Traders Brief - Negative Sentiment on Wall Street May Spillover

HLInvest

Publish date: Wed, 02 Oct 2019, 09:38 AM

MARKET REVIEW

Most of the regional stock markets ended on a higher note as Reserve Bank of Australia slashed its cash rate by a quarter point to a new record low of 0.75%; ASX 200 rose 0.81%, while Nikkei 225 and Kospi Index added 0.59% and 0.45%, respectively. Meanwhile, both China and Hong Kong were closed for public holiday.

Similarly, stocks on the local front mostly traded on a positive note in tandem with the regional markets; KLCI rose 0.35% to 1,589.44 pts. Market breadth was positive with 438 gainers vs. 297 losers. Market traded volume stood at 1.80bn, worth RM1.25bn. With the weaker ringgit tone, technology stocks such as Vitrox, Kesm, Salute and Pie were traded higher for the session.

US stocks were traded higher after the opening until the ISM released the manufacturing data, which suggested that the activity has contracted to its worst level since June 2009 at 47.8% (slowed down for the second consecutive month). The Dow and S&P500 declined 1.28% and 1.23%, respectively, while Nasdaq lost 1.13%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI formed a bullish candle after the key index constructed a hammer candle on Monday. The MACD Indicator remained in the negative territory, while both the RSI and Stochastic oscillators are hovering below 50. Hence we believe the technical rebound yesterday would be short lived and upside could be limited around 1,600. Meanwhile, support is set around 1,572.

Still, the traded volume on the local bourse was below the 2.0bn mark; indicating lackluster trading tone across the board. This could be due to lack of fresh leads in the stock markets as most of the investors are waiting for more clues from the upcoming Budget 2020 as well as the trade discussion between the US and China in Washington on 10th of Oct. Although the negative sentiment may spillover from Wall Street, we think traders may continue to focus on technology stocks on the back of weaker ringgit tone.

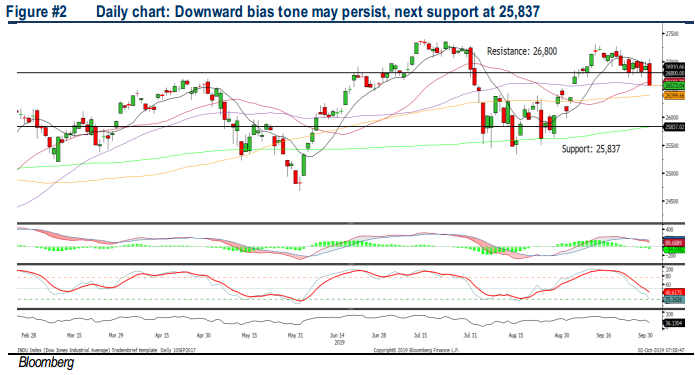

TECHNICAL OUTLOOK: DOW JONES

The Dow violated below the previous support around 26,800 after the 6-day consolidation phase. The MACD Indicator trended lower, while both the RSI and Stochastic oscillators are hovering below 50. Hence, we think the downward bias tone may persist. The Dow’s resistance is located around 26,800, while support is anchored around the SMA200 at 25,837.

Given the weak ISM manufacturing data in the US, coupled with the slowdown in Europe, we think the upside on Wall Street could be limited. In addition, the protracted trade war may dampen the sentiment over the near term. Unless both the US and China could strike a deal in the upcoming meeting in Washington, Wall Street may still trade on a downward bias tone.

Source: Hong Leong Investment Bank Research - 2 Oct 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|