Chin Hin Group - Cheaper Proxy to Solar Theme?

HLInvest

Publish date: Fri, 07 Feb 2020, 09:02 AM

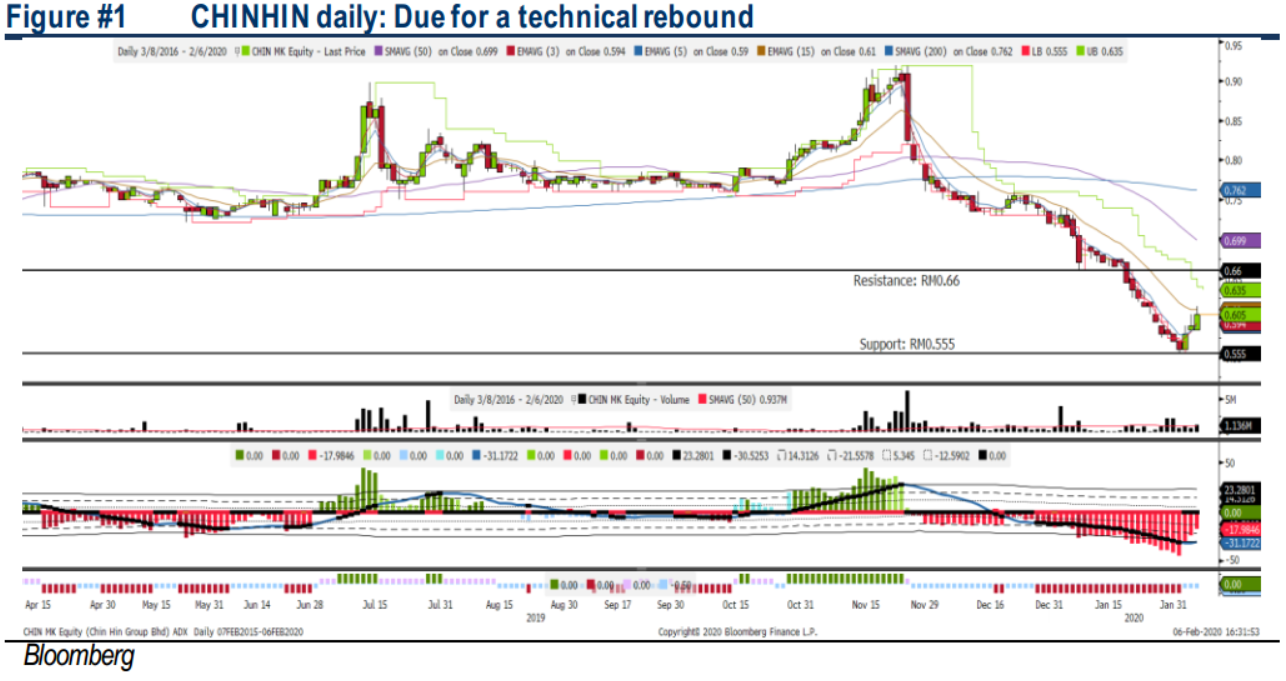

We like CHINHIN for its (i) recovering net profit over the past 3 quarters, (ii) attractive valuation of 13.3x PE (26.5% below its 2Y historical average of 18.1x), (iii) solid FY18-20f net profit CAGR of 30.7%. Also, its 34% shareholdings in Solarvest may translate to a potential earnings boost moving forward. Technically, it is oversold after the recent selldown and our indicator is suggesting that CHINHIN is warrant for a technical rebound in the near term. Resistance is set around RM0.64-0.66, followed by a LT TP of RM0.69. Support is pegged around RM0.54-0.555, while stop loss is set around RM0.53.

Recovering mode, undemanding valuation and solid growth. CHINHIN registered growing net profit of RM4.0m in 4Q18 to RM6.5m in 3Q19. Currently, CHINHIN is trading at an attractive valuation of 13.3x PE (26.5% below its 2Y average PE of 18.1x), supported by a solid 30.7% FY18-20f net profit CAGR.

Solarvest contributions could boost CHINHIN’s earnings. CHINHIN holds 34% in Solarvest and we believe this should be a booster for CHINHIN. Based on the growing net income trend of Solarvest from RM4.2m in FY16 to RM11.1m in FY19, coupled with consensus earnings forecast of Solarvest (FY21f-22f: RM16.6m-17.9m), this would translate to a potential earnings boost of c.RM5.6-6.1m for CHINHIN.

Selloffs likely to be overdone and anticipating for further rebound. Based on the recent sell down in price, we believe its declining trend is overdone and may warrant a rebound in the near term. Our indicator is providing a technical rebound signal and volume is picking up over the past 3 days. Resistance is located around RM0.64-0.66, while LT TP stood at RM0.69. Support is pegged around RM0.545-0.555 with a cut loss set around RM0.54.

Source: Hong Leong Investment Bank Research - 7 Feb 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|