Traders Brief - Cautious Trade With Key Support Near 1571

HLInvest

Publish date: Fri, 24 Jan 2020, 03:48 PM

MARKET REVIEW

Asian markets ended lower again amid hagging concerns of a coronavirus outbreak in China sapped confidence. According to WHO, it was “a bit too early” to declare a new coronavirus a global health emergency as China put millions of people on lockdown amid an outbreak that has killed 18 people in the country and infected around 650 globally. The outbreak, from its origin in Wuhan has reached the US, Thailand, South Korea, Japan, Taiwan, Vietnam and Singapore.

Tracking sluggish regional markets and ahead of the long CNY holidays, KLCI lost 3.5 pts at 1574, recording its 4th straight decline. Trading volume increased to 3.07bn shares worth RM2.57bn as compared to Wednesday’s 2.66bn shares worth RM1.93bn. Market breadth was bearish with 294 gainers as compared to 536 losers.

The Dow slid as much as 219 pts intrday, weighed down by P&G and Travelers earnings failed to meet consensus estimates and investors continue to monitor closely the coronavirus outbreak that has rocked Chinese markets and threatens to hurt an already -fragile global economy. However, the losses were reduced to 26 pts at 29160 as investors took heart from a WHO’s decision to refrain from declaring China’s coronavirus outbreak a global emergency. Meanwhile, Intel shares rallied in the extended session Thursday after the chip maker’s quarterly results and outlook topped Wall Street estimates.

TECHNICAL OUTLOOK: KLCI

Following a mild rebound from a low of 1551 (24 Dec) to a high of 1617 (30 Dec), KLCI had retreated 43 pts to close at 1574 yesterday, below key multiple SMAs. Unless a decisive fall below 1571 neckline support, KLCI’s near term upward momentum remains intact. Key resistances are 1588 (50D SMA), 1600 and 1612 (200D SMA) levels. Conversely, failure to hold at 1571 may aggravate more selling spree towards 1566 (76.4% FR)/1550 levels. For now, we still expect the index to range trade between 1571 and 1612.

Following the 4th straight KLCI declines and further profit taking retracement on Dow after rallying 22% in 2019, the index is envisaged to lock in consolidation mode ahead of the long CNY holidays (half day trading on 24 Jan and reopens on 28 Jan). Overall, lingering worries over the coronavirus outbreak may continue to cloud market sentiment in the near term. Hence, gloves and healthcare-related companies’ share prices could stay firm amid buying support whilst airlines, tourism and retailing stocks could see persistent selling pressure. Meanwhile, technology stocks would remain in focus after a strong Intel results.

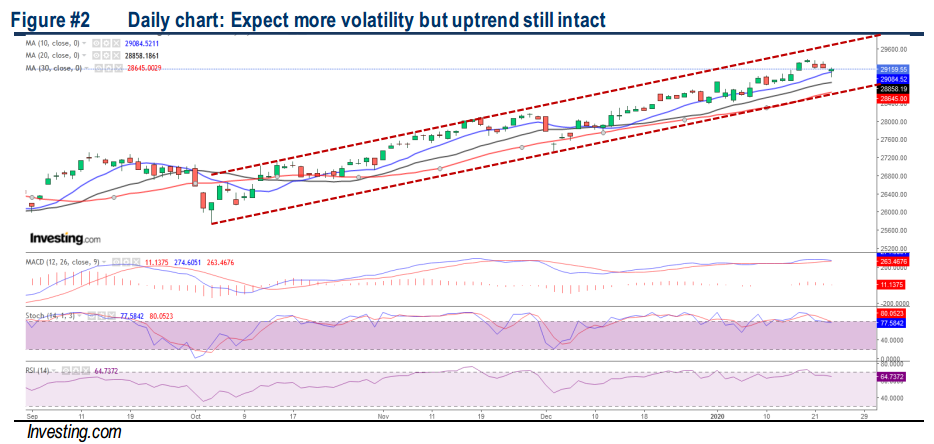

TECHNICAL OUTLOOK: DOW JONES

From an all-time high of 29374 on 17 Jan, the Dow had retraced 214 pts to 29160. Given the weakness in the MACD/RSI/stochastic readings, the Dow is likely to experience choppy sessions ahead. Nevertheless, uptrend remains intact for now unless key supports situated at 28858 (20D SMA) and 28645 (30D SMA) zones are violated. Formidable hurdles are 29500- 30000 levels.

We expect further volatility on Wall Street in the short term with traders seemingly reluctant to make significant moves due to fears of the coronavirus outbreak could grow into a global pandemic. Nevertheless, China’s strong efforts in containing the outbreak and the WHO’s view that it was “a bit too early” to declare a new coronavirus a global health emergency are likely to cushion further selldown. Meanwhile, sentiment is also likely to be supported by the de escalation of US-China trade disputes and the expectation of low Fed’s interest outlook ahead of the 28-29 Jan meeting (US time), as well as ongoing positive 4Q19 reporting season (as 75% of the S&P 500 companies reported beat EPS estimates). Key resistances are 29500- 30000 whilst supports are near 28600-28800 levels.

Source: Hong Leong Investment Bank Research - 24 Jan 2020

.png)