Tex Cycle Technology - Values Resurface After Recent Selldown

HLInvest

Publish date: Thu, 07 Nov 2019, 11:01 AM

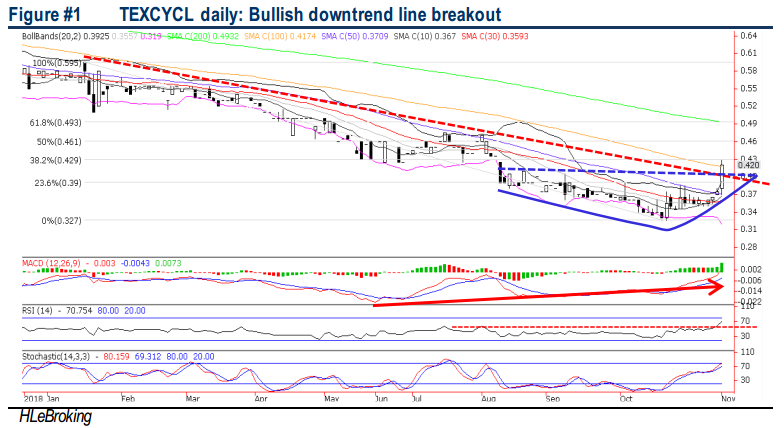

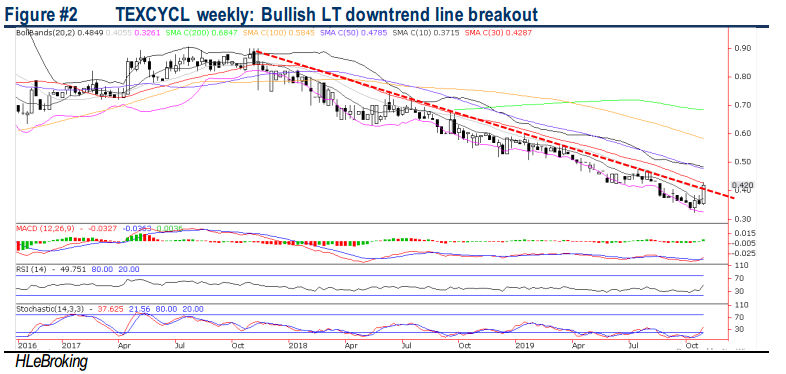

TEXCYCL’s outlook is bright, supported by its bread-and-butter waste management division as well as the eventual kick-start of its Teluk Gong and UK Renewable Electrical Energy Plant (REEP). Moreover, the potential listing to the Main Market would provide TEXCYCL to access to a wider pool of institutional investors and enhance its reputation. After tumbling 28% from YTD, valuation has become more palatable at 16x trailing P/E (vs peers’ 33x) and 1x P/B (10Y average of 1.6x). Technically, the stock is poised for further advance towards RM0.46-0.535 levels after staging a bullish daily and weekly downtrend line breakouts last Friday.

From trash to cash. TEXCYCL (listed in July 2005) is primarily engaged in an environmentally friendly waste management and recycling business that collects soiled rags, cotton fabrics, rubber, gloves, activated carbon and wood, mainly from the E&E, engineering, automobile, oil & gas and printing industries. It also supplies specialized products for the defense industry and further endow chemical products for oil & gas, agro-cultural and chemical related industries. Basically, most of the scheduled wastes collected for treatment are naturally bio degradable, consisting of cotton fabrics, rubber, activated carbon and wood. These wastes, when decontaminated, will be manufactured into fuel pellets which may be consumed as a renewable energy fuel source.

Source: Hong Leong Investment Bank Research - 7 Nov 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

speakup

fund waiting to exit

2019-11-07 15:12