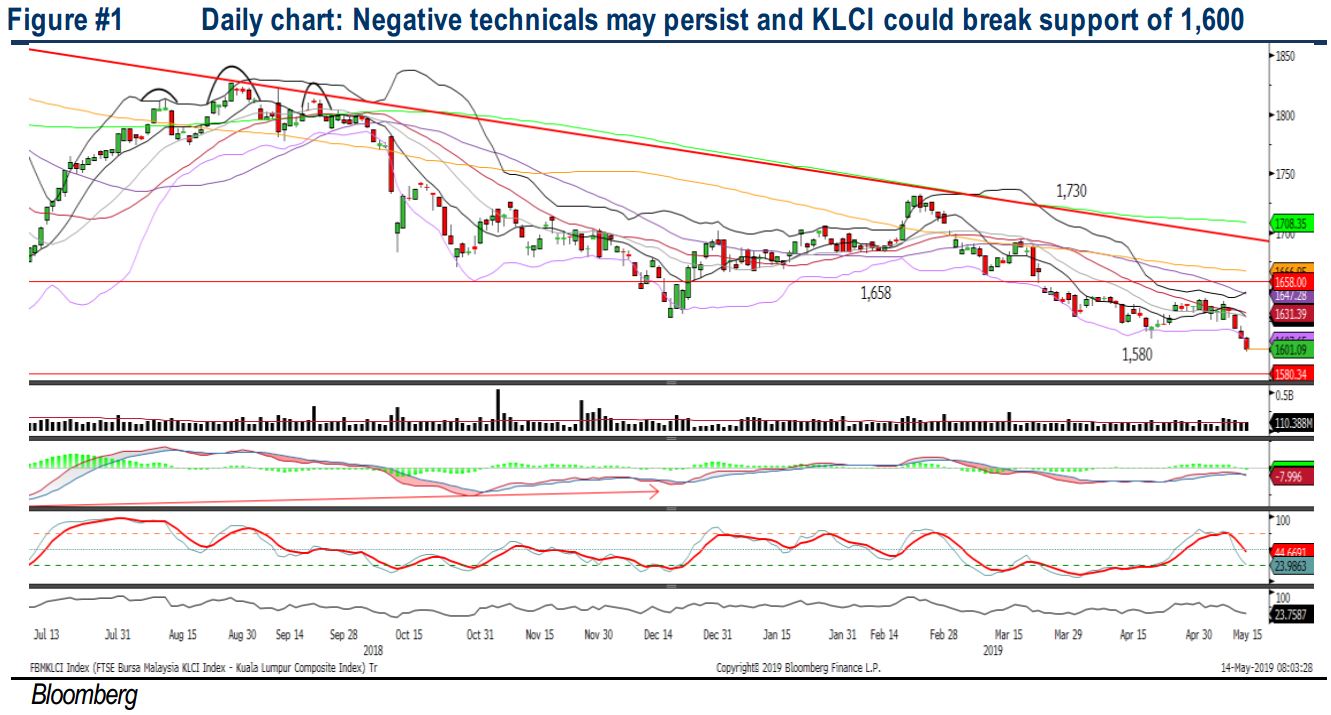

TECHNICAL OUTLOOK: KLCI

The FBM KLCI briefly dropped below 1,600 and ended at 1,601.09 pts for the session and the MACD indicator expanded negatively. The RSI and Stochastic oscillators continue to trend lower suggesting that the negative momentum is intact. Based on the sentiment abroad, the KLCI could breach below the support of 1,600, unless there is a trade resolution in the near term. Resistance is envisaged around 1,630-1,640.

With the negative sentiment under the escalated trade environment, we opine that the selling pressure may dominate for the near term and upside on the KLCI could be limited at this juncture. At this current juncture, market participants are pricing in lower chances of any trade resolutions to be struck between the US and China and the market could stay within the retracement ph ase.

ase.

