Telekom Malaysia - Trading Opportunities Emerge After Selldown

HLInvest

Publish date: Fri, 30 Aug 2019, 09:20 AM

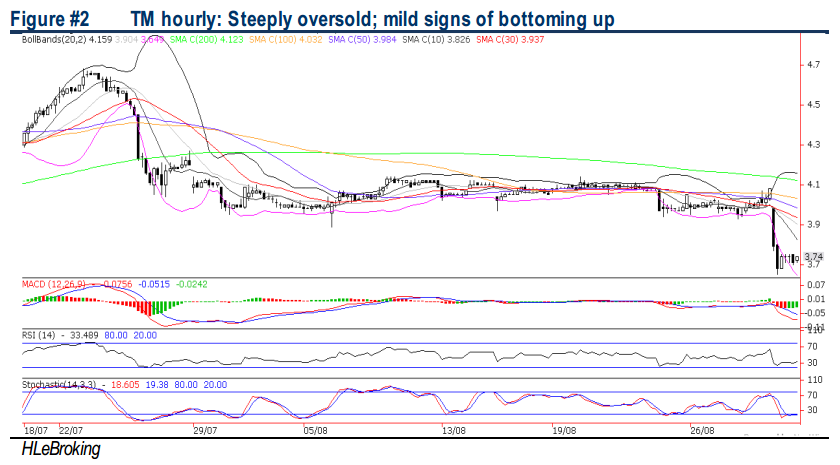

After surging 41% YTD and factoring in expectations for less robust 2H19 results (1H19 core earnings RM523m; 2H RM364m), TM share prices plunged 8.3% or RM0.34 yesterday to RM3.74. We see values in the stock as our DCF derived TP of RM5.00 still offers a strong 33.6% upside. Current valuation at 15.3x FY20 P/E is undemanding (48% lower than peers), supported by a 18.5% EPS FY19-21 CAGR. Technically, traders may accumulate near RM3.65-3.70 levels in anticipation for an oversold technical rebound towards RM3.88-4.18 levels.

Technical rebound could emerge. Based on daily chart, the stock could face further selling pressure amid the long black candlestick and negative technical indicators. However, downside risk could be cushioned by steeply oversold hourly chart. As the hourly chart indicators are flashing mild signs of bottoming up, traders may take an opportunity to accumulate near supports at RM3.65 (29 Aug low) and RM3.54 (SMA 120), in anticipation for oversold rebound targets at RM3.88 (38.2% FR) and RM4.00 before hitting our LT objective at RM4.18 (23.8% FR). Cut loss at RM3.52.

Source: Hong Leong Investment Bank Research - 30 Aug 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-14

TM2024-11-14

TM2024-11-14

TM2024-11-13

TM2024-11-13

TM2024-11-13

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM