DKSH Holdings - Synergies From Auric Acquisition Remains Intact

HLInvest

Publish date: Fri, 28 Jun 2019, 09:36 AM

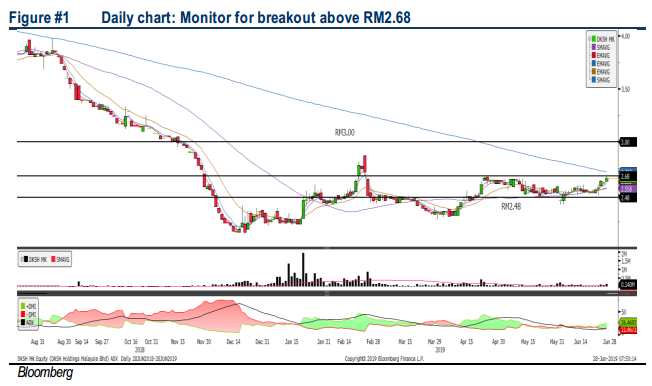

Although we noticed share price have been trending sideways since the Auric acquisition, we think the synergies and efficiencies will be kicking in moving forward, which may reflect in bottom line and share prices. In addition, Auric’s distribution of chilled and frozen products and food services in Malaysia has been averagely garnering profit margins of c.7% compared to DKSH’s 1-2%, while we believe its in-house butter and margarine brands SCS and Buttercup could contribute positively to the 2Q19 results on the back of higher sales during Hari Raya period. Technically, DKSH could trend higher as ADX has been suggesting that the momentum is picking. LT target price will be located around RM3.00, while cut loss is set around RM2.48.

Leading international market expansion services provider. DKSH is deeply rooted in Asia Pacific, serving more than 180 clients and 14,500 customers across Malaysia, focusing on consumer goods, healthcare and performance materials and offers a wide range of market expansion services to business partners in their respective areas.

Synergies and efficiencies could be expected from Auric acquisition. DKSH acquired Auric in March 2019 for c.RM481m, where Auric is involved in the distribution of chilled and frozen products and food services channel in Malaysia (Auric’s average profit margins are c.7% compared to DKSH’s 1-2%). Also, we believe its in-house butter and margarine brands SCS and Buttercup could contribute positively to the 2Q19 results on the back of higher sales during Hari Raya festivities.

Still growing Famous Amos business. In 1Q19, this particular business segment has grown c.15.6% YoY in 1Q19, contributing c.10% to the total revenue due to the improvement in per store revenue growth on the back of more outlet openings.

Short term sideways consolidation breakout. DKSH has started to pick up in momentum over the past few days, surpassing the RM2.58 with improved volumes. The ADX indicator has suggested a positive crossover (-DMI crossed below ADX) and buying interest could emerge over the near term. We expect the trend to sustain towards RM2.75-2.87 after a mild consolidation and the LT target will be set around RM3.00. Support will be located around RM2.54-2.58, while the cut loss level is set around RM2.48.

Source: Hong Leong Investment Bank Research - 28 Jun 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|