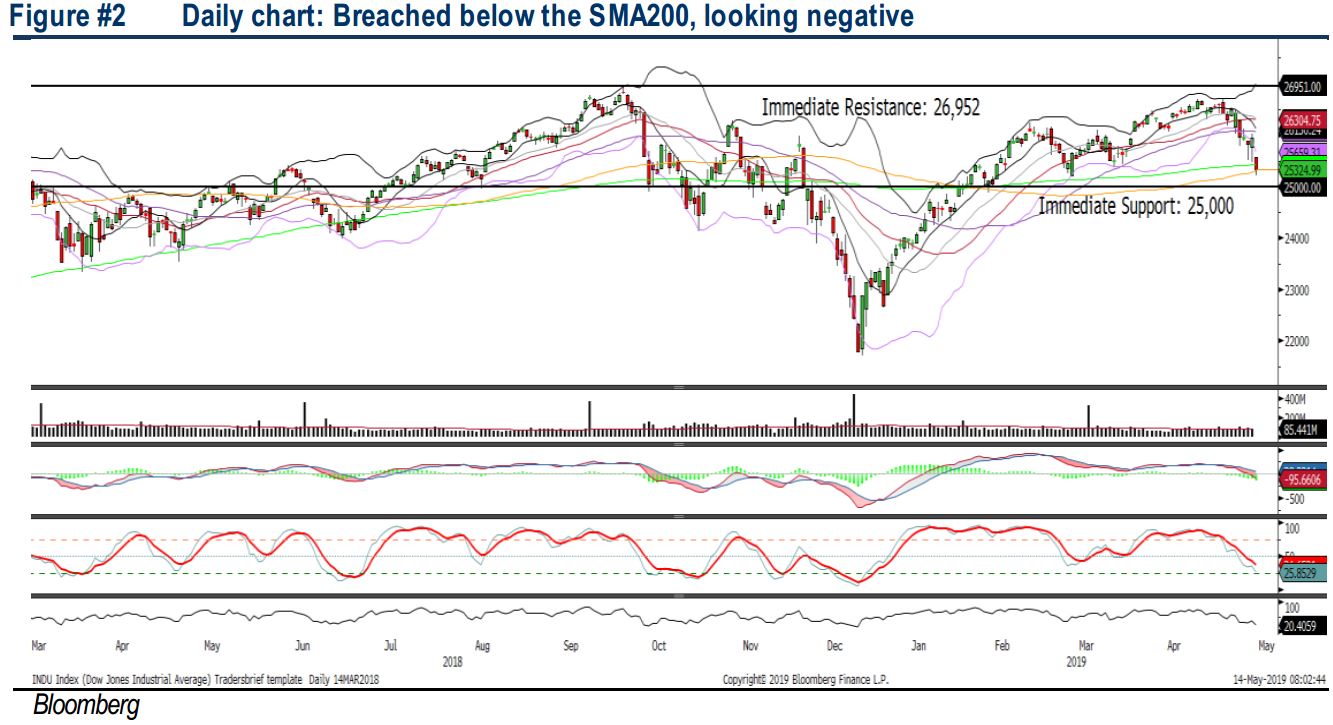

TECHNICAL OUTLOOK: DOW JONES

The Dow has breached below the SMA200 at 25,400 level yesterday after hovering above the long term moving average for more than 13 weeks. The MACD Line has crossed into the negative territory, while both the RSI and Stochastic oscillators are suggesting that the Dow’s negative momentum is picking up. With the negative technical readings, we opine that the Dow may extend its retracement phase towards support of 25,000, while resistance is pegged around 26,000.

Trade-sensitive stocks in the US are likely to suffer over the near term as trade tensions escalated following the reciprocal actions made by China, imposing higher tariffs on US products. In the current sentiment, we opine that the selling pressure is likely to stay until any trade deals are put on the table from both the US and China. Hence, the Dow’s downside risk will be expected in the near term.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, on the back of bearish market undertone, we had squared off entirely our technical trackers and 2Q19 stock picks on DESTINI (11.8% loss), ARBB (11.3% loss), ORION (2.9% loss), GADANG (5.8% loss), GFM (14.8% loss), UCHITEC (2.1% loss), KERJAYA (2.3% loss) and DKSH (10% return).

Source: Hong Leong Investment Bank Research - 14 May 2019