Traders Brief - Selling Pressure May Persist Within Tech Stocks

HLInvest

Publish date: Thu, 23 May 2019, 09:57 AM

MARKET REVIEW

Asia’s stock markets traded mixed as market participants turned cautious amid intensified trade tensions with the ongoing Huawei episode despite the US temporarily backed off restrictions on the Chinese giant telecommunications. The Shanghai Composite Index fell 0.49%, but Nikkei and Hang Seng Index inched marginally higher by 0.05% and 0.18%, respectively.

On the local front, the FBM KLCI closed lower by 0.10% to 1,603.74 pts on Tuesday and market overall activity was tepid as traded volumes only hit 1.80bn shares (valued at RM1.46bn last Friday) as compared to 1.96bn shares. Market breadth was negative with decliners led advancers by a ratio of 3-to-1. Technology stocks were beaten down on the back of the negative US restrictions on Huawei, while gloves stocks were traded positively as ringgit weakens further on Tuesday.

Similarly, Wall Street ended lower for the session as trade concerns amplified on the back of uncertain trade developments between the US and China, coupled with the Huawei ban events. Shares were traded softer led by Qualcomm; the Dow and S&P500 0.39% and 0.28%, respectively, while Nasdaq dropped 0.45%.

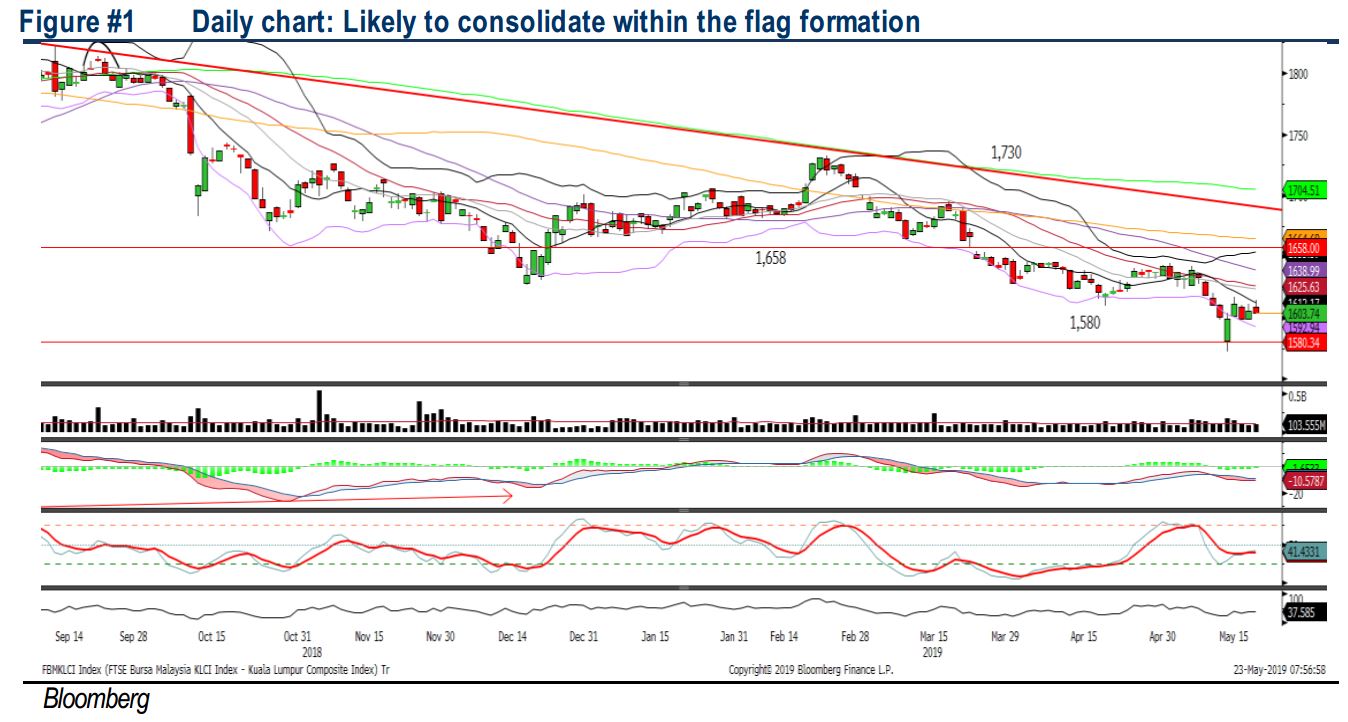

TECHNICAL OUTLOOK: KLCI

Still, the FBM KLCI is trending sideways between a narrow range of 1,600-1,619 over the past four trading days. The MACD indicator was flattish below the zero level, while both the RSI and Stochastic oscillators are threading below 50. Hence, we believe the KLCI’s upside will be capped around 1,619, while the support will be anchored around 1,600.

With the negative sentiment prevailing on Wall Street, we believe there may be spillover to stocks on the local front, especially in the technology sector as the Huawei ban could translate to uncertain business environment amongst the tech industry. In addition, foreign trade flows remained negative over the past 5 days is likely to cap the key index’s upside over the near term. Nevertheless, the weakening bias in ringgit could lift trading sentiment on selected export-oriented stocks within the gloves sector.

TECHNICAL OUTLOOK: DOW JONES

The Dow trended sideways over the past 5 days between the 25,560-25,958 level and the MACD indicator is flattish below zero. Meanwhile, both the RSI and Stochastic oscillators are hovering below 50; suggesting that the negative momentum is still intact. Hence, the Dow’s upside may be limited and the downside risk could persist over the near term. The resistance is pegged around 26,000, while support is located around 25,434 (SMA200).

In the US, the fallout of the Huawei restrictions episode has contributed towards an already - uncertain trade war situation as China may rethink its economic relationship with the US, which may lead to further worsening economic situation. Technology giants could face with further selling pressure and limiting the upside potential on tech-heavy Nasdaq, while the Dow’s resistance will be pegged along 26,000.

Source: Hong Leong Investment Bank Research - 23 May 2019