Traders Brief - Still Uncertain Ahead of the G20 Summit

HLInvest

Publish date: Thu, 27 Jun 2019, 09:13 AM

MARKET REVIEW

Asia’s stock markets ended mixed as Federal Reserve Chairman Jerome Powell commented that the US central bank will be taking a wait-and-see approach on the current economic environment and has tempered the rate cut expectations for now. In addition, traders are staying side-lines ahead of the G20 summit where both the President Trump and President Xi will be meeting up for trade discussions. The Shanghai Composite Index and Nikkei 225 fell 0.19% and 0.51%, respectively, while Hang Seng Index rose 0.13%.

Meanwhile, the FBM KLCI ended lower by 0.13% to 1,674.49 pts after trading mostly in the negative territory throughout the session. Market breadth was negative with nearly 4 decliners for every 3 advancers on the broader market, accompanied by 1.83bn shares traded, valued at RM1.55bn. Meanwhile, IT solutions provider such as Datasonic and IFCAMSC trended actively higher for the day.

With the Fed’s Chief Jerome Powell lowering down the expectation of a potential rate cut this year, market sentiment turned mixed as traders were focusing on the major upcoming event G20 summit to obtain more clues on the trade progress between US and China. The Dow and S&P500 slipped 0.04% and 0.12%, respectively, while Nasdaq gained 0.32% thanks to bullish outlook from Chipmaker Micron Technology.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has pulled back over the past three trading days, taking a short breather after the rebound last week. The MACD Line is above zero, while both the RSI and Stochastic oscillators have trended slightly lower over the past few days. At this juncture, the resistance is pegged around 1,680-1,700, while support will be set along 1,658, followed by 1,640.

Taking cues from lacklustre activities on overnight Wall Street, market participants are likely to stay side-lines ahead the widely anticipated G20 summit and the KLCI may trade within a narrow range between 1,658-1,680. Meanwhile, traders may look into O&G stocks for some trading actions as Brent oil prices jumped above USD65 after EIA reported a significant drop in weekly inventory since September 2016.

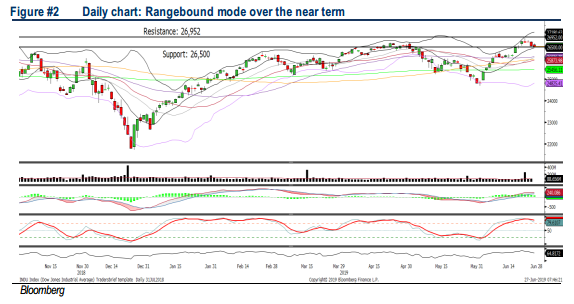

TECHNICAL OUTLOOK: DOW JONES

The Dow declined for another session attributed to the uncertainty ahead of the G20 summit. The MACD Indicator has turned flattish, but still hovering above zero, while the Stochastic oscillator are in the overbought region. Hence, we believe the Dow’s upside will be limited over the near term and the resistance is located around the 26,952 level. Meanwhile, support will be set along 26,500.

On Wall Street, we opine that the market participants will be staying cautious ahead of the G20 summit as any details regarding the trade discussions will be monitored closely to determine the market direction moving forward. However, Treasury Secretary Steven Mnuchin stated “there is a path” for the US and China on the trade front as well as the trade deal is 90% complete should be able to stabilise market movements for now.

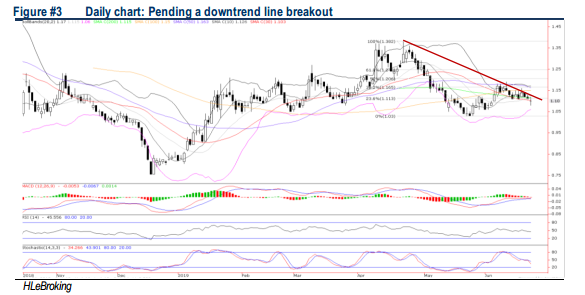

TECHNICAL TRACKER: GKENT

Values resurface on resumption of LRT3 projects, solid balance sheet and attractive dividend yield. Despite reporting a slower 1QFY20 results, our analyst had upgraded the stock to BUY with RM1.43 TP (+30% upside), banking on the stronger 2H performance due to resumption of LRT3 project, cheap valuations (8.9x FY20 P/E/-23% below 10Y average; 1.23x P/B/-35% below 10Y average), sound balance with RM0.44 net cash per share or 40% of market cap, attractive FY20 dividend yield at 5.9%, and solid outstanding construction order book about RM6bn (including ~RM5bn LRT3 PDP) to provide 4-5 years earnings visibility. Meanwhile, positive conclusion of Malaysia’s water restructuring saga should also bode well for GKENT, a vertically integrated service provider in M&E, civil engineering and water metering & valve manufacturing. Technically, GKENT is poised for a downtrend line breakout to spur prices towards RM1.20-1.30 zones.

Source: Hong Leong Investment Bank Research - 27 Jun 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|